Understanding the Starting Points of People’s Credit Scores and Their Variability

When diving into the world of personal finance, one of the key elements to consider is the numerical representation of an individual’s financial reliability. This measurement can determine not only the likelihood of securing loans but also the terms and interest rates that come with them. It’s fascinating how this figure can significantly impact financial opportunities and overall economic well-being.

Curiosity often arises about the foundational values of these assessments. Many might wonder where someone typically finds themselves when first grappling with these metrics. Each individual’s journey varies, influenced by numerous factors, yet understanding the baseline can provide valuable insights into the journey ahead.

Exploring the nuances of these figures reveals a broader picture of an individual’s financial journey. From the outset, the numerical representation offers a glimpse into an individual’s fiscal history and behaviors, guiding financial institutions in their decisions. Knowing the common entry points can empower you with information, helping you navigate your own financial landscape more effectively.

Understanding the Basics of Credit Scores

When diving into the realm of personal finance, it’s essential to grasp the concept that underpins many financial decisions. A certain rating reflects an individual’s ability to manage borrowed funds and demonstrates reliability to lenders. This metric plays a pivotal role in various aspects of life, from securing loans to renting an apartment.

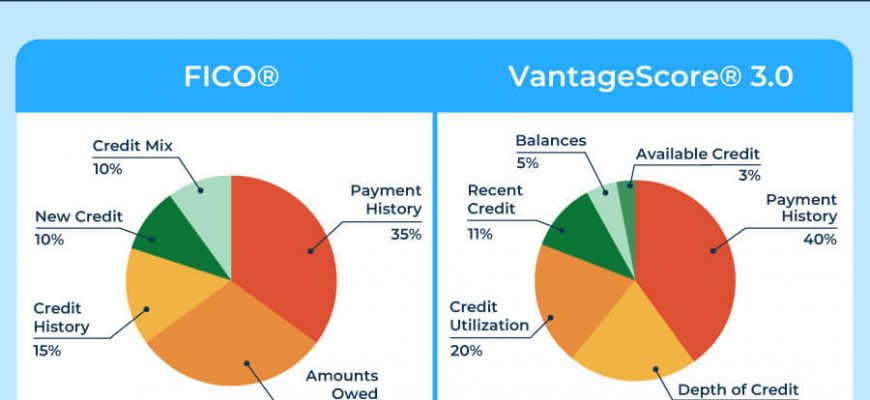

This numerical representation is typically derived from a collection of factors, including payment history, amounts owed, length of credit history, types of credit used, and new credit inquiries. Each of these components contributes uniquely, influencing the overall assessment.

Understanding how these elements work together can empower individuals to make informed choices regarding their finances. The higher the value, the more favorable the perception from potential creditors. Knowing where you stand can also serve as a motivator for improvement, if necessary.

In essence, familiarizing oneself with this critical measurement can lead to better financial opportunities, making it a vital aspect of adult life worth exploring.

Factors Influencing Initial Credit Ratings

When it comes to evaluating a person’s financial responsibility, several key elements come into play right from the beginning. These components contribute to the formation of a preliminary assessment that reflects an individual’s reliability in managing borrowed funds. Understanding these influences can help individuals navigate the complexities of financial assessments with greater clarity.

First and foremost, payment history holds significant weight. Timely payments on existing obligations showcase one’s commitment to meeting financial responsibilities, and any late or missed payments can have lasting repercussions. Furthermore, the length of one’s financial history is another crucial aspect. A longer track record can suggest stability and experience, while a shorter timeline might raise some red flags.

The amounts owed, or the level of outstanding debt, also play a pivotal role in forming that initial judgement. High balances compared to available limits may signal risk, whereas a lower ratio often indicates prudent borrowing practices. Additionally, the variety of credit types utilized can either bolster or hinder an individual’s standing; having a mix can demonstrate versatile handling of different financing options.

Lastly, recent inquiries into one’s borrowing activities can impact perceptions as well. Numerous requests for new credit might be viewed as a sign of potential financial strain. Each of these aspects creates a comprehensive picture that lenders and financial institutions consider before arriving at an initial evaluation, making it essential for individuals to develop healthy financial habits early on.

How Ratings Influence Financial Choices

Your financial journey can be significantly shaped by the ratings assigned to your borrowing habits and repayment history. These evaluations play a crucial role in determining whether you’ll secure loans, the interest rates you’ll be offered, and even the types of accounts available to you. It’s amazing how a single number can unlock or restrict opportunities, isn’t it?

Wow;she’s mesmerizing! Her grace and confidence just radiate through the screen. This video is absolutely stunning.