Understanding the Costs Associated with Credit Repair Services

When it comes to enhancing one’s financial profile, many individuals find themselves seeking assistance from professionals who specialize in this area. These experts offer a variety of services aimed at improving overall financial standings. However, before diving into such services, it’s essential to grasp the potential costs involved.

From consultation fees to monthly subscriptions, the landscape of expenses can vary significantly. Some individuals may wonder if these services are worth the investment and what kind of pricing structures exist. Having a clear understanding of these factors can aid in making informed choices that align with personal financial goals.

In this exploration, we will delve into the various financial implications associated with obtaining expert help. By analyzing the different types of fees and what they encompass, you can better navigate the world of financial assistance and determine the best route for your unique situation.

Understanding Fees for Credit Repair Services

When it comes to enhancing financial standing, many individuals turn to specialized services aimed at improving their overall score. It’s essential to know what you might expect regarding expenses associated with these services, as they can vary significantly from one provider to another.

Generally speaking, there are a few common pricing structures you might encounter. Some providers use a monthly fee model, where you pay a set amount each month for ongoing assistance. Others may offer a one-time payment option for specific tasks or services, allowing you to have a clear idea of what you’re investing upfront. In addition, some organizations may evaluate your requirements and offer customized packages, which can be tailored to your unique situation.

It’s also worth mentioning that while certain services may appear beneficial, it’s crucial to be aware of potential hidden costs. Always inquire about any extra fees or charges tied to the services provided, ensuring that you fully understand what your financial commitment entails. Think of it as an investment in your future, which can yield positive returns if approached wisely.

Finally, remember that transparency is key in this field. A trustworthy service should be eager to explain their pricing structures clearly, providing you with the confidence that your financial wellbeing is in good hands. Take the time to research and compare various options before making a decision, so you can find the best fit for your needs.

Factors Influencing Repair Costs

When considering help to enhance your financial standing, there are several elements that can impact the overall expenses. It’s not just a matter of picking a service and going with it; different aspects come into play that can affect how much you’ll end up spending.

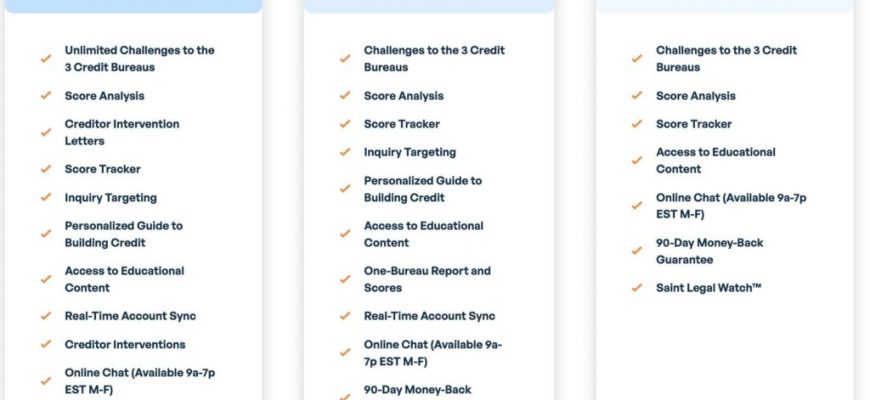

Service Range plays a pivotal role in determining fees. Some providers offer a basic package, while others include a wide array of features, such as ongoing monitoring and personalized consultations. The more comprehensive the service, the higher the potential costs.

Experience Level is another significant factor. Established firms with a proven track record may command higher rates due to their expertise and reputation. On the other hand, newer entities might offer lower prices to attract customers, but this could come with varying results.

Location can also influence pricing structures. Different regions have varying costs of living, which can reflect in the service fees. Often, metropolitan areas could see elevated prices compared to smaller towns.

Additionally, complexity of cases must be taken into account. If your situation involves multiple issues or requires extensive negotiation with creditors, expect to pay more for the additional effort and resources needed to resolve these matters.

Finally, payment models vary widely. Some professionals charge on a flat-fee basis, while others adopt a pay-per-item or monthly subscription approach. Each model comes with its own set of implications for your budget.

Comparing Prices Across Different Companies

When exploring the realm of financial services aimed at improving one’s standing, it’s essential to look closely at the price tags attached. Each provider has its own way of doing things and varying costs, making the landscape quite diverse. Understanding these differences can help you decide which option is the most fitting for your needs.

Some entities offer flat fees, where you know exactly what you’ll be paying upfront. Others might work on a monthly basis, billing you each month for ongoing assistance. Additionally, there are those that charge per item removed or corrected, making it crucial to assess how many entries you’ll need them to address.

Furthermore, it’s wise to keep an eye out for hidden fees that may pop up later in the process. Always ask questions up front to avoid surprises. Comparing total costs and services offered can significantly influence your decision-making. By doing your homework and analyzing different pricing models, you can find a solution that meets both your financial situation and expectations.