Exploring the Services Offered by Credit Rating Agencies

In the intricate world of finance and investment, certain entities play a crucial role in evaluating the soundness of various financial instruments and institutions. These specialized firms dedicate their efforts to analyzing data and providing insights that can guide investors in making informed choices. Their expertise helps to demystify the often complex landscape of loans, bonds, and other financial products.

By offering comprehensive analyses, these organizations help stakeholders gauge risks associated with investments, which ultimately supports more stable and prudent decision-making processes. The information they furnish is vital for both individuals looking to invest wisely and businesses seeking to secure funding. In essence, they serve as a trusted intermediary, ensuring transparency and reliability within the financial market.

Furthermore, their evaluations can influence everything from interest rates to the availability of capital, reinforcing the importance of their role. As you delve deeper into this topic, you will uncover how these entities not only impact the financial decisions of corporations but also shape the broader economic landscape.

Functions of Credit Rating Agencies

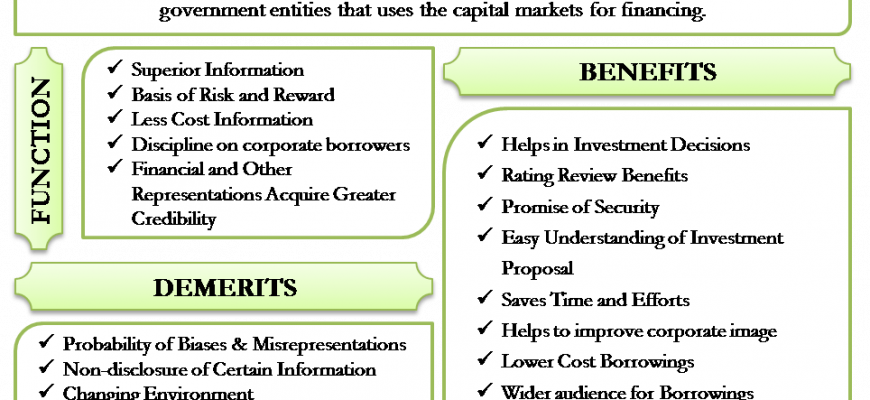

In the financial landscape, certain entities play a pivotal role in assessing the risk associated with various financial instruments and issuers. Their evaluations help investors make informed decisions, influencing both market dynamics and individual investment strategies.

One of the primary tasks these organizations undertake is analyzing the ability of borrowers to meet their obligations. By thoroughly examining financial statements, market trends, and economic conditions, they offer evaluations that reflect an issuer’s creditworthiness. This process involves collecting a wealth of data and applying sophisticated methodologies to ensure accuracy.

Another significant function involves issuing a scale of assessments that allows stakeholders to quickly gauge the level of risk. These grades range from high to low, providing a straightforward framework for comparing various financial instruments. This system not only aids investors in identifying opportunities but also assists issuers in understanding their standing in the marketplace.

Furthermore, these entities contribute to transparency in both the equity and debt markets. Their reports and analyses are pivotal for building trust among market participants. By offering insights and fostering a better understanding of risk, they help drive informed decision-making across the board.

Lastly, they play an advisory role by engaging with borrowers to improve their financial health and enhance their overall standing. This partnership can lead to better outcomes for issuers, ultimately benefiting investors who rely on credible and reliable assessments for their investment choices.

Impact of Ratings on Financial Markets

Assessments of creditworthiness play a vital role in shaping the landscape of financial markets. Their influence can be seen in various aspects, from investment decisions to borrowing costs. When a company or government receives a favorable evaluation, it often results in lower interest rates and increased investor confidence. Conversely, a downgrade can lead to panic selling and soaring costs of borrowing, shaking up the market.

The feedback loop between evaluations and market behavior creates a dynamic environment where perceptions can shift rapidly. Investors tend to react to the latest updates, which can result in immediate consequences for asset prices. As a result, the information shared by these organizations serves as a compass for many market participants, guiding their strategies and influencing portfolio management.

Moreover, these assessments hold significant weight in determining the allocation of capital. Financial institutions may use these insights to establish lending criteria and investment frameworks. When trustworthy evaluations highlight a stable opportunity, it can pave the way for new projects and bolster economic growth. On the flip side, negative assessments might restrict access to funding, stifling innovation and development.

Overall, the interplay between these analyses and financial markets underscores their importance in fostering a transparent economic environment. As stakeholders navigate their choices, these assessments remain a crucial element in the decision-making process, demonstrating their far-reaching impact on market stability and growth potential.

Understanding Credit Risk Assessment

When it comes to financial transactions, understanding the likelihood of repayment is crucial. This evaluation not only helps lenders make informed choices but also empowers borrowers to grasp their own financial standing. The process involves analyzing various factors that can influence an individual or organization’s ability to meet their obligations. It aims to create a clearer picture of potential risks involved in lending or investing.

A key component of this analysis is examining historical performance, income stability, and overall economic conditions. An in-depth look at these elements allows for a comprehensive evaluation of the potential for default. Additionally, external influences such as market trends, interest rates, and regulations can also play a significant role in shaping these assessments.

The ultimate goal of this process is to assign a level of trustworthiness to borrowers, helping stakeholders navigate potential dangers in financial dealings. This offers a sense of security, allowing investors to make calculated decisions aligned with their risk appetite. By synthesizing diverse information, this assessment creates a foundational understanding of how likely someone is to fulfill their financial commitments.