An Overview of the Structure and Components of a Student Aid Report

When navigating the intricacies of higher education financing, one often encounters a crucial document that serves as a window into their financial profile. This valuable piece of paperwork helps institutions gauge an individual’s eligibility for various funding opportunities. As students embark on their academic journeys, grasping the essence of this document can pave the way for informed decisions and successful financial planning.

The content within this essential file reveals key insights about an individual’s financial background, enabling colleges and universities to assess the support they can extend. With a clear understanding of what this paperwork entails, students can better comprehend their standing and the options available to them. It’s more than just numbers; it tells a story of aspirations, challenges, and the potential for future success.

For anyone seeking to further their education, familiarizing oneself with this vital tool is imperative. It not only sheds light on personal financial circumstances but also communicates the broader landscape of resources accessible to learners. A well-prepared individual will find themselves better equipped to tackle the financial realities of college life.

Understanding the Financial Assistance Document

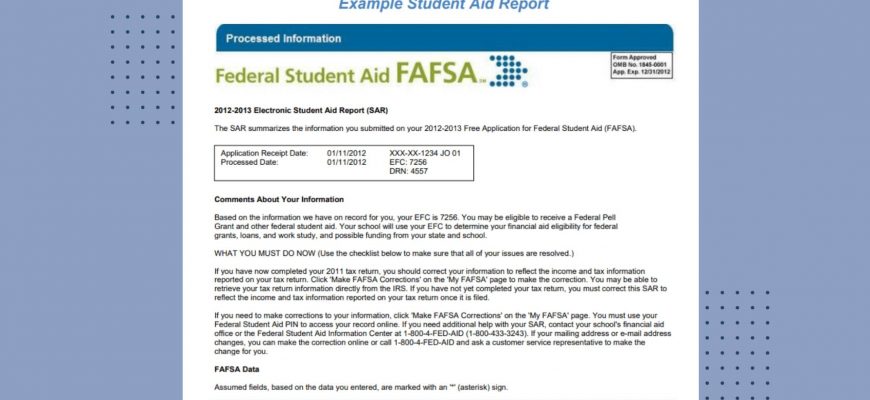

If you’re navigating the world of higher education financing, you’ve likely come across a crucial piece of documentation that holds vital information about your eligibility for financial help. This document serves as a summary of your financial situation and provides insights into the types of aid you may qualify for, making it an essential resource for any aspiring college student.

This summary includes various figures that reflect your financial background, including your Expected Family Contribution (EFC), which plays a key role in determining your eligibility for different types of funding. It’s like a snapshot of your financial landscape as evaluated by educational institutions.

As you delve deeper into this document, you’ll uncover details about the specific types of funding available to you, which can include grants, scholarships, or loans. Each category has its own set of criteria, and this paperwork helps clarify what’s achievable based on your situation.

Reading through the information can initially feel overwhelming, but taking the time to understand each section will empower you to make informed decisions regarding your educational journey. This document is not just a formality; it’s a pathway to securing the financial resources needed to pursue your academic goals.

Key Components of the Report

Understanding the essential elements of a financial assistance summary can greatly enhance the experience for individuals seeking educational funding. Each section plays a crucial role in portraying one’s financial landscape and eligibility for various programs. Let’s dive into the significant parts that one would typically encounter.

1. Personal Information

This section usually includes basic data like name, address, and contact details. It’s essential for the institutions to have accurate information to reach out for any follow-ups or clarifications.

2. Financial Overview

Here, you’ll find a breakdown of income details that influence potential funding opportunities. This portion assesses annual earnings and other financial resources, enabling clearer insights into economic status.

3. Dependency Status

Understanding whether the applicant is considered independent or dependent is key. This section discusses living situations and family dynamics, which can impact the type of assistance available.

4. Expected Contributions

This part outlines what the applicant and their family are expected to contribute to the educational expenses. It gives a sense of how much financial responsibility rests on their shoulders.

5. Eligible Programs

Different types of financial support options will be highlighted. Here, applicants can see what funding programs they may qualify for based on their financial situation.

6. Summary of Awards

Finally, the document often concludes with a summary of any potential awards or scholarships. This gives a clear picture of financial resources that may come their way if they move forward in the application process.

By familiarizing yourself with these components, you can navigate the complexities of educational funding more effectively. Each part serves its purpose in ensuring transparency and guiding individuals toward their financial goals.

Interpreting Financial Assistance Information

Diving into financial assistance resources can feel overwhelming at first, but understanding the details can be much simpler than it appears. This part aims to clarify the essential elements and how they impact the educational funding journey. By grasping the information presented, you empower yourself to make informed decisions regarding your financing options.

First, take a closer look at the estimated cost of your education. This figure usually combines tuition, fees, housing, and other expenses. Comparing this total with the amounts offered in funding opportunities creates a clearer picture of your financial landscape. It’s crucial to assess whether any gaps exist that might require additional planning or financing.

Next, examine the breakdown of funding sources provided. Understanding grants, scholarships, work-study opportunities, and loans will help you identify which options do not require repayment and which will eventually add to your financial obligations. Prioritize non-repayable resources to minimize future debt.

Lastly, keep an eye on the terms associated with loans if they are part of your financial package. Recognizing interest rates, repayment plans, and deferment options can save you from unexpected challenges down the line. By equipping yourself with this knowledge, you’ll navigate your financial journey with much more confidence and clarity.

Steps After Receiving Your Document

Once you have your financial overview in hand, it’s crucial to understand the next moves you need to make. This document is an important piece of your journey towards funding your education, and knowing how to navigate the information it contains can help you make informed decisions.

Here are some key actions you should consider taking:

- Review the Information: Carefully examine every detail for accuracy. Ensure that all personal data, financial details, and expected contributions are correct.

- Understand Your Options: Get familiar with the types of financial support available to you. This may include grants, loans, and scholarships. Each has its own terms and conditions.

- Contact Your Institution: Reach out to the financial aid office at your school if you have any questions or need clarification about certain aspects of the document.

- Create a Budget: With the financial information you’ve gathered, draft a budget that outlines your expected expenses and resources. This will help you plan your finances better.

- Keep Track of Deadlines: Note important dates related to financial aid applications, scholarships, and loan acceptance to ensure you don’t miss any opportunities.

Taking these steps will empower you to make the most of the information you have received, leading you towards a more secure financial path for your academic pursuits.