Exploring the Credit Unions That Offer Zelle Services and Their Benefits

In today’s fast-paced world, having the right tools for seamless financial transactions is a necessity. More and more people are turning to convenient digital platforms that facilitate quick and easy money transfers. Knowing which institutions offer these options can enhance your banking experience and save you time.

Among various services available, some financial establishments stand out for their integration with user-friendly applications that allow for instant exchanges. This has sparked interest in discovering which alternatives provide such capabilities, making it easier for consumers to manage their finances without the hassle of traditional methods.

As you delve into this topic, you’ll uncover a range of institutions that prioritize customer satisfaction by offering modern solutions tailored to your needs. Embracing technology has never been more important, and knowing where to look can significantly improve your daily transactions.

Understanding Zelle Integration in Financial Institutions

In recent times, many financial entities have begun incorporating modern payment solutions into their services. This integration allows members to quickly send and receive funds, making transactions more accessible than ever before. The convenience of instant transfers offers a level of efficiency that meets the demands of today’s fast-paced lifestyle.

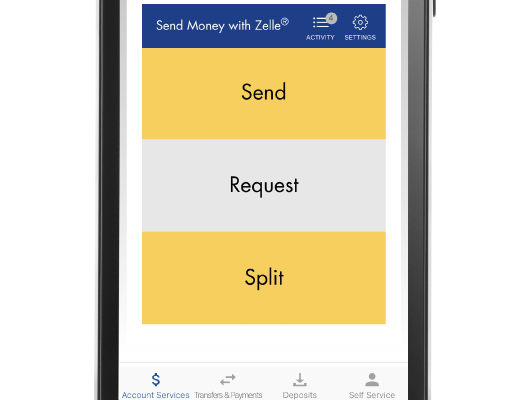

What sets this innovative service apart is its seamless connection with existing banking apps, ensuring a user-friendly experience. Members can take advantage of this feature without the need for additional downloads, simplifying the process of managing their finances. This move towards enhanced digital offerings reflects a broader trend within the financial industry aimed at improving accessibility and satisfaction among users.

By adopting such payment technologies, institutions position themselves as forward-thinking entities, catering to the needs of a diverse membership base. This adaptation not only boosts operational efficiency but also fosters a sense of community, allowing members to easily support each other through secure and swift transactions. The evolution of money transfers continues to shape the relationship between financial services and their users, paving the way for a more connected future.

Benefits of Utilizing Zelle with Alternative Financial Institutions

Integrating a popular payment service with your financial partner can genuinely enhance your banking experience. It streamlines the process of sending and receiving funds, making transactions quicker and more convenient. Here are some advantages to consider when opting for this service through an alternative financial institution.

- Speedy Transactions: Transfers occur almost instantly, ensuring that you or your recipient receive the funds without unnecessary delays.

- User-Friendly: The interface is designed to be intuitive, making it easy for everyone, regardless of tech-savviness, to navigate the process.

- No Fees: Many institutions offer the service without additional charges, helping you save money on your transactions.

- Wide Network: You can send money to anyone with a participating bank account, increasing your options and convenience.

- Secure Transfers: Security features are in place to protect your sensitive information, ensuring peace of mind with your financial activities.

Choosing to work with this service through an alternative financial institution offers a seamless and efficient way to manage your personal finances. With its fast, secure, and user-friendly nature, it’s hard to overlook its numerous benefits!

Top Financial Co-ops Offering Zelle Services

In today’s fast-paced world, transferring money has never been easier, especially with the rise of various digital payment platforms. Some organizations have embraced this convenient method, allowing members to easily send and receive funds instantly, without the hassle of traditional banking processes. Let’s dive into some of the standout cooperatives that provide this seamless service.

One notable institution is the Pentagon Federal, known for its robust digital offerings and focus on community. Another excellent option is the Navy Federal, which serves military personnel and their families, making money transfers a breeze. Additionally, the America First organization has tailored their services for members who want quick and efficient money management.

Also worth mentioning is the BECU, a cooperative that prides itself on innovation and user-friendly solutions. Lastly, the Alliant Credit Union stands out for its dedication to providing cutting-edge technology to its members, allowing for smooth and swift transactions. Each of these options brings unique advantages, making them excellent choices for anyone looking to streamline their financial interactions.