Understanding the Costs Associated with Credit Karma Services

When diving into the world of personal finance management, it’s essential to explore various resources available to help you navigate your financial landscape. Many tools promise to streamline your experience while enhancing your overall financial awareness. Among these, some stand out due to their popularity and user-friendly offerings.

Before committing to any service, one might wonder about the financial implications of utilizing such platforms. Understanding the potential investment is crucial for making an informed decision. It’s important to weigh the benefits against any potential charges or fees that may arise.

In this exploration, we’ll unravel the specifics behind the various pricing structures associated with these financial management services. By examining the different tiers and possible hidden fees, you’ll gain clarity about what you can expect when engaging with these financial tools.

Understanding Credit Karma’s Pricing Structure

When it comes to exploring the financial landscape, many individuals wonder about the expenses involved in utilizing various services. There are often misconceptions surrounding subscription models and hidden fees. It’s essential to clarify how this particular platform operates without any unexpected charges lurking around.

The great news is that access to valuable tools and insights typically comes at no expense. Many users appreciate the transparency associated with this platform’s offerings. You can enjoy a wealth of resources while avoiding monthly payments. A key aspect to consider is that revenue primarily stems from partnerships with other businesses rather than direct user payments.

However, it’s wise to stay informed about potential premium features or upgrades that may appear enticing. Understanding what is freely available versus what might require an investment helps manage expectations and navigate the available options effectively. Always keep an eye on the terms as they may evolve, ensuring you make the most of your financial journey without unnecessary expenditures.

Free Features Offered by Credit Karma

There are some great tools available at no charge that can help you manage your financial health. Many users appreciate the ability to access valuable resources without spending a dime. Here’s a closer look at what’s on offer.

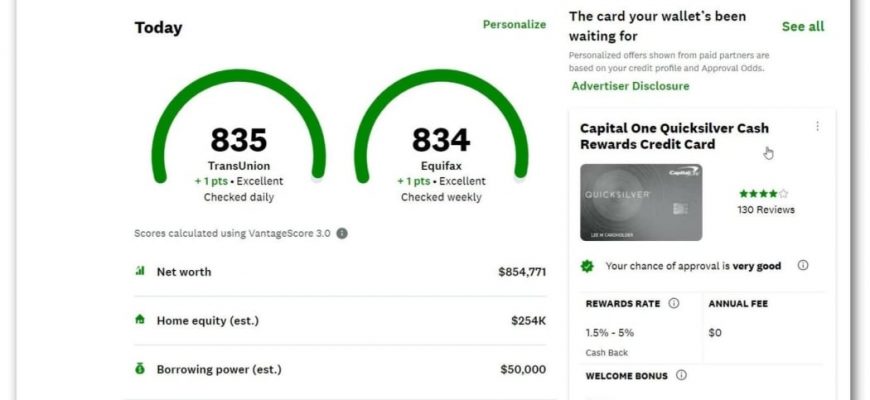

- Credit Scores: Regularly updated scores that allow you to monitor your financial standing.

- Credit Monitoring: Alerts about important changes in your credit report to help you stay informed.

- Financial Calculators: Useful tools to assist with budgeting, loans, and savings plans.

- Personalized Recommendations: Tailored suggestions for financial products based on your profile.

- Tax Information: Resources and tips to help you navigate tax season effectively.

These features empower users to stay on top of their financial situation and make informed decisions without any costs involved. Take advantage of these resources to enhance your understanding and management of your finances.

Potential Costs and Hidden Fees

When exploring financial services, it’s essential to be aware that some offerings may not be as straightforward as they seem. Even platforms that advertise free features can sometimes come with unexpected charges. Understanding these potential expenses and any less obvious fees is crucial for making informed decisions.

For instance, while initial access might be free, certain premium services might require subscriptions or one-time payments. Users should read the fine print thoroughly to uncover any recurring charges that could sneak up on them over time. Additionally, promotional offers may entice users, but it’s wise to check whether these limited-time benefits lapse after a specific period, potentially leading to higher costs down the line.

Furthermore, ensure that you look out for any associated fees that could arise from using specific features or services. Some platforms might charge for access to detailed reports or enhanced monitoring options. It’s always best to ask questions upfront and clarify any ambiguities before committing to a service to avoid surprises later on.