Understanding the Concept of Credit Limits and Their Importance in Personal Finance

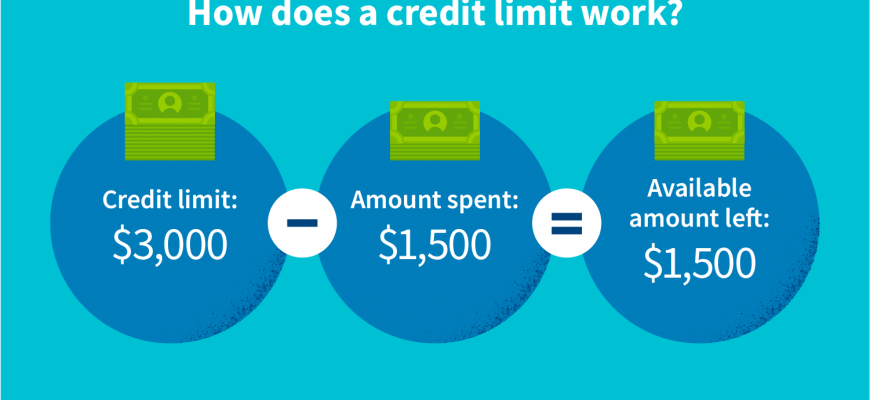

When it comes to borrowing funds, many people might wonder about the boundaries set on their purchasing power. This threshold plays a crucial role in personal finance, serving as an essential guideline for responsible spending. Knowing what this parameter encompasses can help individuals navigate their financial journeys with greater awareness.

Picture it as a balancing act; on one hand, it allows for flexibility in accessing funds, while on the other, it serves as a safeguard against overspending. It’s important to recognize how this boundary not only affects day-to-day transactions but also influences long-term financial health. Gaining insight into this element can empower you to make informed choices about your financial landscape.

With various factors contributing to its determination, understanding this aspect can lead to smarter financial decisions. Whether you’re pondering the implications for your own finances or simply curious about how it works for others, exploring this topic can unlock valuable information that enhances financial literacy.

Understanding the Concept of Credit Limits

When you hear about financial tools, one term often comes up: a specific amount that a lender allows a borrower to access. This figure plays a significant role in determining how much you can spend and manage your finances effectively. It’s essential to grasp its implications for both personal and business finances.

A parameter like this can vary widely based on several factors. Lenders typically assess your financial behavior, including payment history, income, and overall financial stability. This analysis helps them decide the extent to which they are willing to extend their support.

Having a defined threshold can bring both advantages and drawbacks. On one hand, it offers a sense of security, providing a buffer for unexpected expenses. On the other hand, exceeding this preset figure might lead to potential fees or impact your overall creditworthiness. Therefore, it’s crucial to manage your usage wisely and remain aware of your financial boundaries.

Ultimately, understanding this aspect of financial management can empower you. Knowledge gives you the ability to make informed decisions that align with your financial goals while maintaining a budget that works for you.

Factors Influencing Your Credit Limit

Several elements come into play when determining how much borrowing power you possess. Lenders evaluate various aspects of your financial situation to gauge their risk before setting the upper threshold. It’s essential to understand these components, as they can significantly affect your purchasing ability and financial planning.

Credit History often holds significant weight in these evaluations. A lengthy record of responsible borrowing and timely repayments paints a positive picture, while negative marks can hinder your options. The perception of reliability can greatly enhance or restrict your access to funds.

Income Level is another critical factor. Lenders want reassurance that you can manage repayments comfortably. Higher earnings usually correlate with greater limits, as they indicate a stronger capacity to meet financial obligations without undue strain.

Debt-to-Income Ratio also plays a pivotal role. This ratio measures how much of your income goes toward servicing existing debts. A lower ratio suggests good financial health and less risk for lenders, potentially leading to more favorable terms.

Credit Utilization reflects how much of your available resources you are currently using. Keeping this ratio in check–ideally under 30%–demonstrates discipline in managing finances, which can encourage lenders to grant more extensive support.

Lastly, Application Frequency matters. Frequently applying for new credit can signal desperation or mismanagement, which may lead lenders to be more cautious in their assessments. Being strategic about how and when you seek additional funds can positively influence your financial standing.

Impacts of Credit Limit on Finances

Having a specific threshold for borrowing can significantly shape one’s financial landscape. This boundary affects how much individuals can spend, influences their budgeting strategies, and plays a role in managing overall debt. Understanding this relationship helps in making informed decisions about expenses and savings.

When the borrowing capacity is too high, it might lead to overspending, making it easy to fall into a cycle of debt. Conversely, a lower limit can promote better financial discipline, encouraging more thoughtful purchases. It’s essential to gauge personal spending habits against this boundary to maintain a healthy financial balance.

Additionally, reaching or exceeding one’s borrowing capacity can negatively impact credit scores. This result impacts future borrowing potential, creating a ripple effect on major life decisions such as buying a home or obtaining a vehicle. Responsible management of this boundary is key to sustaining long-term financial wellness.