Understanding the Concept of Credit Balance and Its Implications for Your Finances

Have you ever taken a moment to glance at your financial statements and felt a mix of curiosity and confusion? The numbers can sometimes seem daunting, especially when trying to decipher their implications for your overall financial health. One term that often pops up relates to the surplus in your accounts, a concept that can impact your financial decisions significantly.

When we talk about a favorable monetary situation, it’s essential to grasp how it influences everything from daily spending to future investments. This situation reflects a state where your available funds exceed your expenditures or obligations, presenting an opportunity for budgeting and planning.

Exploring this notion further offers insights into managing personal finances effectively. Understanding this aspect can empower individuals to make informed choices, ensuring they are benefiting from their financial resources to the fullest. Let’s dive deeper into this intriguing financial element and unravel its nuances.

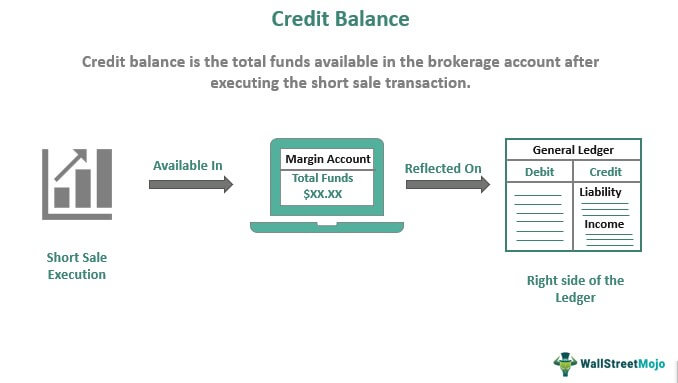

Understanding Credit Balances in Finance

In the world of finance, having an excess amount in an account can be a game changer. It reflects a situation where funds are available, offering flexibility and options for individuals or businesses. This scenario often results from various transactions, such as payments received or returns made, leading to a positive figure that can be utilized in different ways.

Maintaining a healthy surplus is crucial for managing finances effectively. It not only indicates financial stability but also serves as a buffer during unexpected expenses. This reserve can empower individuals to make significant purchases, invest in opportunities, or simply keep their financial affairs in check.

Furthermore, understanding how this figure works can help in making informed decisions. Regularly monitoring fluctuations in this amount allows for better budgeting and planning. By keeping an eye on incoming funds, one can strategize more effectively, ensuring that resources are allocated and used wisely.

In essence, the presence of a surplus in one’s financial records signifies potential growth and security. Being aware of its implications can lead to more confident financial practices moving forward.

The Importance of Maintaining Positive Credit

Keeping a healthy financial image is crucial in today’s world. It influences various aspects of life, including the ability to secure loans, rental agreements, and even job opportunities. A solid record showcases responsible financial behavior, making it easier to navigate different situations that require trustworthiness.

Why is it essential to stay on top of this? For starters, a favorable financial reputation can lead to better interest rates and more favorable terms when borrowing. Lenders are more likely to approve applications and offer attractive deals to individuals who demonstrate reliability. This not only helps in acquiring funds but also in managing repayment plans that won’t break the bank.

Furthermore, being mindful of your financial standing opens doors to various life opportunities. Whether it’s purchasing a home or applying for a new credit card, having a positive financial history gives you the leverage needed to make advantageous decisions. It’s about building a solid foundation that pays off in the long run.

In addition, a robust financial profile fosters peace of mind. Knowing that your financial actions are under control alleviates stress and provides confidence in managing expenses and aspirations. Ultimately, maintaining a healthy status is more than just numbers; it’s about securing a brighter future and achieving your goals.

Common Scenarios Involving Credit Balances

In everyday life, there are various situations where an excess amount appears, creating unique opportunities for individuals and businesses alike. Understanding how these scenarios play out can help one make informed financial decisions and maximize the advantages of having a surplus.

One popular instance occurs when a customer returns a purchased item to a retailer. Often, instead of receiving a refund, the store may opt to provide a store credit, allowing future shopping without immediate cash outflow. This approach can entice customers to continue spending, benefiting both parties.

Another scenario arises in the context of loan payments. For instance, when individuals overpay on their loan installments, they may find themselves with a remaining sum. This surplus can lead to adjusted payment schedules or even a reduction in future fees, positively impacting financial planning.

In the realm of utility services, customers may find themselves with a positive amount due to overpayment or adjustments on their accounts. This can be advantageous, as it provides a buffer for upcoming bills, ensuring that there’s no lapse in service while waiting for the next statement.

Lastly, businesses that provide subscriptions often encounter situations where users accumulate extra funds due to promotions or partial payments. This not only serves as an incentive for continued use but can also enhance customer loyalty and satisfaction.