An In-Depth Look at the Credit Checks Conducted by Zillow

When it comes to navigating the world of real estate, many people wonder how various platforms evaluate potential buyers or renters. This process can involve multiple layers of scrutiny, with a focus on determining financial reliability. Whether you’re looking to purchase a new home or rent an apartment, having a clear understanding of what’s assessed can be crucial for your journey.

Every platform has its own methods for gathering and analyzing information about individuals. This assessment often revolves around personal financial behavior, aiming to paint a picture of someone’s ability to fulfill their obligations. Knowing what factors come into play can help you prepare for any inquiries you might encounter as you make your housing decisions.

By taking a deep dive into what information is typically reviewed, you’ll be better equipped to approach your housing search with confidence. Understanding these nuances not only helps in managing expectations but also empowers you to take proactive steps in presenting yourself as a reliable candidate.

Understanding Zillow’s Credit Check Process

When exploring housing options through various platforms, one aspect often comes into play–the evaluation of potential tenants or buyers. This procedure helps ensure that individuals are financially capable of fulfilling their obligations. It’s essential to know how this assessment unfolds and what it means for your future housing endeavors.

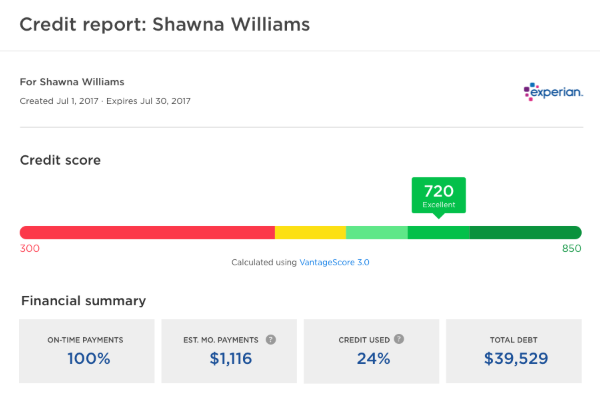

The evaluation typically involves a thorough look at financial behavior, including payment history and current financial standing. Understanding the criteria can play a significant role in determining approval for applications. It’s not just about numbers; patterns in past financial conduct carry weight too.

A key detail for many is the impact of these assessments on personal circumstances. Interested parties may find themselves curious if the insights gained during this process will affect their ability to secure a desirable home. Generally, individuals should be aware of how their financial actions influence their standing.

Overall, being informed is vital. Familiarity with this procedure can provide confidence while navigating the housing market. Knowing what factors contribute to the evaluation can empower individuals to take steps to improve their chances of success.

Impact of Credit Scores on Rentals

When it comes to renting a property, the numbers on an individual’s report play a significant role in determining the outcome. Landlords often rely on these figures to assess potential tenants, making them a key factor in the leasing process. A favorable score can lead to a smoother approval process, while a less-than-stellar rating may raise red flags for property owners.

Many landlords seek assurance that their prospective renters will meet financial obligations consistently. A robust rating suggests reliability, while a poor standing might suggest risk. As a result, those looking to secure a lease should be mindful of how their financial history might influence a landlord’s decision.

It’s essential for would-be tenants to understand that not all property owners weigh these scores equally. Some may adopt a more lenient approach, considering additional aspects like income or rental history. However, in a competitive market, a solid financial record can set candidates apart and enhance their chances of securing their desired dwelling.

In summary, being aware of how these evaluations work can empower tenants in their search for a new home. Taking proactive steps to improve one’s financial credentials can make a world of difference in navigating the sometimes tricky landscape of rental housing.

Alternatives to Zillow for Apartment Search

If you’re diving into the world of apartment hunting, you’re probably seeking platforms that can help streamline your search. Many options exist beyond the most popular services, offering unique features and user experiences.

One fantastic choice is Realtor.com. This site provides comprehensive listings, valuable market insights, and a user-friendly interface. It’s well-suited for those who appreciate detailed information about neighborhoods and property values.

Another platform worth exploring is Trulia. This site offers not only listings but also neighborhood ratings and reviews from residents, giving you a well-rounded perspective on potential areas to call home. You can truly gauge the vibes of a location before making a commitment.

Apartments.com also stands out with its extensive filter options and user-friendly layout. You can easily refine your search based on different criteria and even view floor plans, which is immensely helpful in visualizing your future space.

For a more community-driven experience, consider HotPads. This platform emphasizes rental apartments and houses, connecting you with landlords directly. It often highlights unique rental opportunities that may not be on larger sites.

Lastly, Facebook Marketplace offers a fresh approach to finding an apartment. By browsing local listings posted by individuals, you can discover rentals that are sometimes overlooked in traditional real estate platforms.

With these alternatives, you can expand your search and find that perfect apartment tailored to your needs and preferences. Happy hunting!