Understanding the Information Credit Cards Report About Your Financial Activity

When it comes to managing personal finances, there’s a lot of information floating around that can be quite overwhelming. Many people may not realize the extent of the data captured from their financial endeavors and how it can affect their larger financial picture. This fascinating world encompasses everything from spending habits to repayment timelines, each piece of information playing a vital role in shaping one’s financial narrative.

Financial institutions have developed a system to track and analyze this activity, which then gets compiled into a comprehensive summary. This summary not only reflects current behaviors but also has the potential to influence future lending opportunities, interest rates, and even insurance premiums. Understanding how this system works can empower individuals to make informed choices about their financial habits.

As you delve deeper into this topic, you’ll uncover the significance of various factors in your financial journey. Gaining insights into what gets documented and how it is utilized can be a game-changer for anyone aiming to enhance their fiscal responsibility and ensure a brighter financial future. So, let’s embark on this exploration together!

Understanding Credit Card Reporting Practices

When it comes to managing your finances, the way institutions track your borrowing behavior plays a crucial role. It encompasses a range of activities where lenders compile essential details about your spending habits, payment history, and overall financial reliability. These practices not only help financial organizations gauge the risk involved in lending but also influence the terms offered to individuals seeking to borrow money.

Each time you use your plastic for purchases, a record is created that follows you around. This includes not just how much you owe, but also how promptly you settle your bills. Late payments, high usage relative to your limit, and other factors can contribute to how potential lenders perceive your financial responsibility. The information collected typically updates monthly and can have significant implications for your ability to secure loans or obtain favorable interest rates in the future.

Furthermore, this information isn’t just shared internally; it gets reported to major financial institutions and agencies, creating a broader financial picture. Monitoring what is shared can empower you to maintain a healthy financial status. Being aware of these nuances can help you navigate the lending landscape more effectively, ensuring you make informed decisions that reflect positively on your financial profile.

Components of Your Credit Card Report

When it comes to understanding how financial institutions evaluate your borrowing potential, there are several key elements at play. These components reveal your spending behaviors, repayment history, and overall financial reliability. By familiarizing yourself with these aspects, you can better manage your financial image and make informed decisions.

Personal Information: This section typically includes your name, address, social security number, and date of birth. It serves as the foundation for your profile and helps lenders confirm your identity.

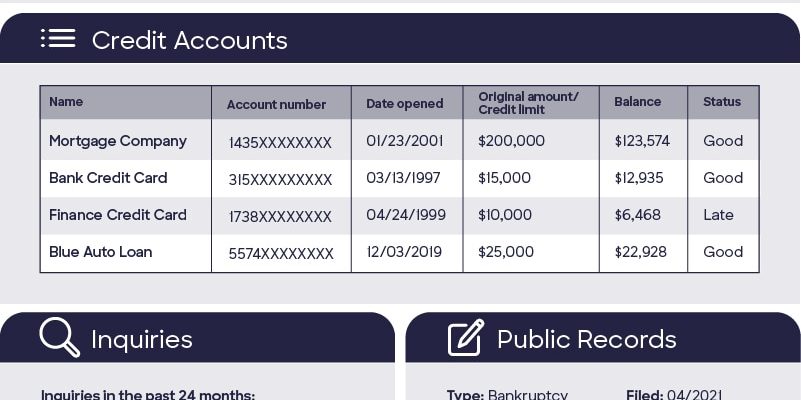

Account History: Here, you’ll find details about your accounts, such as the type of accounts you possess, their opening dates, and credit limits. This information provides insight into your experience and stability in managing credit.

Payment Behavior: Lenders pay close attention to your payment patterns. Timely payments demonstrate reliability, while missed or late payments can raise red flags. Your payment history can have a significant impact on your overall standing.

Utilization Rate: This measures how much of your available credit you’re actively using. Keeping this ratio low shows that you’re not overly reliant on borrowed funds, which can positively influence your standing.

Inquiries: Every time you apply for new financing, an inquiry is noted on your profile. While a few inquiries are normal, too many in a short period can suggest financial distress, which may concern potential lenders.

Public Records: This includes any bankruptcies, liens, or judgments against you. Such entries can have long-lasting effects on your profile, so it’s crucial to address any issues promptly.

Understanding these components can empower you to take control of your financial narrative. Regularly reviewing your information allows you to spot discrepancies and ensure you’re presenting the best version of your financial self.

Impact of Credit Instruments on Credit Scores

When it comes to assessing one’s financial health, the role of diverse financial tools is often underestimated. Using these instruments wisely can lead to significant benefits in your financial journey. They not only assist in daily transactions but also serve as a crucial factor in determining your overall financial reputation.

Understanding the Connection

Every time you use a financial tool, it creates a trail of information that influences your standing with lenders. The way you manage repayments, outstanding balances, and utilization rates contributes to your overall financial picture. This relationship can either bolster your standing or, conversely, pose challenges if not handled correctly.

Benefits of Responsible Usage

When used judiciously, these financial entities can enhance your standing. Timely repayments demonstrate reliability, thereby potentially increasing your score. Additionally, maintaining a healthy balance-to-limit ratio shows responsible borrowing habits, which is favorable in the eyes of lenders.

Risks of Mismanagement

On the flip side, straying into careless usage can negatively affect your standing. Late payments, high balances relative to limits, and frequent applications for additional credit can signal financial instability. Such patterns may lead to declines in your score and make future borrowing options less accessible.

In summary, understanding the impact of these financial tools is crucial. They can either serve as a stepping stone toward a solid financial future or a stumbling block if not managed with care. Adopting a responsible approach will pave the way for beneficial outcomes.