Understanding the Implications of a Student Aid Index of Zero for Financial Support

When it comes to navigating the complexities of financing education, many individuals find themselves sifting through various numerical values and terms. One particular figure often discussed is a measure that indicates an absence of financial need. This can significantly impact the options available for funding education, so it’s essential to understand its implications.

Having a measure that suggests an equal balance in financial assessment can bring a sense of clarity to prospective students and their families. It may lead to questions about eligibility for programs and the types of resources accessible. It’s also important to consider how this specific value influences the broader picture of funding opportunities.

In exploring this concept, many might wonder what it signifies for their circumstances and future plans. While at first glance it might seem straightforward, the underlying factors and potential outcomes warrant a closer examination. Let’s delve deeper into the nuances of this critical financial indicator and its relevance in the realm of education funding.

Understanding the Student Aid Index

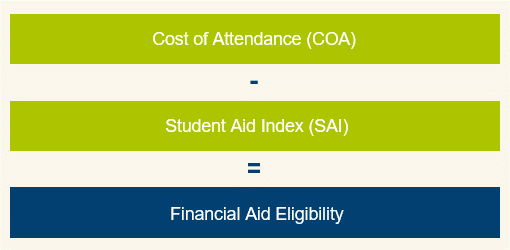

Exploring financial support for education involves many factors, one of which plays a significant role in determining the level of assistance available to individuals pursuing their studies. This numerical representation serves as a key indicator of a person’s financial situation and influences the kind of help they can expect from various sources, including government programs and private institutions.

A score reflecting the ability to contribute towards educational expenses carries important implications. A lower value is often associated with greater eligibility for various forms of financing, crucial for those who may otherwise struggle with the cost of education. It signals to authorities and institutions that the individual may need more financial backing to achieve their academic goals.

Understanding this numeric value helps to navigate the complex landscape of financial resources. It serves as a critical tool for students and families to assess their options and plan for the future, making it easier to discern what kind of support can bridge funding gaps. In essence, it is an evaluation of readiness and potential need, impacting the journey from high school to higher education.

Implications of a Zero Index Score

Reaching a score of none on the assessment scale can have significant effects on individuals. It often creates both opportunities and challenges within various contexts, shaping how resources are accessed and managed.

For individuals in this category, several key aspects come into play:

- Eligibility for Support: A score of none may indicate limited access to financial assistance, making it challenging to afford education or training programs.

- Funding Resources: It typically reflects a lack of funds available from government or institutional sources, pushing individuals to explore alternative financing options.

- Academic Opportunities: Individuals might find it difficult to enroll in certain programs or institutions that require a higher score for consideration.

While there are hurdles, there are also potential pathways to explore:

- Private Scholarships: Many organizations offer funding opportunities that don’t rely solely on financial assessments.

- Work-Study Programs: Engaging in part-time employment can provide financial support and valuable experience simultaneously.

- Community Resources: Local organizations might offer guidance, mentorship, or alternative funding solutions.

Overall, navigating life with a score indicating no eligibility requires creativity and perseverance. Embracing different strategies can lead to personalized growth, opening new doors in unexpected ways.

How to Navigate Financial Aid Options

Exploring financial support pathways is essential for anyone heading toward higher education. It’s all about understanding your choices and how they align with your personal circumstances. With the right information, you can make informed decisions that ease the financial burden while pursuing your academic goals.

Start by assessing your financial situation. Collect all necessary documents, including income statements, tax returns, and any relevant assets. This evaluation gives you a clear picture of your finances and helps identify what types of assistance might be available to you.

Next, research various funding resources. Scholarships, grants, work-study programs, and loans are all part of the mix. Look into local, state, and national organizations, as well as special programs that cater to specific demographics or fields of study. Each option comes with its unique set of criteria, so understanding them fully is key.

Don’t forget to fill out the Free Application for Federal Student Aid, commonly known as FAFSA. This form opens the door to numerous financial opportunities, including federal grants and loans, and many colleges use it to determine their own funding offers.

Seek guidance if needed. Consider meeting with a financial adviser at your school or any community resource center. They can provide insights tailored to your situation and help you navigate the sometimes overwhelming landscape of financial resources.

Lastly, stay organized. Keep track of deadlines, required documents, and any communications from potential funding sources. Timeliness and thoroughness can make a significant difference in securing the financial assistance you need.