Discovering the Characteristics of a Top-Tier Credit Score and How It Influences Your Financial Opportunities

When it comes to navigating the complex world of personal finance, one element stands out as a significant indicator of your financial health. This metric can influence your ability to secure loans, obtain favorable interest rates, and even impact rental agreements. For many, grasping the nuances of this measurement can feel overwhelming, but it’s essential for making informed financial decisions.

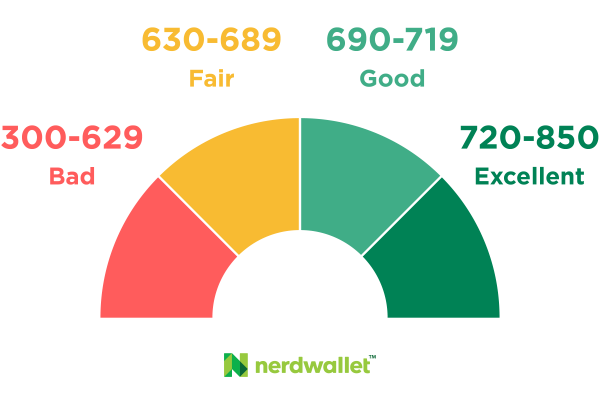

Reaching an excellent level in this measurement opens up a realm of opportunities. Lenders often see individuals with high evaluations as low-risk borrowers, which can lead to more attractive loan conditions and a smoother approval process. However, determining just how high you need to aim can be a challenge. With various scales and interpretations, understanding what constitutes excellence is crucial.

In this discussion, we’ll explore the benchmarks that define success in this realm, the factors that contribute to achieving a commendable position, and how you can strategize to elevate your financial reputation. Whether you’re looking to purchase a new home or simply want to improve your financial standing, gaining insight into this area is the first step towards a more prosperous future.

Understanding Top Tier Credit Scores

Navigating the world of financial ratings can seem daunting at first. It’s essential to grasp the value of a strong numerical representation when it comes to borrowing and financial opportunities. In simple terms, achieving a high rating opens doors to better interest rates and favorable loan terms, which can significantly affect your financial wellbeing.

A robust rating typically signifies that a borrower is responsible and reliable. Lenders often view individuals with solid figures as lower risks, making it easier for them to secure financing for everything from homes to vehicles. However, reaching and maintaining this desired level isn’t just about numbers; it involves cultivating sound habits and making informed decisions about finance.

Ultimately, achieving an outstanding rating isn’t merely a checklist task; it’s a journey that involves education, discipline, and a commitment to responsible financial behavior. Embracing this process can lead to greater financial freedom and stability, paving the way for numerous opportunities ahead.

Factors Influencing High Ratings

Achieving an excellent financial reputation involves a mix of elements that come together to create a favorable impression. The journey to reaching an admirable standing is not just about meeting basic criteria; it’s about the little details that can make a significant difference in how entities view one’s reliability.

Payment History: Timely payments play a crucial role in determining standing. Consistently meeting obligations showcases trustworthiness and responsibility, which lenders highly value.

Credit Utilization: How much of the available borrowing limit is being used can heavily impact perception. Keeping this ratio low indicates prudent management of finances and suggests that an individual is not overly reliant on borrowed funds.

Length of Credit History: The duration of one’s financial activities weighs in significantly. A longer history with various accounts demonstrates experience and reliability, providing confidence to potential lenders.

Types of Accounts: A diverse mix of financial accounts, including revolving and installment loans, can also enhance an individual’s reputation. This variety reflects an ability to manage different types of credit responsibly.

Recent Inquiries: Frequent requests for new credit can raise red flags for entities evaluating financial reliability. Minimizing these inquiries can present a more stable financial picture.

By focusing on these key aspects, anyone can work towards achieving an outstanding financial reputation, opening doors to better opportunities in the future.

Benefits of Achieving Excellent Credit

Having a stellar financial reputation can open up a world of advantages that many people may not even realize exist. When your standing is strong, lenders view you as a low-risk borrower, which can translate into significant savings and opportunities across various aspects of life.

One of the most prominent perks is access to lower interest rates on loans and cards. This can lead to substantial savings over time, whether you’re purchasing a home, a vehicle, or financing other significant expenses. Moreover, a favorable reputation often grants you more flexible terms that can better suit your financial situation.

Additionally, a high-ranking profile can enhance your bargaining power. When lenders compete for your business, you can negotiate for better deals and perks like cash back or travel rewards. It’s a win-win that can elevate your spending experience.

Another noteworthy benefit is the ease of approval for various types of financing. Whether you’re looking to rent an apartment or secure a personal loan, having a solid standing can simplify the process and reduce the stress often associated with applying for credit.

Lastly, a remarkable fiscal reputation can offer peace of mind. Knowing that you have well-managed finances can alleviate anxiety and help you plan for a more secure future. Investing in your financial health is not just about numbers; it’s about fostering opportunities and achieving your goals.