An In-Depth Look at the Components of a Financial Aid Package

When embarking on the journey towards higher education, many individuals navigate a complex world of funding options. It’s essential to grasp what types of resources may be available to ease the financial burden. This section aims to shed light on the various components that can play a pivotal role in making college more accessible.

Imagine preparing for a significant investment in your future. The resources available to you can range from monetary contributions to various forms of assistance that help alleviate costs associated with tuition, housing, and other necessary expenses. Understanding these elements is crucial for making informed decisions and maximizing the support you receive.

From grants to subsidized loans, each component has its own characteristics and benefits. It’s important to dive into the specifics so you can make the most of the opportunities ahead. As you explore, you’ll discover how these different forms of support can align with your unique circumstances and goals.

Components of Financial Aid Packages

When navigating the maze of higher education expenses, various forms of assistance can help lighten the load. Understanding the elements involved in these supportive offerings is crucial for making informed decisions. Each element plays a unique role in ensuring that students can focus on their studies without the constant worry of financial burdens.

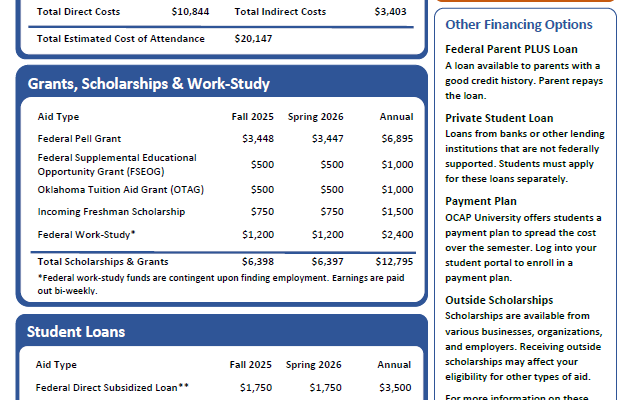

Grants often serve as a primary source of funding, providing money that doesn’t need to be repaid, typically awarded based on need. These funds can come from federal, state, or institutional sources and can significantly ease tuition costs.

Scholarships are another valuable resource, usually based on merit, skills, or specific criteria. Unlike loans, these funds are also non-repayable, making them an attractive option for students who excel academically or demonstrate exceptional talent.

While student loans may not be as attractive due to the requirement for repayment, they are an essential component of many financial support systems. They allow students to borrow money now to pay for their education, with the understanding that repayment will occur after graduation, sometimes with the benefit of deferred interest during studies.

Work-study programs offer opportunities for students to earn money while attending classes. These positions often relate to a student’s field of study, helping them gain valuable experience while also contributing to their education expenses.

In sum, a well-rounded assortment of resources exists to tackle the challenges of educational expenses. By leveraging these various options, students can create a more manageable approach to funding their academic journeys.

Understanding Grant and Scholarship Options

Seeking support for your educational journey can often feel overwhelming, but uncovering various opportunities can really lighten the financial burden. Grants and scholarships are two key avenues that can help you pay for your studies. Let’s dive into these options and see how they can benefit you.

- Grants: Typically awarded based on financial need, these funds don’t require repayment, making them a fantastic resource. They come from various sources, including the government and institutions.

- Scholarships: These are usually merit-based and awarded for academic excellence, talents, or specific interests. Like grants, scholarships also do not need to be paid back.

Both grants and scholarships can cover a portion of tuition, fees, and sometimes even books or living expenses. It’s crucial to explore different types of funding available to maximize support.

- Research: Start by looking into local organizations, educational institutions, and online databases that list available grants and scholarships.

- Prepare: Make sure to gather necessary documents, such as transcripts and recommendation letters, to enhance your applications.

- Apply: Don’t hesitate to apply for multiple opportunities to increase your chances of securing the financial support you need.

Always remember, the earlier you start exploring these options, the better your chances of finding the perfect financial solution for your educational goals. Good luck!

Types of Loans in Educational Support

When it comes to funding your education, loans play a significant role, offering students a way to cover their expenses without immediate financial strain. Understanding the different kinds of loans available can help you make informed decisions and manage your future finances wisely.

One primary category is federal loans, which are backed by the government. These usually come with lower interest rates and more flexible repayment options. Within this group, you’ll find subsidized and unsubsidized loans. Subsidized loans mean the government pays the interest while you’re in school, making them a more affordable choice for many.

On the other hand, there are private loans, offered by banks or financial institutions. While these loans might provide higher amounts of funding, they typically carry higher interest rates and less favorable repayment terms. It’s essential to compare these options carefully before committing to ensure you select the right financial support for your educational journey.

Lastly, there are alternatives like student lines of credit, which allow borrowers to access funds as needed, rather than a lump sum. These options can be more tailored to individual circumstances, making it easier to manage expenses throughout the semester.

Work-Study Programs Explained

These initiatives offer students a fantastic opportunity to balance their academic commitments with part-time employment. Designed to help learners offset educational expenses, such programs link school life with real-world work experiences. Participants gain valuable skills while earning a paycheck, creating a win-win situation.

Typically, students involved in these schemes are given positions on or near campus, making it convenient to juggle work and classes. The jobs can vary widely, ranging from administrative tasks to research assistance or even tutoring fellow students. This diversity allows participants to gain insights into different fields, all while working toward their degrees.

Financial contributions earned through these roles often cover tuition or help with other costs associated with college life. Furthermore, the experience gained in these positions not only enriches a resume but also fosters a sense of responsibility and time management in young adults. For many, it’s an essential stepping stone toward future career aspirations.

Moreover, these programs promote a sense of community among participants. Students typically interact with peers, faculty, and staff, forming connections that might prove valuable well beyond their time in school. Networking opportunities abound, leading to friendships and professional relationships that last a lifetime.

In summary, being part of such initiatives can provide significant support while enriching the college experience. It’s a smart way for students to earn money, develop skills, and build networks, all while continuing their education with a little extra help along the way.