Understanding the Differences Between Credit and Debit – What You Need to Know

When we talk about how money moves in our everyday lives, it’s essential to grasp the different types of transactions that affect our wallets. Each method of payment comes with its own set of characteristics and implications, influencing how we manage our finances and navigate our spending habits. The distinction between these methods is often subtle but significant, shaping our approach to budgeting and managing resources.

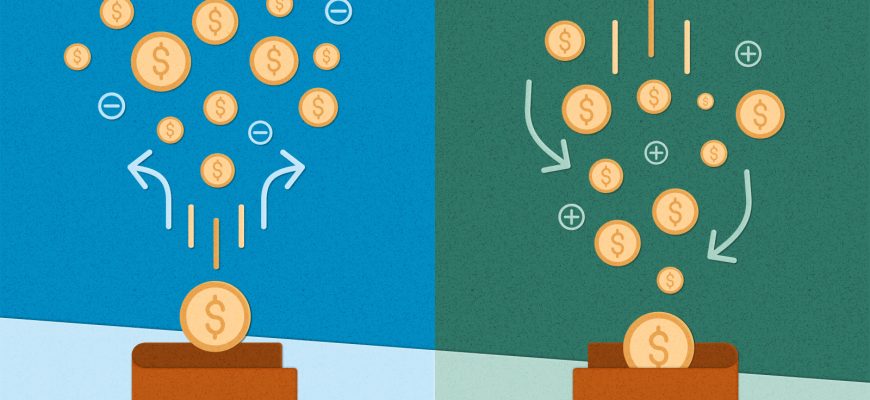

One approach involves drawing directly from the funds available in our accounts, providing a sense of immediacy and control. The other method offers a way to borrow money, allowing for greater flexibility in purchases and expenditures, but it also comes with certain responsibilities. Knowing how these options work can empower individuals to make informed decisions that align with their financial goals.

Understanding the nuances of these financial tools helps consumers navigate the complexities of personal finance. By recognizing their features and potential consequences, people can create strategies that ensure their money is working for them, rather than the other way around. This exploration is both enlightening and crucial for anyone looking to optimize their financial well-being.

Understanding the Basics of Credit

Diving into the world of borrowing can be quite fascinating. It’s a financial tool that many of us engage with, whether consciously or unconsciously. This resource allows individuals to access funds now, with the promise of repayment later. It’s a common practice in everyday life, from making large purchases to covering unexpected expenses.

The allure of such a system lies in its convenience and flexibility. It provides the opportunity to enjoy products or services immediately, without having to wait until all funds are accumulated. However, with this power comes responsibility; managing it wisely is crucial to maintaining a healthy financial life.

Rates and terms associated with using this financial resource can vary significantly. Understanding how these elements work, including the implications of interest rates and repayment schedules, can empower individuals to make informed choices. It’s essential to recognize that while it opens doors, it requires careful navigation to avoid pitfalls.

Building a positive relationship with borrowing can also lead to rewards. Establishing a good track record may enhance one’s reputation in the eyes of lenders, potentially unlocking better terms and rates in the future. Thus, one’s journey in utilizing this tool can pave the way for greater financial opportunities.

Debunking Common Myths About Debit

When it comes to understanding the nuances of payment methods, there’s a lot of misinformation floating around. Many people hold onto misconceptions that can lead them to make less informed choices. Let’s clear the air and set the record straight about this particular form of payment that often gets a bad rap.

One prevalent myth is that transactions using this method are inherently unsafe. Contrary to that belief, modern banking systems have implemented robust security features to protect users from fraud. With features like chip technology and two-factor authentication, you can feel more secure than ever when making purchases.

Another common misconception is the notion that linked accounts are always limited to a certain budget. While it’s true that these transactions withdraw directly from your balance, this setup can actually help individuals manage their finances more effectively. The immediate deduction prompts better spending habits and financial awareness.

Some people also think that all transactions are devoid of any rewards or benefits. However, many institutions offer incentives such as cashback programs or points for every dollar spent, making this payment option surprisingly rewarding for regular use.

Lastly, many assume that using this method limits their purchasing power. In reality, it provides a straightforward approach to spending, helping to avoid the pitfalls of overspending and accumulating debt from other options. It’s all about how you choose to leverage it.

Impact of Credit and Debit on Finances

Managing money effectively often involves understanding two key components of personal finance: borrowing and spending from one’s own funds. These elements play a significant role in shaping financial behavior and overall economic health.

Borrowing can provide immediate access to funds, enabling individuals to make large purchases or invest in opportunities even if they lack enough cash on hand. However, this convenience comes with responsibilities, such as paying back the borrowed amount along with potential interest. On the other hand, utilizing personal funds encourages better budgeting and control over expenses, preventing overspending and fostering a sense of financial discipline.

Both approaches contribute to building a financial identity. A responsible use of borrowed resources can enhance one’s credit score, opening doors to favorable loan conditions in the future. Conversely, mishandling these funds can lead to debt accumulation and financial strain. Hence, it’s crucial to find a balance that aligns with individual goals and spending habits.

Ultimately, the way one navigates these financial tools can significantly influence one’s economic stability and future prospects. Making informed choices will pave the way for a smoother financial journey.