Understanding the Significance of an Estimated Financial Aid Budget in Planning Your Educational Expenses

When embarking on the journey of higher education, one of the most pressing concerns is how to afford the expenses that come with it. Navigating the landscape of available resources can be daunting, yet it is essential for students and their families to grasp certain financial concepts. One of those concepts revolves around the approximations that institutions offer regarding available resources for learners.

These projections serve as a guiding light, helping prospective students envision their financial responsibilities. They highlight potential assistance sources, shedding light on various options that may ease the financial burden of tuition, housing, and other essential expenses. By diving into this topic, individuals can gain vital insights into what they might expect regarding support when planning their educational experience.

Moreover, understanding these financial projections empowers students to make informed decisions. Each institution may have its own approach, leading to variations in what can be anticipated. Therefore, comprehending how these approximations are formulated can significantly influence one’s planning process and overall college experience.

Understanding Estimated Financial Aid Budgets

Navigating the world of college expenses can be overwhelming, especially when trying to plan your finances for higher education. Having a clear understanding of the projected costs associated with attending a school is essential for making informed decisions. This aspect encompasses everything from tuition and fees to a variety of living expenses, allowing students and families to prepare accordingly.

When you receive an overview of potential costs, it serves as a valuable tool for evaluating your resources and options. With this insight, you can assess how much assistance you may require and what types of support might be available. It’s not just about knowing the numbers; it’s about gaining peace of mind as you embark on this educational journey.

One key element in this planning process involves estimating different categories of expenses. These may include housing, meals, books, supplies, transportation, and personal needs. By breaking down these figures, you can create a clearer picture of your financial landscape, helping you to prioritize and strategize your approach.

Furthermore, understanding these projections encourages proactive discussions with financial advisors or school representatives. Having a solid foundation of anticipated costs lets you confidently explore scholarship opportunities, work-study programs, or other funding avenues, ensuring that you are prepared for any challenges that may arise.

Ultimately, grasping the concept of these anticipated expenses empowers you to take control of your educational funding. It lays the groundwork for mindful planning and thoughtful decision-making, making the entire college experience more manageable and focused on your academic success.

Components of Financial Assistance Calculations

Understanding the elements that contribute to the determination of support for education is crucial for students and their families. Various factors interplay to create a comprehensive picture of just how much help a student can receive. It’s not always straightforward, but breaking down these components can make it more manageable.

First up, we have the student’s financial background, which includes income, assets, and any other resources available to them. This aspect helps to gauge the ability of the individual to contribute to their education costs. Additionally, family size and the number of dependents can influence the expected contribution.

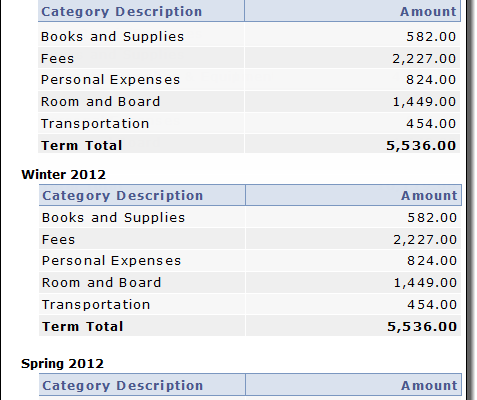

Then, there is the cost associated with attending a particular institution. This includes tuition fees, room and board, textbooks, and other necessary expenses. Each school has a different price tag, so understanding these figures allows for a more accurate evaluation of overall support options.

Lastly, a significant piece of the puzzle is the type of funding available. This includes grants, scholarships, and loans, each with its own set of criteria and conditions. Recognizing the differences among these options can greatly affect the financial planning process.

By piecing together these elements–individual circumstances, institutional costs, and types of funding–students can develop a clearer understanding of their potential support for educational pursuits.

How to Interpret Your Financial Assistance Package

Understanding your support package can feel like reading a foreign language, but it doesn’t have to be overwhelming. The key is to break it down into manageable parts and recognize what each component represents for your educational journey. Approaching this document with a clear mind can help you make informed decisions regarding your schooling and expenses.

Start by identifying the various types of support included in the package. You’ll likely see grants, loans, and work-study options listed. Grants and scholarships are often gift aid that you won’t have to pay back, making them particularly valuable. Loans, on the other hand, require repayment and might come with interest, so it’s important to understand the terms before you accept them.

Next, take a close look at the cost of attendance outlined in the package. This figure typically encompasses tuition, fees, room and board, and other living expenses. By comparing this total with the assistance provided, you can gauge how much additional funding you may need to secure. It’s crucial to know your overall financial picture to prepare adequately for any gaps.

Another essential aspect is the conditions attached to different forms of help. Some support may require maintaining a specific academic performance or commitment to a particular program. Familiarize yourself with these requirements to ensure that you can meet them and continue receiving assistance throughout your academic career.

Finally, don’t hesitate to reach out for clarification. Financial aid offices are there to assist you. They can explain any confusing parts of your package and offer guidance on how to maximize your support. With the right information, you’ll feel more confident navigating your educational expenses and making the most of your opportunities.