Exploring the Tax Credit Opportunities Available in 2025

Every year, individuals and families have an opportunity to lighten their financial load through various incentives offered by the government. These benefits can make a significant difference in budgeting, affording essential expenses, and even planning for the future. Understanding these advantages is crucial for maximizing your financial well-being.

As we look ahead to 2025, numerous options are emerging that could provide relief and support for different demographics, whether you’re a hard-working professional, a parent balancing family needs, or someone looking to further their education. The landscape of available assistance is ever-evolving, making it vital to stay informed about what might be available to you.

In this exploration, we will delve into the various forms of financial opportunities that could be accessible, shedding light on the requirements and benefits that come with them. By familiarizing yourself with these potential advantages, you can make informed decisions that align with your unique circumstances and goals.

Overview of 2025 Tax Credits

As we look ahead to 2025, there’s an array of financial benefits designed to lighten the load for various groups. These incentives aim to reward individuals and families, encouraging specific behaviors and supporting different sectors. Understanding what’s in store can help you make informed financial decisions and maximize returns.

Next year brings with it a blend of existing advantages along with new initiatives to stimulate economic growth. Some incentives target parents, while others focus on enhancing energy efficiency or supporting education. Keeping abreast of these offerings can mean significant savings, so it’s worth diving into the details.

Staying aware of these changes not only prepares you for tax season but also helps in strategic planning throughout the year. Whether you’re a homeowner, parent, or small business owner, there’s likely something tailored to your circumstances. By familiarizing yourself with the latest opportunities, you’re setting yourself up for potential financial relief.

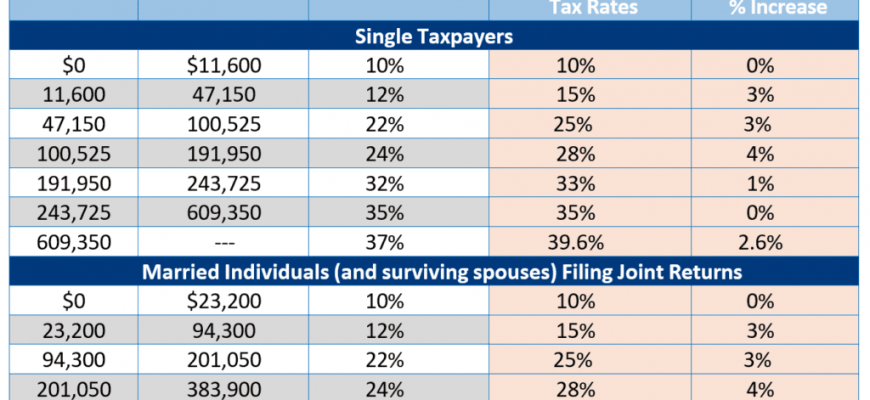

Key Changes in Tax Policies for 2025

As we approach the year 2025, significant adjustments in fiscal regulations are on the horizon. These changes are designed to impact individuals and businesses in various ways, potentially reshaping financial landscapes. It’s essential to stay informed about the latest developments, as these modifications could bring about new opportunities and obligations for taxpayers.

One notable shift includes alterations in deductions and exemptions that may alter the way individuals manage their finances. Taxpayers could find certain benefits either expanding or contracting, which necessitates a thorough review of personal budgeting strategies. Additionally, businesses might experience a revised approach to incentives as new programs are introduced to stimulate economic growth.

Moreover, some credits might see enhancements, making them more accessible to a wider audience. This could encourage investment in areas like renewable energy or education, reflecting a broader commitment to sustainability and well-being. Through these adjustments, officials aim to create a more equitable system while incentivizing positive contributions to society.

By understanding these forthcoming modifications, everyone can better prepare themselves for the financial landscape ahead. Staying updated will ultimately ensure that individuals and businesses can effectively navigate the new environment and capitalize on potential advantages.

Benefits of Utilizing Tax Incentives

Maximizing potential financial advantages through available deductions and incentives can significantly ease the burden of annual obligations. Taking the time to understand these opportunities often results in higher savings and improved budget management.

These financial advantages not only reduce the overall liabilities individuals face but can also encourage investments in personal growth and community engagement. By tapping into these incentives, taxpayers often find themselves with additional resources to allocate towards their goals.

Enlightening oneself about available options leads to informed decision-making. By planning ahead and strategically leveraging these incentives, individuals can enhance their financial well-being and foster a sense of security for themselves and their families.