Understanding Financial Aid Offers and How They Impact Your College Experience

Navigating the world of higher education can be quite overwhelming, especially when it comes to figuring out how to finance your journey. Many students and families find themselves lost in a sea of choices and information. Fortunately, there are programs available that can help lighten the load, making the pursuit of knowledge a bit more manageable.

These resources come in various forms, tailored to meet the diverse needs of learners. They might include grants, scholarships, or even loans designed to assist individuals in covering the costs associated with their studies. By exploring these options, students can gain a clearer understanding of the support available to them, enabling them to make informed decisions about their educational paths.

As you delve deeper into this topic, you’ll discover nuances that can greatly impact your finances while pursuing a degree. It’s essential to grasp the details surrounding these packages, as they can significantly influence your academic experience and future opportunities. With the right information, anyone can navigate this complex landscape with confidence and clarity.

Understanding Financial Aid Offers

Navigating the world of educational funding can feel overwhelming, especially when it comes to deciphering the details laid out in assistance packages. These documents are essential in helping students and their families determine how much support they can expect and what they might need to contribute themselves. A clear grasp of these specifics can significantly impact the decision-making process regarding schooling options.

Breaking Down the Components

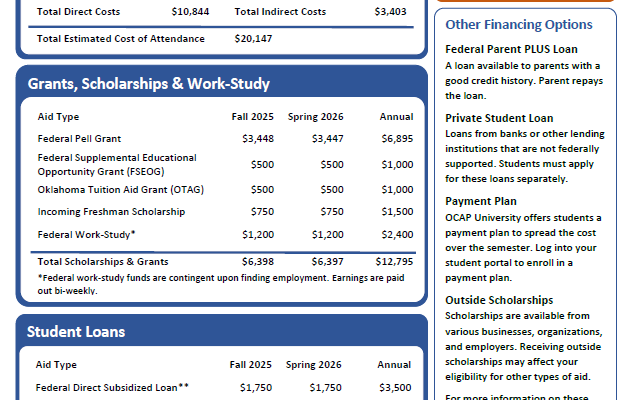

Each assistance package typically includes several elements such as grants, scholarships, loans, and sometimes work-study opportunities. Grasping the differences between these types can help individuals make informed choices. For instance, grants and scholarships do not require repayment, unlike certain types of loans that must be paid back with interest. It’s crucial to scrutinize the details provided to fully understand the financial implications associated with each component.

Evaluating Your Financial Position

Once you have a handle on the various types of support, it’s important to assess your own circumstances. Look at your current financial situation, including income, savings, and expenses. This can help determine whether the available resources meet your educational needs without placing undue strain on your budget.

Acceptance and Action

After thoroughly reviewing your assistance package, the next step is deciding how to move forward. If the terms and conditions align with your expectations, promptly accepting the support is essential to securing the funds. However, if there are discrepancies or concerns, reach out to the institutions involved for clarification. Taking proactive steps can lead to a more favorable financial experience during your academic journey.

Types of Support Options Available

When it comes to funding education, a variety of resources can help lighten the financial burden. These different avenues offer a range of opportunities tailored to diverse needs and circumstances. Understanding these options can empower individuals to make informed choices for their educational journeys.

Here are some of the most common varieties of support:

- Grants: These are typically awarded based on need and do not require repayment. They can come from federal programs, state governments, or private organizations.

- Scholarships: Often merit-based, these funds are given to students who excel in academics, sports, or other areas. They can also consider various personal factors.

- Loans: Unlike grants and scholarships, these funds must be repaid with interest. They can be offered by government entities or private banks, allowing students to borrow money for tuition and living expenses.

Additionally, there are other forms of support:

- Work-Study Programs: These allow students to work part-time on campus or in community service roles to help pay for their education.

- Tuition Reimbursement: Some employers may cover a portion of the educational expenses for their employees, especially for courses related to their job.

- State and Local Programs: Various regional initiatives may provide funds or resources for residents pursuing higher education.

With so many options available, it’s essential to explore and understand each choice to find the best fit for individual circumstances. By doing so, students can effectively manage the costs associated with higher learning.

How to Interpret Your Financial Aid Package

Understanding the details of your support package can feel overwhelming, but breaking it down makes things easier. You’ll want to familiarize yourself with the various components that contribute to your total support. Each element plays a role in determining how much funding you can access, so it’s essential to grasp what each part means.

Start by examining the types of assistance included in your paperwork. You’ll typically see grants, scholarships, loans, and work-study opportunities. Grants and scholarships don’t require repayment, making them especially valuable. Loans, on the other hand, will need to be paid back later, often with interest, so it’s crucial to understand the terms before proceeding.

Next, look at the total amount being offered and check if it meets your estimated expenses for the academic year. Compare this figure to your tuition fees, room and board, books, and other associated costs. This step will help you determine if you need to seek additional resources or adjust your budget.

As you review your document, make note of deadlines and conditions tied to the funds. Some assistance may come with stipulations–like maintaining a certain GPA or enrolling in a specific number of credits–so be sure to understand what you’re committing to.

Finally, don’t hesitate to reach out for clarification. Financial aid offices are there to help. If something isn’t clear, asking questions can ensure that you make the right financial decisions moving forward. Get comfortable with the terminology, and take charge of your educational funding journey!

Important Considerations for Applicants

When navigating the landscape of educational support, it’s essential to keep a few key points in mind. Understanding the different aspects involved can help you make informed decisions that align with your goals. With so many options available, a thoughtful approach will ensure you select the best opportunities for your circumstances.

Reviewing Eligibility Criteria is a crucial step. Every program has specific requirements, and knowing these can save you time and energy. Make sure to carefully read through the qualifications to see if you meet them. Sometimes, seemingly minor details can significantly impact your chances of receiving assistance.

Another aspect to consider is grant vs. loan distinctions. While grants are typically funds you don’t have to repay, loans can add to your financial burden later. Understanding the difference helps in mapping out your future financial health and choosing wisely.

Additionally, take note of deadlines and submission processes. Missing a deadline can mean losing out on valuable resources. Keeping a calendar and setting reminders could be your best allies in this process.

Finally, don’t hesitate to seek guidance. Whether it’s talking to a mentor, counselor, or even peers who have been through the process, gathering insights can shed light on the path ahead. Their experiences may provide tips and tricks you hadn’t considered.