Understanding What Constitutes a Good Credit Score and Its Impact on Your Financial Health

Talking about financial ratings can sometimes feel overwhelming, but it plays a crucial role in our daily lives. These assessments determine how lenders view us, influencing our ability to secure loans, mortgages, and even favorable interest rates. Knowing the nuances can empower us to make informed decisions regarding our finances.

Many people wonder where they stand on this scale and what factors ultimately contribute to a top-tier evaluation. A high rating not only reflects trustworthiness but also opens doors to better opportunities. It’s fascinating to see how various elements, from payment history to overall debt load, come into play.

In this discussion, we’ll delve into the ranges that classify as acceptable and beneficial for those looking to navigate the world of lending and financial products. Understanding these nuances can help demystify the process and provide clarity for anyone eager to enhance their standing.

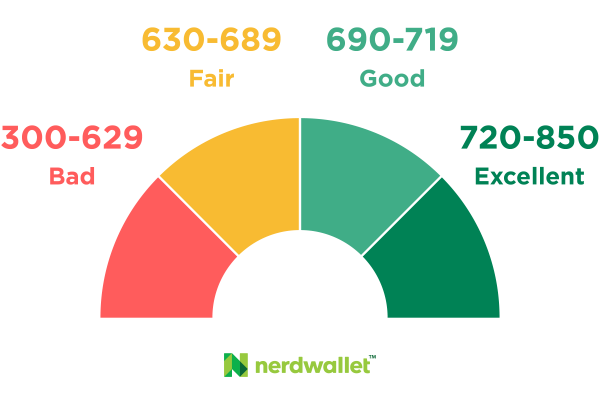

Understanding Credit Score Ranges

When it comes to personal finance, knowing where you stand in terms of numerical evaluations can be quite enlightening. These numbers play a crucial role in determining financial opportunities, influencing how lenders perceive your trustworthiness. Understanding the ranges can help you navigate through various options effectively.

The measurement typically falls into several categories. Each range signifies different levels of reliability, affecting everything from loan approvals to interest rates. Generally, lower ranges indicate higher risk, while elevated numbers suggest stronger financial health. Getting familiar with these divisions is essential for making informed financial decisions.

In most scenarios, individuals aim for positions within favorable brackets. Achieving stronger ratings often leads to benefits like lower payments and increased access to loans. It’s important to recognize that even minor changes can influence your standing, so keeping track of fluctuations is wise.

Ultimately, knowing where you fit within this framework empowers you. It allows you to take control of your financial future and make choices that bring long-term advantages. Remember, understanding these ranges is more than just a number; it’s about unlocking potential and enhancing your economic wellbeing.

Factors Influencing Your Rating

Understanding how your financial health is assessed can be quite enlightening. Several elements come into play to shape the overall perception of your monetary behavior, affecting decisions made by lenders and institutions. It’s essential to be aware of these components to effectively manage and improve your standing.

One primary aspect is your payment history. Timely payments on bills and loans play a significant role in reflecting reliability. Lenders view punctuality as a strong indicator of your financial responsibility. Additionally, the amount of debt you carry compared to your overall limits can influence the evaluation. Keeping balances low in relation to available credit is often seen as a positive sign.

The length of your credit history is also crucial. Longer relationships with financial institutions generally indicate stability and trustworthiness. However, if you are new to handling finances, it’s beneficial to establish accounts and demonstrate responsible use over time.

Another vital factor is the variety of accounts you manage. A mix of installment loans and revolving credit provides a broader view of your ability to handle different types of obligations. Lastly, hard inquiries–when lenders check your profile for making decisions–can have a temporary impact, so it’s wise to limit the number of applications for new accounts.

By keeping these factors in mind, you can work towards enhancing your financial reputation and positioning yourself favorably in the eyes of lenders.

Benefits of a High Credit Score

Having a strong numerical representation of your financial health can open many doors. It can lead to numerous advantages that enhance your borrowing experience and bring peace of mind. Understanding these perks can motivate you to maintain or improve this essential figure.

Lower Interest Rates: One of the most significant advantages includes access to more favorable interest rates on loans and mortgages. Lenders view you as a lower risk, which often translates into savings over time.

Easier Approval: A robust figure can make the loan application process smoother. Whether you’re looking for a new car or your dream home, a healthy rating increases your chances of approval.

Higher Credit Limits: Institutions may be willing to extend larger limits on your accounts. This flexibility can be beneficial in managing expenses without the need for frequent applications for additional credit.

Better Rental Options: Landlords commonly check financial health when processing applications. A solid standing can make you a more attractive tenant, paving the way for premium housing options.

Insurance Benefits: Certain insurers consider your financial reliability when determining premiums. Maintaining a strong rating might lead to lower rates on various insurance policies.

Financial Peace of Mind: Knowing you have a strong standing allows for greater financial freedom and confidence. It can reduce the stress often associated with borrowing and budgeting.