Understanding the Meaning and Implications of Cash Credit Limits

When it comes to personal finances, sometimes we find ourselves needing a little extra flexibility. Managing day-to-day expenses or preparing for unexpected situations can often require access to available funds without too much hassle. This is where certain features of financial products come into play, allowing users to tap into their assets in a straightforward manner.

Essentially, one important aspect of these financial offerings involves the portion of your available balance that can be withdrawn directly as cash. This specific category often comes with its own set of rules and considerations, influencing how easily you can access funds when you need them most. Navigating through this process can be crucial to understanding your overall financial health.

As you explore this topic, you’ll uncover the ins and outs related to accessing funds, as well as the implications it can have on your financial strategy. Grasping these concepts can empower you to make informed choices, enhancing your ability to manage your resources effectively and confidently.

Understanding Cash Credit Limit

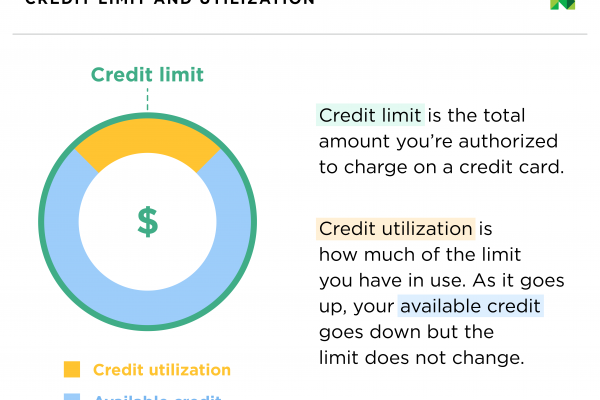

Having a grasp of withdrawal thresholds can truly enhance your financial management skills. When it comes to using funds from your financial services, knowing how much you can access without incurring extra fees is essential. This concept revolves around the maximum amount available for direct cash transactions, and it plays a crucial role in ensuring you stay within your financial boundaries.

Withdrawal thresholds empower individuals to make informed choices by determining the available resources when needed. It essentially serves as a buffer, allowing you to withdraw money without getting into debt or facing penalties. Understanding this framework ensures that you can utilize your finances effectively while keeping control over your spending habits.

Moreover, recognizing the terms related to these limits can assist in planning your expenditures accordingly. It’s all about balancing your available resources with your financial obligations, which ultimately leads to healthier financial habits. So, keeping track of these factors can make a significant difference in your overall economic wellbeing.

How Cash Limits Affect Your Finances

Understanding how withdrawal caps can influence your overall financial health is essential for effective money management. These restrictions play a key role in determining how much liquid funds you can access, which can impact budgeting and spending habits. By knowing these constraints, you can better navigate your financial landscape.

When you have a predefined ceiling on available funds, it can encourage more intentional spending. Instead of impulsively buying items, you’ll likely consider your choices carefully. This aligns with creating a budget that reflects your actual needs versus desires, which is crucial for long-term financial stability.

Additionally, being aware of these limitations can help you avoid overdraft fees and other penalties that come from overspending. By sticking to a set amount, you’re less likely to dip into debt, which is a common pitfall for many. Staying informed and disciplined can lead to improved financial well-being.

Having designated access to a certain amount of cash can also make it easier to plan for emergencies. It’s always a good idea to have some funds set aside for unexpected expenses, and knowing your boundaries can aid in that preparation. This way, you can tackle any surprise costs without derailing your entire financial strategy.

In summary, while these monetary ceilings might seem restrictive, they can actually foster healthier spending habits and encourage careful planning. Embracing these guidelines can lead to stronger financial management and a more secure future.

Strategies for Managing Cash Withdrawals

Effective handling of cash withdrawals is essential for maintaining financial health and avoiding unnecessary stress. By adopting strategic methods, individuals can navigate their finances with confidence and ensure they’re fully prepared for both planned and unexpected expenses. A well-thought-out approach helps in keeping track of spending habits while enabling better decision-making.

Firstly, setting a budget specifically for withdrawals can be a game changer. Knowing your limits allows for clearer financial planning and prevents overspending. This can include creating a separate savings account for emergencies or allocating a specific amount to withdraw each month for daily use.

Secondly, monitoring transaction history provides insight into spending patterns. Regularly reviewing this information helps identify areas where adjustments might be necessary. Keep an eye on any recurring expenses that could impact the available balance, and assess if they can be minimized or eliminated.

Additionally, utilizing tools and apps designed for expense tracking can offer valuable assistance. These resources help visualize your financial situation, making it easier to manage funds efficiently. Having everything at your fingertips can also encourage mindful spending.

Finding alternative ways to access funds, such as cashless payments or digital wallets, might also reduce the need for frequent withdrawals. This shift not only simplifies the process but can also lead to less cash handling, which can be more secure and convenient.

Lastly, always think ahead before making withdrawals. Evaluating the necessity of each cash need can prevent impulsive decisions. Planning your cash requirements in advance, especially for larger expenses, can lead to more responsible financial behavior.