Understanding Vendor Credit in QuickBooks Online for Effective Financial Management

When running a successful business, maintaining smooth interactions with your suppliers is crucial. Finding efficient ways to manage the financial aspects of these relationships can streamline operations and enhance overall productivity. One effective method involves keeping track of the amounts owed to and received from these important partners, which can significantly impact your cash flow and budgeting strategy.

However, navigating the intricacies of these financial transactions doesn’t have to be daunting. There are practical solutions designed to simplify this process, making it easier for you to focus on building strong partnerships and achieving your business goals. Incorporating these tools into your financial management practices can lead to better decision-making and ensure you are always on top of your obligations and resources.

In this article, we will explore some handy strategies and tips that can help you efficiently manage your financial arrangements with your suppliers. By leveraging these insights, you can create a robust system that not only saves you time but also enhances your overall financial health.

Understanding Vendor Credit in QuickBooks Online

When managing your business finances, it’s common to encounter situations where adjustments or reimbursements are necessary. Knowing how to handle these situations can help you maintain accurate records and streamline your accounting process. Essentially, this concept involves acknowledging amounts that you may not need to pay back, either due to overpayments or product returns.

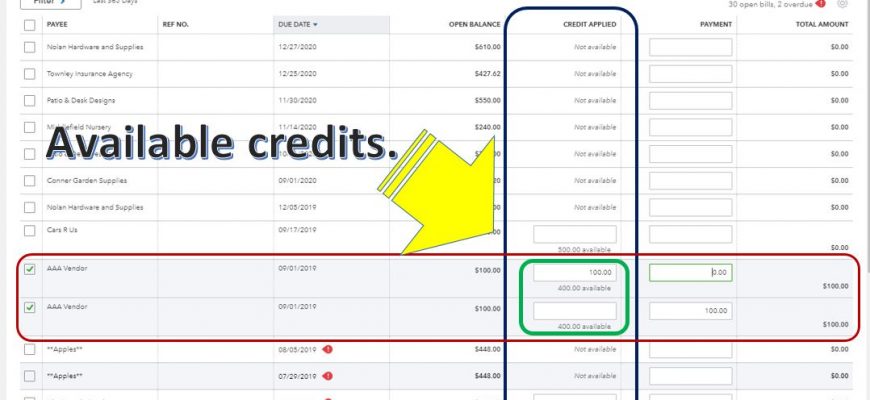

Essentially, this tracks any owed amounts that can be applied against future purchases. By properly recording these instances, you can keep your financial statements in check and avoid discrepancies. Utilizing this feature can be a real game-changer, providing insight into future cash flow and maintaining solid relationships with your suppliers.

Remember, it’s important to properly manage these transactions to ensure your financial records reflect your actual obligations. Making sure to accurately document these occurrences will not only aid in your bookkeeping but also enhance your operational efficiency.

Incorporating this practice into your routine will help you stay organized and informed about your business’s cash landscape. Keeping an eye on these adjustments leads to smarter financial decisions and better resource management.

How to Create Vendor Credits Efficiently

Managing returns or adjustments in your accounting software can feel daunting, but it doesn’t have to be. With the right approach, you can streamline the process and ensure everything is in order. Here’s a simple guide to help you handle this task smoothly.

- Gather Necessary Information:

Before you begin, collect all relevant details such as transaction IDs, amounts, and related documentation. Having everything at hand will save you time and hassle.

- Access the Right Section:

Navigate to the area of your software dedicated to transactions. This is typically where you manage your purchases and expenses.

- Create a New Entry:

Look for an option to add a new record or entry. This is usually accompanied by a prominent button or link. Click on it to get started.

- Input Details:

Fill in the fields with the information you gathered earlier. Be sure to double-check the amounts and any other specifics to avoid discrepancies.

- Attach Supporting Documents:

If your platform allows, upload any files or images that support your transaction. This can help clarify the context later on.

- Save and Review:

After entering all the necessary data, save your work. Take a moment to review the information for accuracy before finalizing the record.

Following these steps will help you handle adjustments efficiently. Remember, the key is to stay organized and keep your records up to date!

Managing Supplier Adjustments for Accurate Accounting

When running a business, it’s crucial to stay on top of your financial transactions. One key aspect involves dealing with adjustments you might receive from suppliers, which can significantly impact your bookkeeping. Keeping track of these transactions not only ensures you maintain a clear financial picture but also helps you in making informed decisions. In this section, we’ll explore some effective strategies to handle those adjustments like a pro.

First off, always document every adjustment promptly. When you receive a notification about an alteration, make it a habit to log the specifics immediately. Whether it’s an invoice correction or a refund, having this information saved will help you when reconciling your accounts later on. You’ll want everything clearly outlined so that nothing slips through the cracks.

Next, categorize these adjustments properly. It’s important to classify them into the correct account to avoid confusion down the line. For instance, if you receive a refund, ensure that it goes against the right expense category. This will make your reports more accurate and insightful, aiding you in financial planning and analysis.

Additionally, regularly review your adjustments and reconciliations. Set aside time each month to go through your records. This practice can reveal discrepancies or trends that need addressing and will give you an overall sense of your business’s financial health. Staying organized will save you headaches when tax season rolls around.

Lastly, consider leveraging technology to streamline your processes. Numerous accounting tools can help automate tracking and reporting, reducing manual errors and saving you precious time. Adopting these solutions will enhance your efficiency and help maintain accuracy in your financial reporting.