Understanding the Importance and Significance of a Student Aid Index Number

When it comes to pursuing higher learning, understanding the financial landscape can feel overwhelming. There are numerous factors that play a crucial role in determining how accessible education is for many individuals. Among these factors, a specific metric is crucial in assessing financial support eligibility, which ultimately impacts the journey of learners in their academic pursuits.

This particular metric serves as a guiding light for institutions and applicants alike. It reflects not only the necessity but also the potential for financial assistance, allowing educational establishments to allocate resources effectively. As the academic world becomes increasingly competitive, grasping the significance of this tool enables prospective scholars to navigate funding options more confidently.

In essence, this evaluative element acts as a bridge, connecting students with the resources they need to thrive in their educational endeavors. By decoding its implications, learners can better prepare for the challenges that lie ahead, ensuring that financial support aligns with their aspirations and goals.

Understanding the Student Aid Index

Delving into the realm of educational financing can be a bit overwhelming, especially when it comes to deciphering various metrics used in the assistance process. One such metric serves as a crucial tool for evaluating financial need, impacting eligibility for various forms of support. Grasping the essence of this numerical representation can significantly influence your approach to funding your academic journey.

This figure plays a pivotal role in determining how much financial help you might qualify for when pursuing higher education. By examining your personal and family financial situation, it helps institutions understand your circumstances. The lower the number, the greater the perceived need for assistance. This means students with high financial requirements are often prioritized, ensuring that those who need help the most receive it.

It’s important to recognize that while this figure is vital, it’s just one part of the larger picture. Other factors come into play to provide a comprehensive understanding of your overall financial landscape. Institutions consider academic performance, enrollment status, and even the cost of attending specific programs when formulating their offers of support.

Ultimately, familiarizing yourself with this aspect of the funding process can empower you. Knowledge equips you to make informed decisions, explore more resources, and approach your educational aspirations with confidence. Understanding how it works not only prepares you for the applications but also helps you plan for what lies ahead on your academic path.

Calculating Financial Need for Education

Understanding the financial requirements for education can really help families plan their budgets. When looking at the costs associated with studying, it’s crucial to assess income levels, savings, and other financial resources. This process allows families to determine how much assistance might be necessary to bridge the gap between available funds and the total expenses for tuition, books, and living costs.

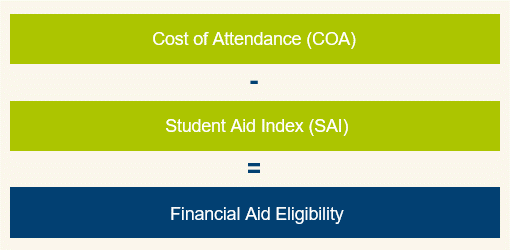

To accurately evaluate this need, one typically starts by gathering relevant financial information. This includes total household income, assets, and any existing scholarships or grants. With these figures in hand, individuals can calculate the expected family contribution. By subtracting this contribution from the overall educational costs, they can uncover the potential amount of funding required.

The goal here is to create a comprehensive picture of financial readiness. It’s not just about numbers; it’s about making informed decisions for the best educational path without causing undue financial strain. By understanding the true costs and resources available, families can feel more confident as they navigate the complexities of funding higher education.

The Role of the Index in Aid Applications

The process of securing financial support for education can often feel daunting, and that’s where an essential reference point comes into play. This metric serves as a guiding factor, helping institutions and applicants navigate the complexities of funding possibilities. It acts as a bridge between the financial needs of individuals and the resources available to meet those needs.

When applying for funds, this key figure simplifies the assessment of an applicant’s eligibility and financial situation. Institutions utilize it to evaluate how well applicants match their aid criteria, making it easier to determine the level of support they can offer. In essence, it streamlines the decision-making process, ensuring that those in genuine need receive the assistance necessary for their educational journey.

This reference also plays a crucial role in fostering transparency in the allocation of resources. By using a consistent method to gauge financial circumstances, both applicants and institutions can trust the system. This level of clarity helps to ensure that every individual receives a fair chance at accessing the funds that can make a significant difference in their academic endeavors.