Understanding the Meaning and Implications of Credits on Your Energy Bill

Every month, when you receive your statement from your service provider, there’s often a section that catches your eye. It may look different each time, but it usually represents a potential adjustment to the overall amount due. This intriguing aspect can play a crucial role in managing your expenses and budgeting effectively.

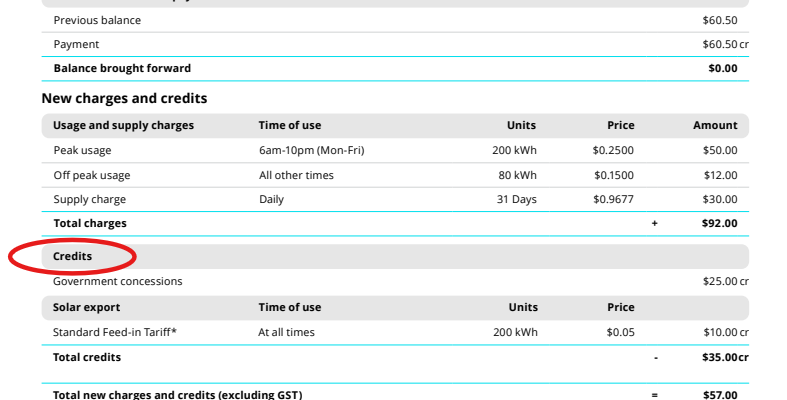

When examining the details surrounding these adjustments, it’s essential to grasp how they come into play. This particular notation can reflect previous payments, special offers, or even unexpected overcharges. By deciphering these entries, you can gain valuable insights into your financial responsibilities and possibly uncover ways to save money.

Understanding this element can empower you to take charge of your finances. Being aware of any adjustments allows you to make informed decisions, which may lead to better management of your household costs. Let’s explore the nuances behind these entries and how they can impact your financial landscape.

Understanding Energy Bill Credits

When you’re looking at your monthly statement, you might notice certain adjustments that can either add to or reduce your total amount due. These adjustments often reflect various programs or incentives that can have a positive impact on your overall charges. Grasping how these adjustments function can help you make sense of your total expenses.

Incentives and rebates often play a significant role in altering the bottom line of your statement. They are designed to encourage efficient usage of resources and reward consumers for adopting sustainable practices. Recognizing the specific criteria that allow you to benefit from these incentives can lead to meaningful savings.

Additionally, credits can sometimes result from overpayments or errors in previous transactions. It’s essential to stay vigilant and read through your statement thoroughly to ensure accuracy and maximize your benefits. Having a clear understanding of these elements can empower you as a consumer, allowing you to take advantage of any available opportunities to lower your financial obligations.

How Credits Are Calculated on Bills

Understanding how these adjustments are figured on statements can be quite beneficial for consumers. These calculations often reflect various factors that may influence your expenses each month. Let’s break down the essential elements that come into play when determining those numbers on your statement.

Usage Patterns play a vital role in this process. Utility providers typically analyze your historical consumption to spot trends and variations. For instance, if you consistently use less than the average, you may qualify for adjustments that lessen your overall payment obligation.

Incentive Programs are another important aspect. Many companies offer rewards for energy conservation or the adoption of renewable sources. If you participate in such programs, credits may appear on your statement as a reflection of your contribution to sustainability.

Errors and Adjustments that occur in billing cycles can also lead to favorable changes. If there has been a miscalculation or overcharge in prior months, the provider might issue a rectifying amount that will reduce what you owe in subsequent statements.

Lastly, keep an eye on seasonal adjustments. Rates can fluctuate based on the time of year, and these variations can result in additional benefits for those who manage their usage wisely. Being aware of these factors can help you maximize your savings and make the most of your financial arrangement with your utility provider.

The Benefits of Energy Bill Credits

Many consumers often overlook the advantages that can arise from adjustments on their utility statements. These financial perks can significantly lighten the monthly load, providing relief in various ways. Understanding how these reductions can impact your finances is essential for making informed choices.

Financial Relief: One of the primary advantages involves direct savings. A reduction on your payments can lead to improved cash flow, enabling you to allocate funds to other necessary expenses or even save for future goals. This financial cushion can be particularly beneficial during challenging economic times.

Encouragement for Efficiency: Such adjustments also promote a culture of energy conservation. By being rewarded for lower consumption, customers are incentivized to adopt more sustainable practices, ultimately leading to a healthier planet. It’s a win-win situation for both households and the environment.

Flexibility in Budgeting: Knowing you have potential savings allows for better planning. With fewer funds going towards utilities, it becomes easier to manage household budgets. People can invest in improvements or consider options that enhance comfort at home.

Increased Awareness: Engaging with these deductions encourages individuals to monitor their consumption patterns. As you stay more informed about usage, it can spark conversations about sustainability and energy efficiency within communities, fostering a collective effort towards responsible consumption.

In summary, embracing these financial advantages not only eases the burden on your wallet but also cultivates a more sustainable future. By recognizing their value, you can make smarter decisions that benefit both you and the wider community.