Discover the Benefits of Having a Strong Credit Score

Maintaining a robust financial reputation can open numerous doors in your life. It’s not just about numbers; it reflects trustworthiness and responsibility in handling financial obligations. This positive image can significantly impact various aspects of your personal and professional ventures.

When your financial track record is in good standing, lenders and institutions perceive you as a lower risk. This perception often translates into more favorable terms when seeking loans or credit lines. Low interest rates, higher borrowing limits, and more tailored options become accessible, enhancing your financial flexibility.

Beyond loans, a solid financial reputation can influence many other areas. Rental applications might become a breeze, and even job prospects can improve, as employers often conduct background checks that include financial insights. Essentially, a commendable financial history cultivates confidence among those who may be evaluating your reliability.

Understanding the Importance of Credit Scores

When it comes to managing finances, having a solid understanding of numerical evaluations that reflect your reliability as a borrower can greatly influence your economic journey. These ratings not only shape your lending options but also pave the way for various opportunities in both personal and professional realms. Knowing how they function and what they represent can empower you to make informed decisions about your fiscal behavior.

Superior ratings often lead to increased trust from lending institutions, which can result in better interest rates, premium loan options, and even favorable terms on insurance policies. In many instances, they serve as a reflection of your financial habits and responsibility, significantly impacting not only how much you can borrow but also how easily you can secure credit when needed.

Furthermore, strong evaluations can facilitate smoother transactions when renting a home or seeking employment, as many landlords and employers take these metrics into account. They act as a window into your financial past, demonstrating your ability to manage debts and responsibilities. Therefore, understanding their significance is crucial for anyone looking to navigate through financial landscapes successfully.

Benefits of High Credit Ratings

Achieving a high rating in the world of personal finance can open many doors. It’s not just about numbers; it’s about the advantages that come with a solid financial reputation. When your rating is up to par, you’ll find that various opportunities become more accessible and appealing.

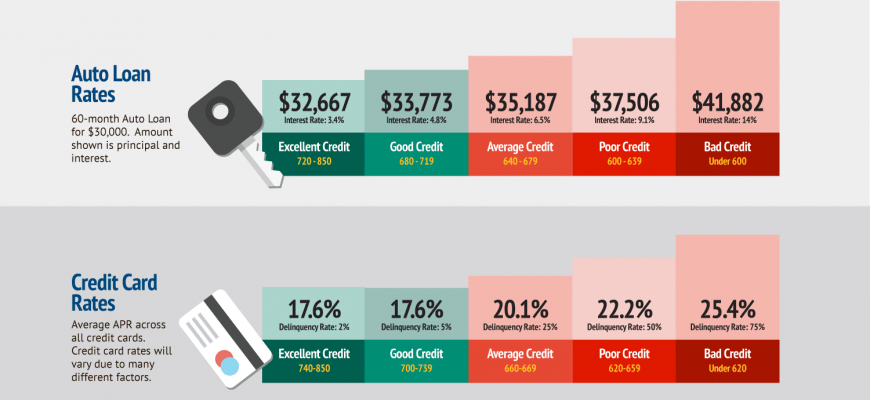

One of the most noticeable perks is the ability to secure loans at lower interest rates. Lenders often view individuals with strong financial histories as less risky, which translates into savings over time. This means whether you’re looking to buy a home or finance a car, the money you save on interest can be substantial.

An impressive rating can also enhance rental prospects. Property owners typically prefer tenants with solid financial backgrounds, which can lead to quicker approvals and even better lease terms. Additionally, many employers conduct financial checks as part of the hiring process, and a favorable rating can strengthen your job application in competitive fields.

Moreover, having a robust financial standing can lead to increased credit limits. This can provide greater flexibility in managing expenditures and may also boost overall financial health. Plus, it may facilitate easier access to premium credit cards, which often come with beneficial rewards and perks.

In summary, maintaining a strong financial reputation is key. The advantages extend beyond mere financial transactions; it shapes various aspects of life, from housing to employment, offering a sense of security and ease in financial dealings.

How Credit Ratings Impact Loan Opportunities

When it comes to securing financing, your financial history plays a crucial role in shaping your options. Lenders examine various factors to assess risk and determine the likelihood of repayment. A well-maintained reputation for managing finances can open doors, while a less favorable situation can limit potential choices.

A high rating often leads to more favorable terms on loans, including lower interest rates and higher borrowing limits. Lenders are more inclined to extend credit to individuals who demonstrate responsible management of their finances. This means that achieving a strong standing not only paves the way for additional funds but also enhances the overall affordability of borrowing.

Conversely, a poor reputation can diminish access to necessary funds. In many cases, lenders may require additional guarantees or collateral if they perceive higher risk. This can complicate the process and result in less favorable conditions, such as elevated interest rates or a need for a co-signer. Overall, the implications of your financial background are significant when navigating the world of lending.