Understanding the Differences Between Credits and Debits in Financial Transactions

In the realm of personal finance and accounting, transactions play a crucial role in determining the flow of resources. Whether you’re balancing your checkbook or managing a business ledger, grasping the distinctions between inflows and outflows becomes essential. Each entry impacts the overall financial health and provides insights into spending habits or revenue generation.

When diving into bookkeeping, two terms often surface. They represent opposite sides of a financial equation, each contributing unique insights into an individual’s or organization’s financial landscape. Appreciating their nuances can empower you to make informed decisions regarding budgets, investments, and operational strategies.

Understanding how these terms interact not only simplifies financial processes but also enhances your overall financial literacy. Mastery of these concepts can pave the way for better management of assets and liabilities, ensuring that you’re always on top of your financial game.

Understanding the Basics of Credits

In the realm of finance, there exists a fundamental practice of tracking value in various forms. This system plays a crucial role in monitoring transactions, influencing how we manage our resources. By gaining insight into these principles, individuals can enhance their financial literacy and make informed decisions.

At its core, this concept involves an increase in financial or asset value within accounts. It signifies a positive movement that reflects incoming resources or benefits. This can happen through various mechanisms, such as income from employment, sales, or even the repayment of prior loans.

Recognizing these transactions is vital for understanding personal finances. This awareness not only aids in maintaining balanced accounts but also empowers individuals to take control of their economic situation. Grasping how these inflows operate can pave the way for smarter budgeting and spending habits.

When we see an increment in our balance, it signals a thriving monetary environment. This information allows for better planning, whether it’s saving for future goals or investing in new opportunities. The interaction between these flows can shape our financial future significantly.

The Role of Debits in Finance

In the world of finance, tracking the flow of money is crucial for maintaining balance and understanding financial health. This process involves recording transactions that reflect outflows or expenditures. These transactions play a vital part in creating a clear picture of an individual’s or organization’s financial activities, helping to ensure that resources are managed effectively.

When it comes to managing accounts, those outflows represent a direct impact on available funds. They showcase expenses for goods, services, or various obligations. By diligently documenting these outflows, one can analyze spending patterns, identify areas for improvement, and make informed decisions about future financial strategies.

A crucial benefit of keeping a close eye on these transactions is the ability to maintain oversight on budgetary constraints. Knowing where money is going enables individuals and businesses to avoid overspending and ensure that they allocate resources wisely. This, in turn, sets the groundwork for achieving financial goals, whether it’s saving for a future project or maintaining a healthy cash flow.

Integrating these records into financial statements provides insight that goes beyond mere numbers. It helps to establish accountability, giving stakeholders a chance to evaluate financial stability and risk. Addressing these elements proactively can lead to smarter financial planning and ultimately, more secure financial futures.

How Credits and Debits Affect Accounting

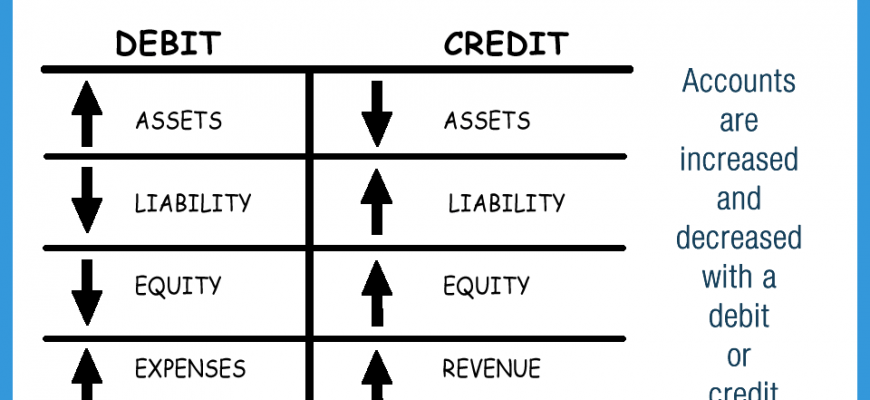

In the world of financial record-keeping, every transaction leaves a mark, shaping the financial landscape of a business. This dual-entry system relies on a balance between two primary components, creating a foundation for accurate reporting and analysis. Understanding how these elements interact is essential for anyone navigating the complexities of finance.

Each transaction consists of movements that either increase or decrease specific accounts, impacting the overall financial picture. For instance, when a company earns revenue, it enhances its income statements while simultaneously reflecting a rise in assets. Conversely, expenses reduce overall capital, playing a critical role in ensuring reports remain transparent and informative.

Maintaining this equilibrium is vital for anyone involved in managing finances. Efficient tracking of these movements allows for a clearer understanding of a business’s operation, providing insights that drive strategic decisions. Moreover, a firm grasp of this system aids in compliance with regulations and financial reporting standards.

Over time, the effects become evident in the financial statements, guiding stakeholders in assessing profitability and sustainability. As this system is put into action, it ensures that each transaction is thoughtfully evaluated, leading to a balanced approach in financial management. Ultimately, this foundational principle is key to achieving lasting success in any venture.