Understanding the Essential Criteria for Obtaining Financial Aid

Navigating the world of assistance options can feel overwhelming. Many individuals find themselves pondering what it takes to qualify for various forms of support that can significantly alleviate educational expenses. This journey often begins with an exploration of foundational criteria and essential factors that influence eligibility.

Different pathways to receive support exist, and each may come with its own set of benchmarks. Determining one’s standing involves more than just filling out applications; it requires an understanding of personal circumstances, financial situations, and institutional requirements. Grasping these aspects can lead to a clearer picture of available options and how to successfully tap into them.

Engagement with the right information becomes crucial in this process. Realizing how to present your case effectively can make all the difference in securing the assistance you need. Through careful research and preparation, those seeking support can uncover exciting opportunities that can pave the way toward educational success.

Eligibility Criteria for Financial Assistance

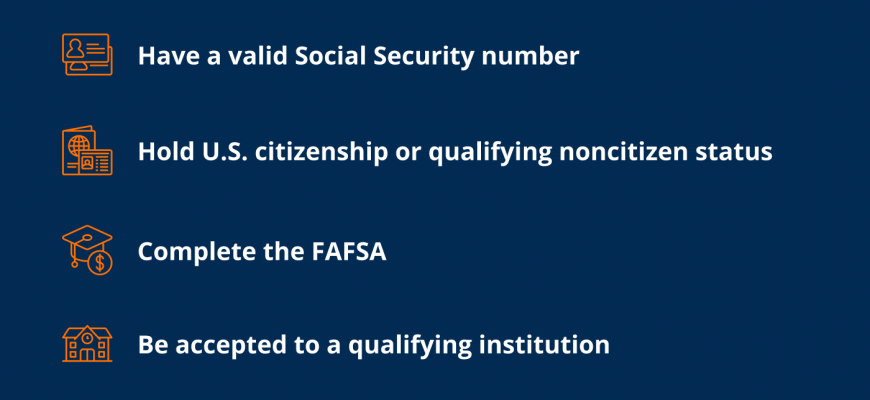

When it comes to securing support for education expenses, understanding eligibility parameters is crucial. Different institutions and programs have various guidelines that determine who can apply for assistance. These guidelines often take into account several factors that reflect a student’s unique situation.

First off, academic performance plays a significant role. Many programs require a certain grade point average or completion of specific coursework. Additionally, the enrollment status is important–full-time or part-time status can influence eligibility. Another critical factor is financial situation; applicants may need to submit documentation revealing their income levels, family size, and sometimes assets to demonstrate need.

Residency and citizenship can also affect eligibility. Many initiatives are only open to citizens or permanent residents, while some may target local residents to support education within the community. Lastly, particular programs might have age limits or require participation in extracurricular activities, adding layers to the eligibility landscape.

Documentation Needed for Aid Application

Applying for support often requires gathering various documents that help substantiate your request. These papers are crucial for demonstrating your situation and eligibility, giving reviewers a clearer picture of your circumstances. Having everything in order can make the process much smoother and increase your chances of receiving the assistance you need.

Typically, you’ll want to have identification documents handy. This may include items like a driver’s license or a passport to prove your identity. Additionally, personal financial information plays a significant role, so be prepared to provide tax returns or pay stubs that reflect your income status. If applicable, you might also need proof of your enrollment status or other educational records.

Don’t forget about documents related to your expenses or debts. Bills, loan agreements, and other financial obligations can showcase your need for support more vividly. Each institution may have slightly different expectations, so it’s worth checking their specific guidelines to ensure you have all necessary materials ready as you embark on this journey.

Types of Financial Assistance Available

When it comes to paying for education, various options exist to help ease the burden. Each type has its own unique characteristics and benefits, making it essential to explore what suits you best.

- Grants: These funds typically do not require repayment and are often based on financial need. They can come from federal, state, or institutional sources.

- Scholarships: Awarded based on merit, these financial resources recognize achievements in academics, sports, or community service. Like grants, they usually do not need to be repaid.

- Loans: Unlike the previous types, this support is borrowed money that must be repaid with interest. Various options are available, including federal and private loans, catering to different circumstances.

- Work-Study Programs: These opportunities allow students to work part-time while attending school, helping them earn money to offset costs while gaining valuable job experience.

- Tax Benefits: Some financial assistance comes in the form of tax credits or deductions, which can significantly reduce the overall cost of education.

With so many forms of support out there, it’s crucial to research each option thoroughly to find the right mix that aligns with your needs and aspirations.