Understanding the Implications of a Negative Financial Aid Balance and Its Impact on Your Education Funding

When navigating the world of educational funding, you might come across various terms and concepts that can be a bit confusing. It’s essential to grasp the implications of certain financial metrics and how they can affect your ability to pay for school. Among these, one particular scenario can leave students and parents feeling puzzled and unsure of the next steps.

In essence, there are circumstances where the resources allocated for study fall short or are mishandled, leading to a situation that raises concerns. This can present a complicated picture that requires immediate attention. Understanding the root of this issue is vital for anyone relying on these resources to further their education.

Arming yourself with knowledge regarding this peculiar predicament helps you make informed decisions and strategize effectively. Tackling the various aspects surrounding this term can empower you to take control of your educational journey, ensuring you’re not caught off guard as you embark on this exciting chapter of your life.

Understanding Negative Financial Aid Balances

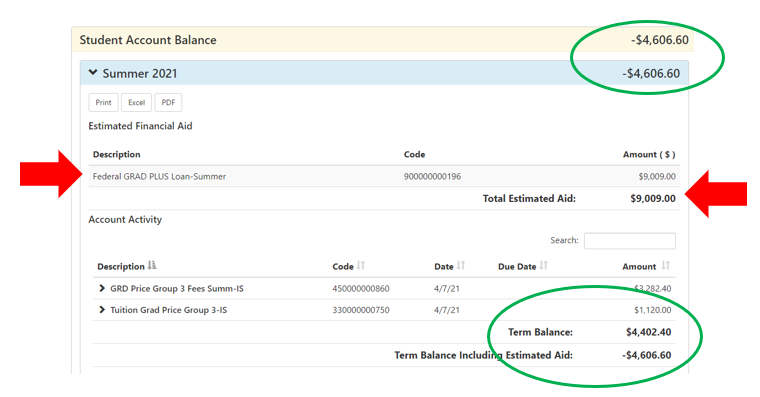

When dealing with the complexities of educational funding, encountering a situation where the calculations don’t quite add up can be puzzling. It often indicates that certain amounts surpass the necessary expenses related to tuition and fees. This scenario invites students to look deeper into how their scholarships, grants, or other resources align with their academic costs.

The presence of a deficit in your funding can raise questions about budgeting and the management of resources. In simple terms, it suggests that you may receive excess support beyond what you actually need for schooling. While this might initially sound like a boon, it’s essential to grasp the implications that come along with it.

Being aware of these situations can help in avoiding any unexpected surprises. For many, it may signal the need to return those extra funds to the institution, as they should only retain what is necessary for educational purposes. This is crucial to understand, as maintaining a clear grasp of your finances promotes a smoother academic journey.

Moreover, an awareness of these discrepancies can enhance your ability to effectively plan for the remainder of your studies. Keeping track of your expenses and funding can lead to smarter decisions, ensuring you utilize your resources wisely. So, though it may feel overwhelming at times, taking the time to evaluate your situation can ultimately empower you.

Impact on Student Financial Health

Having a shortfall in support can significantly influence a student’s overall monetary situation. This can lead to additional stress, affecting not only academic performance but also personal well-being. When young adults are faced with unexpected costs, they often need to make tough choices between education and essential daily expenses.

The repercussions of such a scenario can extend beyond immediate funding issues. Students may find themselves in situations where they must rely on loans or credit cards, which can lead to long-term debt and hinder their financial stability after graduation. Understanding and managing these impacts is crucial for maintaining a balanced approach to both education and financial planning.

Additionally, a lack of sufficient resources can affect students’ ability to participate in extracurricular activities or internships, which are vital for career development. This can result in missed opportunities that enhance resumes and networking, ultimately influencing future employment prospects. Thus, addressing any funding deficiencies is essential for ensuring a bright future.

Steps to Resolve Financial Aid Issues

Navigating the complexities of funding can sometimes feel overwhelming. It’s important to address any discrepancies in your support quickly and effectively. These steps will guide you through the process of resolving any challenges you may encounter, ensuring you stay on track with your educational goals.

First, gather all relevant documentation. This includes your award letters, payment receipts, and any correspondences with your institution’s financial office. Having everything organized will save you time and help provide clarity when discussing your situation.

Next, reach out to the financial services department directly. Schedule a meeting or phone call to discuss your case. Be clear about the issues you are facing and provide them with the necessary documents for their review. A direct conversation can often lead to quicker resolutions.

If you are not getting the assistance you need, don’t hesitate to escalate the matter. Ask to speak with a supervisor or a financial adviser who specializes in your specific circumstances. It’s important to advocate for yourself and ensure your concerns are heard.

Consider researching additional resources that your school may offer. Some institutions have support groups, workshops, or counseling services designed to help students navigate funding challenges. Utilizing these resources can provide additional guidance and support.

Lastly, stay persistent. Follow up on your case regularly and keep a record of all interactions. It’s crucial to remain engaged and proactive until your issue is fully resolved. Remember, your education is an investment, and addressing any funding problems is an essential part of that journey.