Exploring the Various Assets Taken into Account for Financial Aid Eligibility

When it comes to seeking assistance for educational purposes, many individuals often wonder what plays a role in the evaluation process. There’s a wide array of elements that can impact the level of support one can receive. From personal savings to various investments, these different components are carefully assessed to determine eligibility.

Each potential contribution brings its own significance to the table. It’s essential to recognize that not every item holds the same weight in the evaluation process. Some may be viewed as essential resources while others might not significantly influence the outcome. Understanding these nuances can make a difference in how one approaches the whole experience.

Ultimately, being informed about these various factors can empower individuals to make strategic decisions. Whether it’s managing savings or re-evaluating holdings, every choice can have an impact. Gaining clarity on this subject is the first step towards optimizing support opportunities.

Understanding Financial Aid Eligibility

Navigating the world of assistance can sometimes feel overwhelming. Many factors come into play when determining who qualifies for support. It’s important to grasp the various components influencing these decisions.

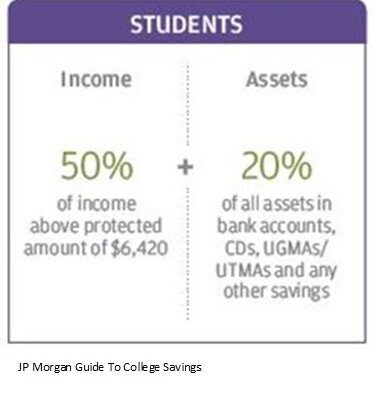

One key element is the overall financial picture of a student or their family. This encompasses various resources and holdings that may impact the amount of support granted. Let’s break down some crucial factors that can influence eligibility:

- Income levels from various sources

- Investments and savings accounts

- Home equity and real estate values

- Retirement savings

- Business ownership and assets

Additionally, specific situations such as dependents and unique hardships can also influence assessments. Understanding these variables is essential for anyone looking to secure financial assistance.

Each institution may have its own criteria, so it’s wise to check the requirements of the specific organizations you are targeting. Being informed enhances your chances of receiving the support you need to pursue your educational dreams.

Types of Assets Affecting Aid Decisions

When it comes to securing support for education, understanding the range of resources that play a role in eligibility can make a significant difference. Different categories of wealth may impact the assistance you receive, so it’s essential to be aware of what counts in the eyes of evaluators.

Liquid Holdings: This encompasses items that can quickly be converted into cash. Savings accounts, stocks, and bonds fall into this category. Evaluators closely examine these, as they can be easily accessed to cover educational costs.

Real Estate: Property ownership is another crucial factor. This includes your primary residence and any investment properties. The value of these holdings can influence the overall picture of your financial standing.

Business Interests: If you own a business, its value and how it operates may also affect your eligibility for assistance. The income generated and the value of the company will be part of the assessment process.

Retirement Funds: While these may not be directly accessible, certain accounts are still considered. Evaluators may look at retirement savings to gain a clearer view of your long-term financial situation.

Ultimately, a comprehensive understanding of how different resources are evaluated can help you navigate the complexities of obtaining support for educational pursuits.

Strategies to Manage Your Assets Wisely

When it comes to maximizing opportunities, one must approach their resources with careful consideration. Making smart choices today can shape a brighter future, allowing individuals to access various possibilities down the line. It’s all about finding the right balance between saving, investing, and spending effectively.

Evaluate Your Resources – Start with a thorough assessment of your current holdings. Understanding their value and potential growth can help you identify which areas need more attention. Create a comprehensive list of everything you own that contributes to your overall worth.

Set Clear Goals – Determine what you want to achieve. Whether it’s funding education, purchasing a home, or saving for retirement, clarity will guide your decisions. Break down your objectives into manageable steps that lead you toward your desired outcome.

Diversify Your Portfolio – Rather than putting all your eggs in one basket, consider spreading your investments across different sectors. This strategy can reduce risks and potentially enhance returns. Do your homework to find the right mix that aligns with your goals.

Regularly Review Your Progress – Keep an eye on your situation by revisiting your strategy periodically. Market conditions change, and so do personal circumstances. Assessing your progress can help you adjust your plan to stay on track.

Seek Professional Advice – Consulting with a knowledgeable expert can provide valuable insights. They can offer guidance tailored to your unique circumstances, helping you to navigate complex decisions confidently.

Making thoughtful choices about your resources today can pave the way for brighter opportunities tomorrow. Stay proactive, informed, and flexible to make the most out of your financial journey.