Understanding the Implications of a Negative Balance on Financial Aid Eligibility and Management

Financial assistance can often feel like a lifeline, providing crucial support for students and families navigating the expenses of education. However, encountering a situation where expectations and reality don’t quite align can lead to some confusion and concern. When resources fall short, it creates a ripple effect that can alter the landscape of support available to individuals in need.

Many people might find themselves puzzled when confronted with a premise that indicates a lack of resources. It’s essential to unpack the implications of such a scenario. Impacts on eligibility and availability of resources can be significant, as institutions often evaluate overall circumstances before determining how much support can be granted or adjusted.

Understanding the dynamics at play is crucial. Being aware of how this condition influences potential opportunities can empower students and families to better navigate their choices. With the right knowledge, individuals can take proactive steps to seek alternative options or rectify their situations, ensuring they remain on the path to academic success.

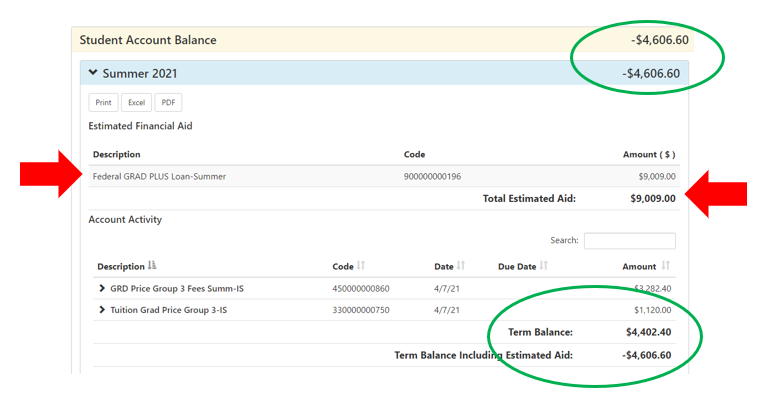

Understanding Negative Balances in Financial Aid

Many students and their families encounter situations regarding assistance during their educational journey. These circumstances can lead to confusion and concern, especially when it comes to managing funding and expenses. When examining one’s funding status, it’s essential to grasp how certain discrepancies can influence the overall financial picture.

An adverse amount often indicates that expenses exceed the support received. This scenario may arise from various factors, like unexpected costs or changes in enrollment status. When students find themselves facing this challenge, it’s crucial to explore options for addressing any shortfall in available resources.

It’s vital to stay informed about the implications of a deficient figure. This condition can impact future eligibility for assistance and overall financial planning. Open communication with school officials can shed light on possible solutions, whether through additional fund applications or budgeting strategies to mitigate the impact.

Ultimately, understanding this financial situation empowers students to make informed choices about their education funding. Making timely decisions can help balance educational expenses effectively, ensuring a smoother academic experience.

Impacts on Eligibility for Support

Understanding how certain financial situations influence your ability to receive assistance can be vital for students and families. A situation where educational costs are not fully covered may lead to complications regarding funding opportunities. This section will explore how specific circumstances could affect access to various forms of support.

When a student is faced with owing more than what is provided in grants or loans, it often raises questions about continued eligibility for various assistance programs. This condition may prompt institutions to assess a student’s financial need more critically, potentially affecting their status in relation to scholarships and other forms of economic support.

Moreover, if an individual has encountered challenges meeting financial obligations, it can signal to grantors that they may be at risk of defaulting, which in turn might lead to restrictive measures. Many organizations require students to maintain a certain financial standing to qualify for ongoing support. As a result, being in a precarious economic position could cause students to lose out on crucial funding opportunities.

In addition, the repercussions of insufficient funds might not only impact immediate financial support but could also have long-term effects on credit ratings and future student loan eligibility. Understanding these implications is essential for anyone navigating the complexities of educational financing.

Strategies to Address Financial Shortfalls

Finding yourself in a tricky spot when it comes to funding can be overwhelming. The good news is that there are alternatives and methods to navigate these challenges. By exploring various options, you can create a plan that alleviates stress and secures the resources you need for your education or living expenses.

First, consider budgeting more effectively. Track your expenses and prioritize necessities over luxuries. This might mean cutting down on non-essential spending or finding more economical alternatives. Next, look into part-time job opportunities that fit your schedule. Flexible roles can provide additional income while still allowing you to focus on your studies.

Additionally, reaching out for support can make a significant difference. Many institutions offer guidance and resources for students facing funding issues. Connecting with a financial advisor can open doors to scholarships, grants, and even emergency funds. Don’t hesitate to utilize these resources–they’re designed to help you succeed.

Lastly, communicate your situation. Whether it’s with your school’s financial office or your personal network, being open about your challenges can lead to unexpected support. People are often willing to assist when they understand your circumstances. Remember, you’re not alone in this, and taking proactive steps can significantly improve your situation.