Understanding the Meaning and Implications of Credit Pending Status

Many of us have encountered those moments when a transaction isn’t quite finalized, leaving us in a bit of uncertainty. It’s that waiting period where you might wonder about the availability of your funds. This can happen for various reasons, often related to the financial processes behind the scenes. In this context, it’s essential to grasp what this pause signifies and how it impacts your overall financial picture.

When you see that certain amounts are not yet accessible, it can be puzzling. You might be curious about its implications for your budget and spending habits. After all, knowing how long you might wait and the potential reasons for this delay can help you navigate your finances with more confidence. In essence, this temporary hold can be a common aspect of managing money, and understanding it can empower you to make informed decisions.

This exploration will clarify the nuances of this transient phase in financial transactions and equip you with the knowledge to handle your funds with ease. Let’s dive into the intricacies and see how these situations unfold, paving the way for a clearer understanding of your financial transactions.

Understanding the Credit Pending Status

In the world of finance, there are times when transactions or adjustments take a little while to process fully. This period can sometimes leave individuals feeling uncertain about the status of their accounts. Understanding how these temporary holds function is crucial for effective financial management.

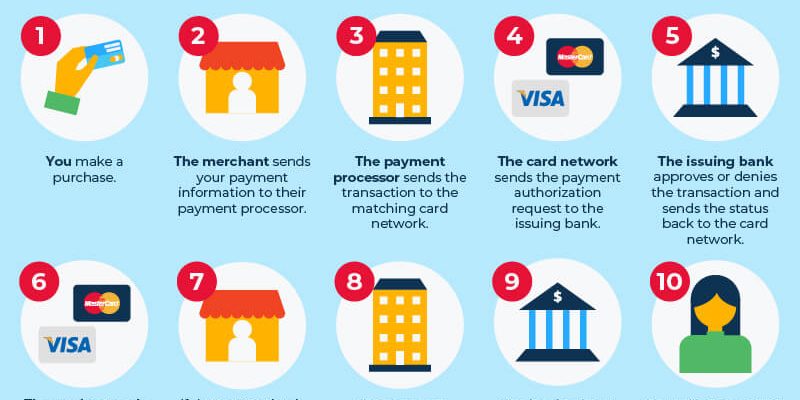

When a transaction is in this intermediate phase, it means that the funds have been requested or authorized but have yet to be officially applied to the account balance. This can occur for a variety of reasons, such as waiting for merchant verification or completion of bank processes. During this time, the amount may still appear in your available balance, but it might not reflect in your actual funds just yet.

It’s important to keep track of these occurrences and understand the typical timeframe for resolution. Most situations in this phase resolve within a few days, but knowing how long to expect can alleviate stress. Keeping an eye on your transactions and frequent statements can help in monitoring this process effectively.

Having this knowledge can empower you to navigate your finances better and prepare for any upcoming expenses or obligations. Being informed about the timelines and procedures involved ensures a smoother financial experience.

Implications for Your Financial Transactions

When you spot a status indicating that a transaction has not yet been finalized, it can raise questions about how this affects your finances. Such situations often suggest that there’s still some administrative work going on behind the scenes. Understanding how this affects your available funds and spending power is essential for effective financial management.

First and foremost, it’s crucial to consider that transactions in this state might not be reflected in your current balance. This discrepancy can lead to confusion if you’re trying to keep an eye on your budget. Imagine planning a purchase only to find out later that the amount was still tied up in processing–that can create unintentional overspending.

Moreover, this temporary status can also have implications for timing. If you’re waiting on funds from a sale or a payment, delays could impact your cash flow. It’s wise to factor in these waiting periods when you’re planning anything significant, like larger purchases or upcoming bills.

Lastly, frequent occurrences of this status may suggest a need for you to monitor your transaction habits closely. If you’re consistently seeing this delay, it might be worth checking with your financial institution to understand their processes and ensure everything is running smoothly. Being proactive can help you avoid pitfalls and maintain a clearer view of your financial landscape.

How to Handle Pending Credit Situations

Dealing with uncertain transactions can be a bit tricky, especially when you’re not quite sure where your funds stand. It’s crucial to stay informed and proactive in these situations. The good news is that with the right approach, you can navigate through these circumstances more effectively.

Start by keeping a close eye on your financial statements and notifications from your bank or financial institution. Regularly checking these channels can help you spot any unusual delays or issues early on. If something seems off, don’t hesitate to reach out for clarification. Customer service representatives are typically more than willing to assist you.

Being patient is also key. Often, these situations resolve themselves after some time. However, if you find that the hold persists longer than expected, it’s advisable to escalate the matter. Contact your financial provider to inquire about the cause of the delay and ask for an estimated timeframe for resolution.

In some cases, keeping records of your transactions can be beneficial. Documenting any communications and receipts related to the situation can serve as helpful proof if disputes arise later. Organization can significantly ease your stress and help in resolving issues swiftly.

Finally, consider this an opportunity to educate yourself about the policies that govern such transactions. Understanding your rights and responsibilities can empower you and enhance your overall management of finances. Stay informed, and you’ll navigate any uncertainties with confidence.

I’m speechless! You have such a radiant energy that just shines through. This is absolutely stunning!