Understanding the Credit Requirements for Purchasing a Vehicle

When considering a new or used vehicle, many individuals find themselves pondering the various financial aspects involved in the process. It’s not just about the price tag; there are numerous factors at play that can influence how smoothly everything goes. Having a solid grasp of the financing landscape can make all the difference in securing that dream ride.

Different lenders have their own criteria, and it’s essential to familiarize oneself with the options available. Various elements come into play, from income stability to overall financial health, and even the history of repayment on previous commitments. A good understanding of these components will empower potential buyers, helping them navigate the sometimes complex world of vehicle financing.

Critical to this journey is assessing what lenders might expect when it comes to funding. Knowledge of ranges and standards can help inform decisions, ensuring that individuals are well-prepared when approaching financial institutions. After all, being proactive can lead to more favorable outcomes and a smoother transition into vehicle ownership.

Understanding Credit Scores for Auto Loans

When it comes to financing a vehicle, it’s crucial to grasp a few basic concepts regarding numerical evaluations of financial reliability. These scores can significantly influence the terms and conditions offered by lenders. Knowing how these ratings are determined can empower you to make informed choices and enhance your chances of securing favorable loan options.

The evaluation process typically considers several factors, including payment history, total debts, length of credit history, types of accounts, and recent inquiries. Each component plays a role in portraying overall financial behavior, which lenders assess to determine risk levels associated with lending funds for your intended purchase.

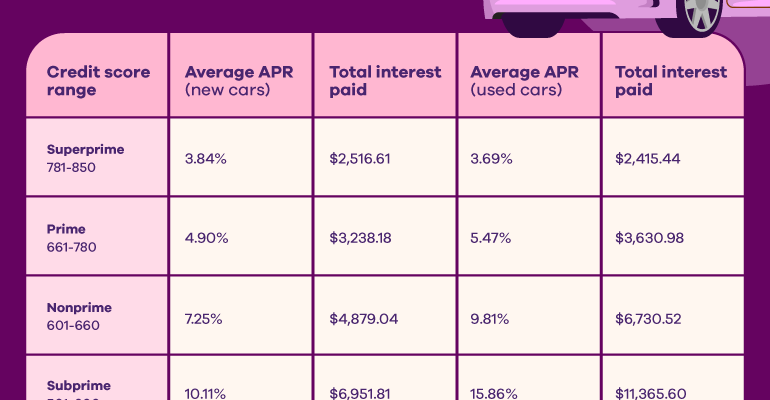

A higher rating often translates to better interest rates, which can lead to substantial savings over the life of your loan. For individuals with lower ratings, exploring avenues to strengthen financial profiles might open doors to improved financing opportunities. Monitoring progress and addressing any discrepancies can create a clearer path toward obtaining desired vehicle financing.

Understanding the nuances of financial ratings can ultimately help you navigate the world of auto financing with confidence. It’s all about being aware and proactive, ensuring that any venture into vehicle ownership becomes a rewarding experience.

Factors Influencing Vehicle Loan Approval

When it comes to securing financing for a new ride, several elements play a crucial role in determining whether lenders will greenlight your application. Understanding these aspects can make the process smoother and help you present yourself as a suitable candidate.

First and foremost, your financial background stands out. Lenders delve into income stability, monthly expenditures, and overall financial management. A steady job and a reliable income stream can significantly bolster your chances of approval.

Next, the history of managing previous loans or credit lines comes into play. A solid track record demonstrates responsibility and lowers the perceived risk for lenders. On the contrary, any delinquencies or bankruptcies in your past could raise red flags.

Another crucial factor is the amount requiring financing. The size of the loan requested should align with your financial capability. Lenders often assess your debt-to-income ratio to ensure you won’t be overextending your budget.

Lastly, the type of vehicle being financed can affect approval odds. Newer models might provide better terms, while older or higher-mileage vehicles could present additional challenges. Being aware of these nuances can give you an edge in your pursuit of funding.

Ways to Improve Your Credit Rating

Enhancing your financial reputation is an essential step towards achieving your goals. Whether it’s securing favorable loans or accessing better interest rates, taking meaningful actions can significantly impact your standing. Here are some practical strategies to elevate your score.

- Pay Bills on Time: Set reminders or automate payments to ensure you never miss a due date.

- Reduce Outstanding Balances: Focus on paying down existing debts to lower your utilization ratio.

- Limit New Applications: Avoid applying for multiple accounts at once, as each inquiry can slightly lower your score.

- Check Reports Regularly: Review your financial reports for errors or inaccuracies that could harm your standing.

- Keep Old Accounts Open: Maintain older accounts to show a longer history of responsible usage.

Implementing these tactics can lead to a healthier financial profile over time, opening up new opportunities and advantages.