Understanding the Importance and Impact of Financial Aid Opportunities

Seeking assistance for academic endeavors can often feel like navigating a complex maze. Many individuals often wonder how to tackle the financial burden of education and what options are available to alleviate that stress. The possibilities are vast, ranging from grants and scholarships to various repayment programs, each designed to make learning more accessible for everyone.

In this exploration, we’ll delve into various forms of support that can significantly lighten the load on students and their families. Understanding these resources can empower learners to make informed decisions, ensuring that cost does not become an obstacle on their educational journey. Let’s break down the essentials and discover how to harness the support systems available in the world of academia.

Whether you are a high school graduate ready to take the next step or an adult learner returning to the classroom, knowing what resources exist can transform your experience. Join us as we uncover the different ways to secure financial resources necessary for smooth sailing through educational pursuits and how to maximize these opportunities.

Understanding Assistance Options

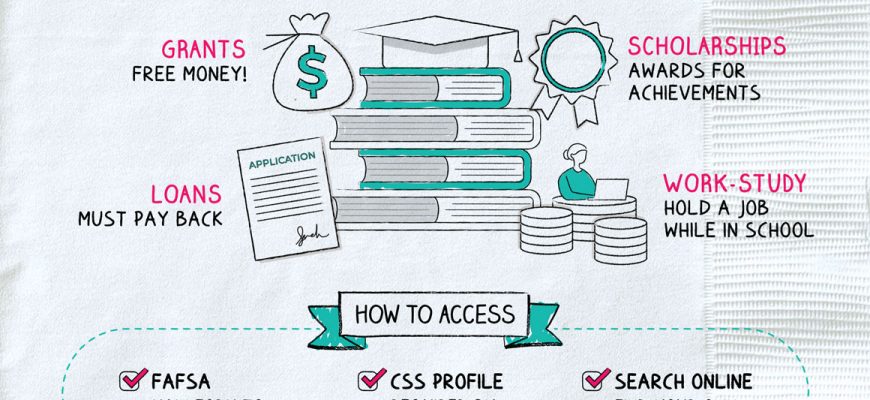

Exploring the various forms of support available can feel overwhelming, but it’s essential to know you’re not alone in this journey. There are numerous pathways designed to help individuals and families navigate the financial landscape, making education and other opportunities more accessible. These resources vary greatly, each with its unique criteria and benefits, tailored to meet diverse needs.

Different programs can provide crucial backing, whether you need a boost for schooling, help with living expenses, or guidance for short-term projects. Several institutions, organizations, and government entities work tirelessly to create an landscape where support is available for everyone. In understanding what’s out there, you empower yourself to make informed decisions that align with your goals.

Diving deeper into these options can uncover various types, such as grants, low-interest loans, or work-study initiatives. Each type serves specific groups and situations, allowing you to choose the most suitable path. Remember, the key is to research and identify opportunities that resonate with your circumstances, ensuring you receive the assistance that best fits your unique situation.