Understanding Credit Policies and Their Impact on Financial Institutions and Borrowers

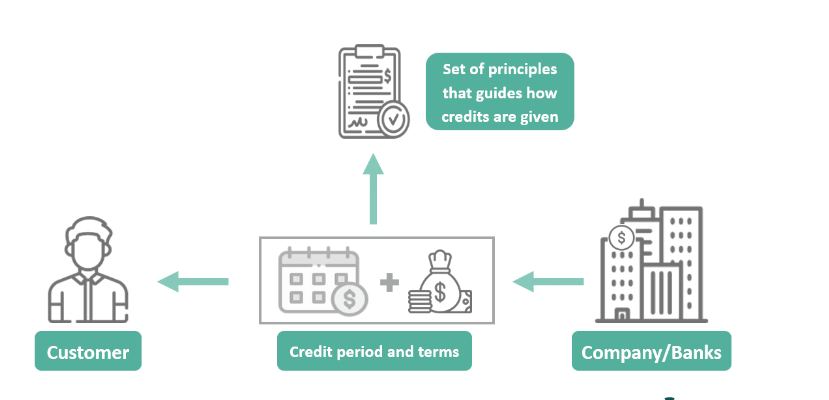

When diving into the world of lending and financial transactions, one soon encounters a fundamental framework that governs the relationship between lenders and borrowers. This structure provides clarity and sets expectations, ensuring that all parties are aware of their responsibilities. It serves as a roadmap, helping to navigate through the complexities of monetary exchanges in both personal and business contexts.

These guiding principles play a crucial role in maintaining the balance between risk and reward for financial institutions. By establishing clear criteria, they aim to safeguard the integrity of transactions while fostering trust and transparency. Whether you’re seeking funds for personal endeavors or business expansions, familiarizing yourself with these regulations can significantly influence the outcome of your financial endeavors.

Understanding the intricacies of these frameworks can empower individuals and organizations alike. It allows them to make informed decisions, negotiate better terms, and ultimately, manage their finances more effectively. With the right knowledge at your fingertips, navigating the lending landscape can become a much more straightforward process.

Understanding the Basics of Credit Policies

In the world of finance, establishing guidelines for lending is crucial for both lenders and borrowers. These frameworks help manage risk, ensure fairness, and maintain healthy cash flows. By laying down clear terms and conditions, institutions create a structured environment where transactions can occur smoothly and confidently.

Having a solid grasp of these essential guidelines is beneficial not just for financial organizations, but also for individuals looking to navigate their options wisely. Knowing how these principles function enables borrowers to make informed decisions while also providing lenders the security they seek.

Generally, lending institutions evaluate various factors before approving requests. These may include applicant’s creditworthiness, income levels, and existing debts. Each of these elements plays a significant role in shaping the overall approach and determining the terms included in the agreement.

Understanding these criteria is key to navigating the landscape effectively. It empowers individuals to enhance their chances of approval and fosters a positive relationship between banks and clients. The clearer the understanding of the underlying elements, the smoother the entire financial process becomes.

Types and Objectives of Credit Policies

When it comes to lending practices, various approaches shape how lenders conduct their business and manage risks. Each method highlights specific goals, influencing decisions on whom to lend to and under what terms. Understanding these diverse approaches helps in comprehending the broader financial landscape.

One prevalent approach is the risk-based model, focusing on the borrower’s creditworthiness. Lenders often use this method to assess the likelihood of repayment, tailoring offerings based on the perceived risk level. This strategy ensures that those with lower credit risks receive favorable terms, while higher-risk individuals may face stricter conditions.

Another approach involves the flexible lending model, which emphasizes adaptability in responding to market changes. Proponents of this method often adjust their criteria and terms to remain competitive and accommodate varying borrower needs. This can lead to creative financing options that benefit both parties.

Additionally, there are strictly defined frameworks aimed at minimizing defaults. Lenders following this strategy set rigid guidelines regarding eligibility, repayment schedules, and loan amounts. The primary objective here is to safeguard their financial interests while maintaining a clear structure for borrowers.

Ultimately, the ambitions behind these approaches often include enhancing profitability, maintaining a healthy portfolio, and fostering long-term client relationships. By aligning their strategies with specific objectives, lenders can effectively navigate complexities in the lending environment.

Impact of Credit Policies on Businesses

When a company decides how to manage lending practices, it significantly influences its financial health and future prospects. The guidelines set forth can either pave the way for growth or create hurdles that stifle expansion. Understanding these effects is crucial for both startups and established organizations.

Effective strategies in this area can enhance cash flow, ensuring that enterprises remain agile and can invest in new opportunities. For example, a liberal approach may allow for increased sales through customer financing options, enabling clients to make larger purchases without immediate upfront costs. This can lead to heightened customer loyalty and repeat business.

On the contrary, restrictive measures might hinder sales and deter potential customers, ultimately affecting revenue streams. Tightened lending standards may result in missed opportunities, as clients seek alternatives elsewhere. In this scenario, businesses could experience stagnant growth and struggle to keep pace with competitors who offer more favorable terms.

Furthermore, balancing risk and reward is essential. Each decision impacts not just immediate cash flow, but also long-term relationships with clients and partners. A well-thought-out approach can build trust and encourage repeat engagements, creating a winning formula for success.