Exploring the Various Uses of Financial Aid in Pursuit of Education and Beyond

When it comes to pursuing education or personal growth, various forms of assistance open doors to a world of possibilities. This support not only alleviates the burden of costs but also empowers individuals to focus on their goals without the constant worry of finances. Understanding the breadth of what this support can cover is crucial for making informed decisions.

Diving into the specifics, funds provided can be allocated towards numerous essential expenses. From tuition fees to the everyday necessities of living, the options are varied. It’s fascinating to consider how these resources enhance the overall experience, ensuring that the focus remains on learning and development rather than financial strain.

Furthermore, recipients of these benefits often discover that they can invest in their future in ways beyond traditional academic routes. Whether it’s purchasing textbooks, accessing learning materials, or even covering transportation costs, each investment plays a role in building a brighter future. Ultimately, recognizing the diverse avenues available allows one to maximize the impact of every dollar received.

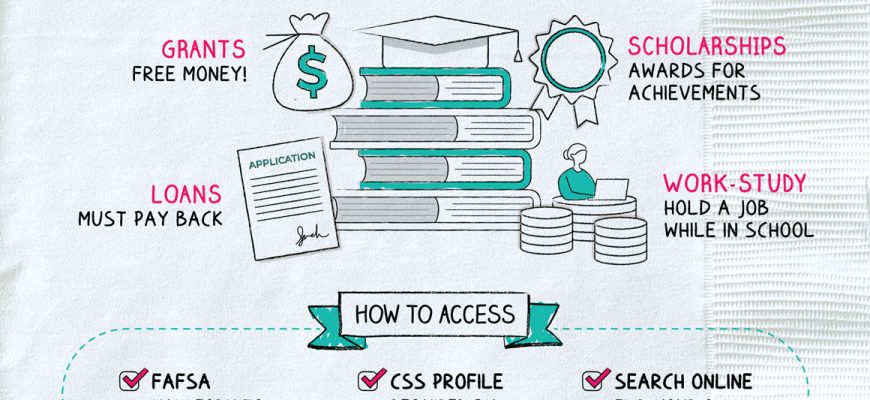

Understanding Financial Aid Categories

When it comes to financing education, there are several avenues available to consider. Each type offers distinct benefits and serves different needs. Let’s break down these classifications and how they can help aspiring students achieve their academic goals.

- Grants: Typically awarded based on financial need, these funds do not require repayment. They can be sourced from the federal government, state organizations, or even private institutions.

- Scholarships: These are often merit-based and recognize academic achievements, talents, or specific demographic qualities. Like grants, scholarships do not need to be repaid.

- Loans: This category involves borrowed money that must be returned with interest. Various types of loans are available, including federal and private options, each with unique terms and conditions.

- Work-Study Programs: This provides students the opportunity to work part-time during their studies, helping cover expenses while gaining valuable experience.

Each classification plays a vital role in the educational funding landscape. Understanding these differences allows individuals to navigate their options more effectively and select the best paths for themselves.

Covering Tuition and Fees

Getting an education often comes with a hefty price tag, but there are ways to ease the financial burden. Expenses associated with classes, such as tuition and various fees, can quickly add up, and it’s essential to understand how to manage these costs effectively. With the right resources, students can focus more on their studies and less on their wallets.

Tuition is usually the most significant expense, reflecting the cost of instruction. Different institutions have varying rates, and these can depend on factors like residency status or chosen program. Moreover, fees often accompany tuition and encompass various services, including library access, technology support, and health services. Understanding these charges is crucial for budgeting and financial planning.

Assistance options are available to help offset these educational expenses. By exploring scholarships, grants, or payment plans, individuals can find avenues to alleviate some financial stress. Smart budgeting and exploring available resources can lead to a more manageable and enjoyable educational experience.

Funding Living Expenses Effectively

Managing daily costs while pursuing education can be challenging, yet it’s crucial for a successful academic journey. Finding the right balance allows students to focus on their studies without the constant worry of meeting basic needs. Exploring various strategies helps ensure that every penny is allocated thoughtfully, contributing to a smoother experience both in and out of the classroom.

One effective method involves creating a detailed budget that outlines all necessary expenditures. This way, it’s easier to identify areas that require more attention or where adjustments may be beneficial. Prioritizing essentials, such as housing, utilities, and groceries, ensures that crucial needs are met first, paving the way for better financial management overall.

Additionally, seeking out local resources can provide further relief. Many communities offer assistance programs designed to alleviate costs associated with living. From food banks to scholarships aimed specifically at helping with everyday expenses, tapping into these resources can significantly ease financial burdens.

Consider sharing living spaces too. Roommates can reduce housing costs dramatically and foster a supportive environment conducive to learning. Splitting bills not only lessens individual financial responsibility but also encourages collaboration on household tasks, creating a sense of community.

Being mindful of spending habits is essential. It’s all too easy to get carried away with non-essential purchases. Keeping track of expenditures helps in recognizing patterns that may be unsustainable, allowing for better decision-making in the long run. Mindfulness around finances fosters discipline and an awareness that can lead to healthier financial habits.

Investing in Educational Resources

Enhancing one’s learning experience is essential in today’s fast-paced world. Allocating funds toward various educational tools can significantly elevate comprehension and retention of knowledge. Access to quality resources often paves the way for deeper understanding and improved academic performance.

Textbooks, online courses, and study guides are just a few of the options available. Purchasing these materials not only facilitates a smoother learning journey but also helps in grasping complex concepts more effectively. Additionally, tools like software programs and educational apps can provide interactive learning opportunities that traditional methods may lack.

Furthermore, participating in workshops and conferences can broaden perspectives in a particular field. Engaging with industry professionals and like-minded peers fosters a richer academic environment. This investment leads to an enriched curriculum delivery and a more immersive educational experience.

Ultimately, dedicating resources towards these avenues can create a solid foundation for future success. With the right tools at hand, individuals are better equipped to tackle their studies and unlock their full potential in their academic endeavors.