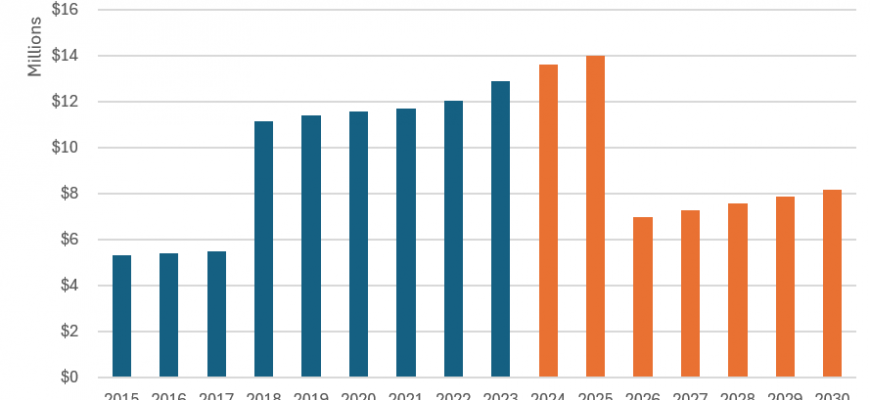

The Impending Conclusion of the Unified Credit Program in 2025

As we approach a significant shift in fiscal policy, many individuals and families are left pondering what this means for their financial landscape. The anticipated alteration in government support programs is set to impact countless lives, and understanding these changes is crucial for effective financial planning. This moment presents both challenges and opportunities that merit our attention.

The current assistance options have provided a level of security for various demographic groups, ensuring that they can manage their expenses with greater ease. However, with impending shifts on the horizon, it’s vital to examine how these adjustments will influence overall financial strategies. The transformation is not merely a bureaucratic update; it signifies a shift in how support is structured and distributed across the populace.

As we navigate through this period of transition, keeping informed about what lies ahead is essential. Analyzing the implications of these upcoming adjustments will enable individuals to prepare adequately and make informed decisions about their finances in the coming years. By staying engaged with the evolving landscape, one can better adapt to the financial realities that await.

The Implications of Benefit Expiration

The coming end of certain financial advantages brings with it a wave of consequences that individuals and families should carefully consider. This shift can alter the landscape of personal finance, leaving many to reassess their long-term plans and strategies. Understanding these impacts is crucial for navigating the impending changes.

As these benefits approach their expiration, taxpayers may find themselves in a more precarious situation. The potential to leverage various allowances for minimizing tax liabilities will diminish, prompting individuals to explore alternative methods to safeguard their finances. It’s essential to begin evaluating other options sooner rather than later, as time is of the essence.

Moreover, this change can have a ripple effect on estate planning. Families may need to adjust their inheritance strategies, knowing that previous tools for tax efficiency will no longer be available. In light of this, it becomes increasingly important to seek professional guidance to ensure that one’s legacy is protected as much as possible.

Additionally, there is a broader economic context to consider. When many people begin to reevaluate their financial situations, it could lead to shifts in consumer behavior and a reduction in spending. Economists will likely be keeping a close watch on how these transitions unfold in the market.

In summary, the impending expiration of these financial benefits marks a significant shift that demands attention and proactive measures. Embracing a thoughtful approach can help individuals and families mitigate potential challenges, ensuring they remain on solid financial footing amid the changes ahead.

Understanding the Unified Credit System

When discussing the financial framework designed to assist individuals with their tax obligations, it’s essential to grasp how this system functions. Essentially, it serves as a safety net, providing support to taxpayers while ensuring that wealth is appropriately distributed among various demographics. This concept is all about balancing the scales and making the tax experience smoother and fairer for everyone involved.

The system is structured to minimize the burden on those with lower incomes, allowing them to retain more of their earnings. It operates under a set of guidelines that determine eligibility and benefits, ensuring that assistance is targeted effectively. By understanding these principles, individuals can make informed decisions that align with their financial goals.

Moreover, this framework emphasizes the importance of proper planning and awareness. Individuals need to stay informed about any changes or updates that may affect their financial landscape. This proactive approach not only empowers taxpayers but also fosters a sense of responsibility and understanding of the fiscal environment.

In conclusion, grasping the nuances of this financial support structure is crucial for navigating personal finances successfully. By engaging with this system and utilizing its benefits wisely, taxpayers can build a more secure financial future.

Financial Strategies Ahead of 2025

As we look toward the evolving landscape of personal finance, it’s essential to consider how upcoming changes may impact our financial planning. With adjustments on the horizon, now is the perfect time to strategize and ensure that your financial foundation remains solid and adaptable to new regulations and opportunities.

One effective approach is to review your current planning tools and investment vehicles. Diversifying your portfolio can spread risk and potentially lead to higher returns. Explore various asset classes, such as stocks, bonds, and real estate, to safeguard against possible downturns. Also, think about incorporating alternative investments, which can provide unique opportunities for growth.

Another important aspect is to prioritize savings. Building an emergency fund can provide a safety net, allowing you to tackle unexpected expenses without derailing your financial stability. Aim for at least three to six months’ worth of living expenses set aside in a high-yield savings account or another easily accessible vehicle.

Additionally, consider the implications of taxation on your investments. Proactively managing your tax liability can enhance your overall returns. Consult with a financial advisor to explore tax-efficient strategies, such as utilizing tax-advantaged accounts or understanding how capital gains tax may affect your investment decisions.

Lastly, staying informed about financial news and trends is crucial. Being aware of changes in the economy, regulations, and market conditions allows you to make educated choices. Engaging in continuous education through workshops, online courses, or reputable financial literature can empower you to stay ahead in your financial journey.