Understanding the Concept and Implications of Credit Tax in Financial Management

Navigating the world of personal finance can feel overwhelming at times, especially when it comes to understanding various incentives offered by the government. These financial advantages can significantly influence an individual’s economic well-being. Gaining insight into these mechanisms is essential for making informed decisions about your finances.

In essence, these benefits often serve to lessen the burden of financial obligations, enabling individuals to retain more of their hard-earned income. They can be highly beneficial if you know how to leverage them effectively. Let’s explore how these initiatives operate and what you should be aware of to maximize your financial situation.

By grasping the nuances of these incentives, you can become better equipped to take control of your financial landscape. It’s important to stay informed, as these perks can vary from year to year, influencing your planning and investment strategies. Join me as we delve deeper into this intriguing topic!

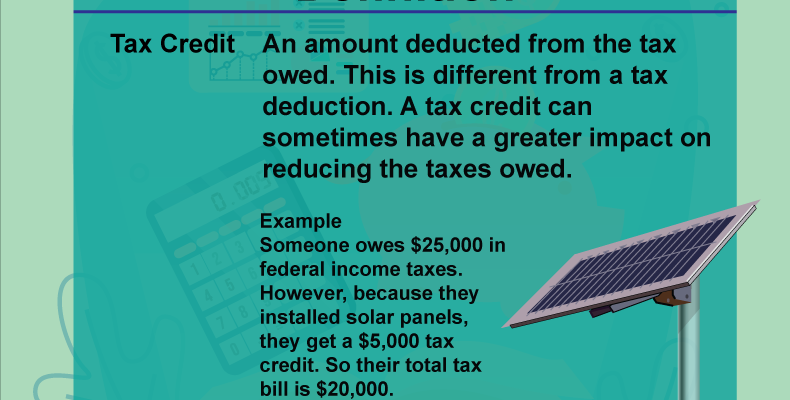

Understanding the Concept of Credit Tax

Diving into the realm of financial obligations can be quite overwhelming, especially when it comes to the nuances of fiscal responsibilities tied to borrowing. The interplay between borrowed funds and governmental levies is essential knowledge for anyone navigating the world of finance. It’s important to familiarize yourself with how your borrowing choices can lead to certain financial implications, particularly when it comes to your overall liability to the state.

Many individuals might overlook the impact of their financial decisions on their annual contributions to the government. Understanding this relationship is crucial for maintaining a healthy financial profile. By recognizing how these levies are calculated based on your borrowing, you can make more informed choices about the types and amounts of financing you pursue. Ultimately, a solid grasp of these principles ensures better preparation when tax season arrives.

Being aware of the subtleties involved can empower you to strategize effectively, allowing you to mitigate potential burdens. Knowing how your financial moves affect your future obligations can lead to smarter decisions, ensuring you’re not caught off guard when it comes time to settle up. It’s all about navigating the complexities of financial responsibilities and making educated choices.

How Tax Incentives Influence Your Finances

Understanding the impact of incentives related to borrowing can be a game changer for your personal finances. These incentives can influence how much you owe over time and shape your overall financial strategy. The interplay between these elements and your financial decisions might not be immediately obvious, yet it plays a vital role in your economic health.

When you engage with different types of borrowing or lending, the benefits or costs attached can significantly affect your available budget. This can lead to important decisions about managing expenses, saving for the future, or even handling emergencies. Navigating through these financial waters effectively requires awareness and planning.

Additionally, favorable conditions linked to borrowing can provide opportunities for investments or major purchases. By leveraging these incentives wisely, you can potentially save more in the long run. Conversely, overlooking the fine print might lead to unexpected obligations that could strain your finances.

As you consider your economic prospects, remember that recognizing and understanding these influences is essential. A well-informed approach can not only safeguard your financial stability but also position you for growth and success in various aspects of your financial life.

Benefits of Utilizing Strategies for Tax Credits

When it comes to managing your finances, implementing smart techniques for maximizing incentives can bring significant advantages. These approaches not only enhance your fiscal efficiency but also help in keeping more money in your pocket. By understanding and effectively applying these methods, individuals and businesses can unlock valuable opportunities that might otherwise go unnoticed.

One of the primary benefits is the potential for substantial savings. By leveraging the various available incentives, you can reduce your overall financial obligation. This means that you can free up funds for other investments or expenses, contributing to a more robust financial strategy. Additionally, employing these tactics often leads to improved cash flow, allowing for greater flexibility in budgeting and spending.

Moreover, engaging with these strategies can enhance your financial awareness. As you navigate through different options and guidelines, you become more informed about your own fiscal situation. This knowledge empowers you to make smarter decisions moving forward, ensuring that you are always on the lookout for ways to improve your economic standing.

Furthermore, taking advantage of special schemes often contributes to long-term financial planning. By integrating these techniques into your overall approach, you can create a solid foundation for future endeavors, whether that involves personal goals or growth objectives for your business. Ultimately, making the most of these opportunities can lead to a more secure and prosperous financial future.