Understanding Tax Credits and Their Impact on Your Finances

Picture a scenario where your hard-earned money can be stretched a little further, thanks to specific provisions in the financial framework set by the government. This concept revolves around mechanisms designed to lessen the burden of obligations and provide relief to individuals and businesses alike. It’s like a helpful hand reaching out when you need it most, making it easier to manage your finances.

These financial tools come in various forms, often tailored to encourage certain behaviors or support specific groups within society. Whether aimed at promoting education, supporting families, or boosting investments in eco-friendly initiatives, they are crucial in shaping the economic landscape. Understanding how these incentives function can empower you to make informed decisions and reap potential benefits.

In essence, grasping how these financial adjustments work and who qualifies for them can open up a world of opportunities. From reducing overall expenses to strategically planning your fiscal responsibilities, this knowledge is invaluable. Let’s dive deeper into the mechanisms and examples of these helpful provisions and explore how they impact our financial lives.

Understanding Tax Credits and Their Benefits

Many people wonder about certain financial incentives offered by the government that can help reduce their overall financial burden. These incentives serve as a kind of support, allowing individuals and families to keep more of their hard-earned money. By leveraging these tools effectively, you can often find yourself in a more favorable position when it comes to financial planning.

Diving a bit deeper, these provisions come in various forms, often aimed at encouraging specific activities or helping those in need. For instance, individuals pursuing education or making eco-friendly choices might discover advantages that can lessen their expenses. Additionally, families with children may find opportunities that enable them to receive financial relief simply by meeting a few criteria.

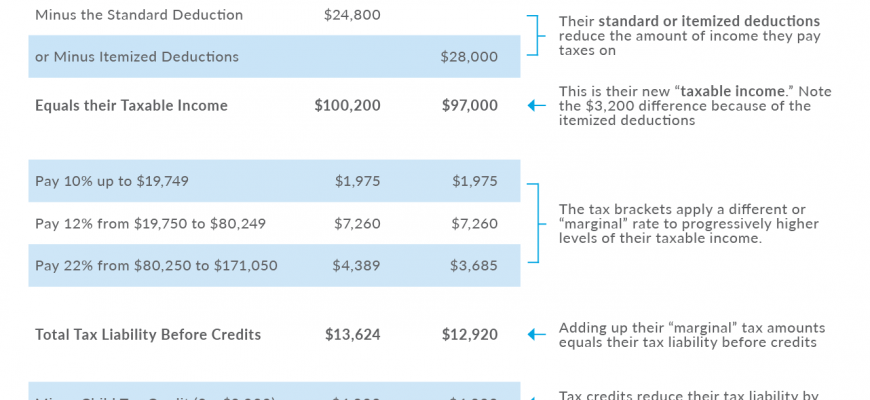

One of the most appealing aspects of these provisions is their direct impact on your financial situation. Unlike deductions, which reduce your taxable income, these incentives directly lower the amount you might owe, resulting in potential refunds or lesser amounts to pay. This distinction can make a significant difference during tax season, allowing you to reinvest in your personal or family needs.

Moreover, it’s essential to stay informed about available options, as they can frequently change based on new legislation or economic conditions. Keeping an eye on updates can open up unexpected avenues for savings. Consulting with financial professionals or using reputable online resources can also provide clarity and guidance tailored to your unique circumstances.

Types of Tax Incentives Available Today

In the realm of financial planning, various forms of incentives can significantly ease the burden on individuals and businesses alike. These benefits serve as tools to reduce liabilities, allowing for savings that can be utilized elsewhere. Let’s explore the different varieties that exist today, each designed to support specific situations or encourage particular behaviors.

One popular category is the refundable incentive, which provides a payment back to the taxpayer when the incentive exceeds the amount owed. This can be particularly beneficial for those with lower incomes. On the other hand, nonrefundable options only reduce the amount owed, making it crucial to understand your financial standing for optimal benefit.

Another group focuses on encouraging education. Programs aimed at offsetting the costs of post-secondary education can lighten the load for students and their families. Additionally, initiatives that promote eco-friendly practices give incentives to those who invest in renewable energy solutions or energy-efficient home improvements.

Don’t overlook healthcare support either, as some measures exist to assist with medical expenses or insurance costs. Finally, for businesses, there are incentives that reward job creation or investment in certain regions, promoting economic growth and community development.

Understanding these various forms can empower you to make informed decisions that align with your financial goals. Whether you’re a student, a parent, or a business owner, there’s likely an incentive that fits your needs and can enhance your financial strategy.

How to Claim Tax Benefits Effectively

Navigating the world of financial advantages can sometimes feel overwhelming, but there are straightforward ways to ensure you’re maximizing your returns. Understanding the process can lead to significant savings and make filing less stressful.

Here are some practical steps to enhance your experience:

- Research Available Opportunities: Take the time to explore different alternatives that may apply to your situation, such as educational funds, homeownership incentives, or energy-saving programs.

- Organize Your Documents: Keep all necessary paperwork in one place. This includes receipts, statements, and any other relevant information. A well-organized file can make the process smoother.

- Consult with Professionals: If you find the regulations daunting, consider reaching out to a financial advisor or accountant. Their expertise can provide clarity and help you identify potential benefits you might overlook.

- Double-Check Your Entries: Mistakes can lead to missed opportunities. Review all forms and submissions to ensure accuracy before you submit anything.

- Stay Informed: Rules can change yearly, so it’s vital to keep up with the latest updates. Subscribe to newsletters or follow reputable sources to stay ahead.

By following these simple yet effective strategies, you can make the process of accessing financial benefits more manageable and rewarding.