Exploring the Different Categories of Financial Aid Available to Students and Individuals

In today’s world, pursuing higher education can often come with a hefty price tag. Many individuals seek ways to lessen this financial burden, looking for options that can help them achieve their academic goals. Understanding the avenues available for assistance can make a significant difference in navigating the complexities of funding one’s education.

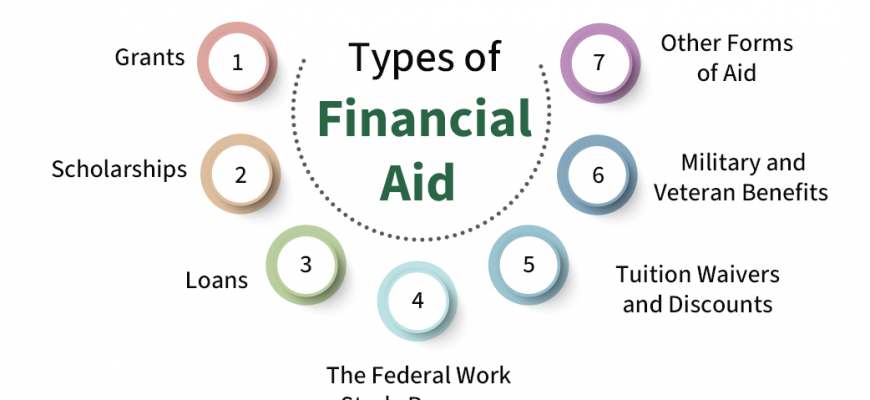

From scholarships to grants and loans, a wide array of resources exists to help students bridge the gap between their aspirations and the costs associated with obtaining a degree. Each option brings its own unique set of advantages, eligibility requirements, and potential impacts on a student’s financial future. Getting acquainted with these resources can empower individuals to make informed decisions about their academic journey.

Whether you’re embarking on your educational path or considering further studies, knowing how to access and utilize these resources effectively is crucial. With the right knowledge and approach, students can harness these support mechanisms to pave a smoother road toward their aspirations.

Understanding Grants and Scholarships

When it comes to supporting education, various options are available to lighten the load on students and their families. Among them, certain resources stand out due to their unique characteristics and advantages. These forms of assistance can provide much-needed relief and open doors for many individuals pursuing their academic goals.

Grants typically come from government entities or institutions, focusing on aiding students based on financial need. They are often considered a gift, meaning there’s no obligation to pay back the amount received. This aspect makes grants particularly appealing, especially for those navigating financial difficulties while aiming for higher education.

On the other hand, scholarships often reward academic excellence, talent, or specific backgrounds, creating opportunities for many. These awards can come from various sources, including universities, private organizations, and community groups. Unlike loans, scholarships, too, do not require repayment, allowing recipients to concentrate more on their studies rather than stress over accumulating debt.

Both grants and scholarships serve as excellent mechanisms to facilitate learning and enable dreams to flourish without the constant worry of financial barriers. Embracing the possibilities they offer can lead to a more fulfilling educational journey.

Loans: Categories and Their Implications

When it comes to financing education or other significant expenses, borrowing money can be a common route. It’s essential to understand the various options available and how they might affect your future. Choosing the right kind of funding can significantly impact your financial landscape in the long run.

Federal Loans typically offer lower interest rates and more flexible repayment plans. These are backed by the government, making them a popular choice for students. Within this group, there are subsidized options where the government pays the interest while you’re in school, and unsubsidized ones where interest accrues from the moment the money is received.

Private Loans come from banks or other lenders and can vary widely in terms of rates and terms. They often require a credit check, which means your credit score can play a large role in determining your eligibility and interest rates. Be cautious, as these loans might not offer the same protections or repayment options as their federal counterparts.

There are also Consolidation Loans, which allow you to combine multiple borrowing sources into a single payment. This can simplify your finances but may extend the repayment period, potentially increasing the total interest paid.

Finally, Income-Driven Repayment Plans can be a lifesaver when you’re struggling to make ends meet. These plans adjust your monthly payments based on your income, ensuring that your financial obligations remain manageable.

In summary, understanding the various loan options and their implications is crucial for making informed choices. Evaluate each alternative carefully to ensure you’re selecting the path that aligns best with your financial goals and circumstances.

Work-Study Programs and Benefits

Engaging in programs that blend education and employment is a smart move for many students. These opportunities allow individuals to gain practical experience while supporting their academic journey. It’s a win-win situation where learning goes hand in hand with earning.

One of the great things about these initiatives is the flexibility they offer. Students can often choose hours that fit around their class schedules, making it easier to balance work and studies. Additionally, the positions are typically related to their field of study, providing a chance to apply classroom theories to real-world situations.

Moreover, participants in these schemes often enjoy financial incentives that help offset tuition costs. This approach not only alleviates some of the monetary burdens but also cultivates valuable skills that employers seek after graduation. Networking opportunities arise naturally, allowing students to connect with industry professionals and build relationships that may lead to job offers down the road.

In essence, these programs foster both academic and professional growth, making them an appealing option for many individuals looking to finance their education while gaining essential work experience.

You’ve set the bar so high with this one! It was entertaining;fun;and so well-made. I loved it!