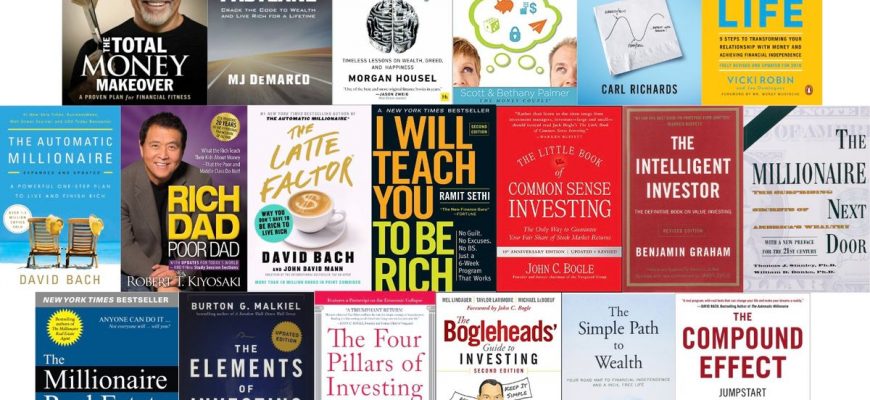

Essential Books for Financial Guidance and Empowerment

Managing your resources can feel like a daunting task, especially with the endless options available today. The good news is that there are invaluable resources out there that can illuminate your path, providing insights and strategies to navigate the complex world of money. Whether you’re just starting out or looking to enhance your existing knowledge, these materials can offer a refreshing perspective.

It’s fascinating how the right words can inspire action and change. Within the pages of these insightful guides, you’ll find not only practical advice but also motivation to reshape your approach to wealth and budgeting. Engaging narratives paired with actionable steps can transform how you perceive challenges in your financial landscape.

Diving into such literature can be a transformative experience. The wisdom shared by seasoned authors can empower you to take control of your financial destiny, making the journey less intimidating and far more rewarding. Let’s explore some of these enlightening reads that are sure to spark your curiosity and enhance your understanding.

Essential Reads for Financial Literacy

Understanding money matters is crucial for navigating today’s world. A solid foundation in this area empowers you to make informed choices, manage your resources effectively, and plan for the future. Whether you’re looking to save, invest, or simply gain a clearer picture of your finances, diving into some insightful literature can provide the knowledge you need.

There are numerous titles that can transform your perspective on managing personal resources. These works often blend practical advice with compelling narratives, making complex concepts accessible and engaging. They can serve as a guide through the maze of budgeting, investing, and retirement planning, equipping you with skills that will benefit you for years to come.

Incorporating these insightful narratives into your reading list can spark motivation and encourage proactive steps toward achieving your financial goals. From understanding economic principles to mastering the art of investing, these selections inspire readers to take control and make wise decisions. Embrace the journey of learning and watch your confidence grow as you delve deeper into the world of wealth management.

Investing Insights from Influential Authors

When it comes to navigating the complex world of investments, gleaning wisdom from experienced voices can be a game changer. Renowned thinkers have shared their journeys, strategies, and philosophies, offering valuable lessons for both novices and seasoned investors alike. Let’s dive into some of the key perspectives these authors provide, helping to illuminate the path toward making informed decisions.

Understanding Risk and Reward is a common theme among many influential writers. They emphasize the necessity of assessing potential pitfalls alongside expected returns. By weighing these factors carefully, investors can better prepare themselves for the unpredictable nature of markets.

Long-term Vision emerges as another critical insight. Successful authors often advocate for a patient approach, encouraging readers to resist the temptation of short-sighted gains. This mindset helps to cultivate resilience and fosters sustainable growth over time.

The importance of emotional discipline is frequently highlighted. Leading figures in the investment realm stress that being aware of one’s feelings during market fluctuations can prevent hasty decisions. They advocate for sticking to one’s proven strategies despite the noise surrounding them.

Engaging with diverse investment philosophies is also a vital takeaway. Rather than following a single doctrine blindly, embracing a variety of approaches allows investors to adapt to changing landscapes. This flexibility can be a significant asset in achieving long-term financial goals.

Ultimately, insights from these respected authors can empower aspiring investors to approach their financial journeys with confidence and knowledge. Harnessing their wisdom not only enhances understanding but also inspires a more strategic mindset in the ever-evolving world of investment.

Strategies for Budgeting and Saving

Managing your finances doesn’t have to feel overwhelming. With a bit of planning and some simple techniques, you can take control of your spending, set aside money for the future, and even enjoy life a little more without constantly worrying about your wallet.

There are several effective methods to streamline your budgeting and enhance your savings. Here are some strategies you can incorporate:

- Create a realistic budget: Assess your income and expenses to determine how much you can allocate to different categories like necessities, entertainment, and savings.

- Track your spending: Keep a record of where your money goes each month. This will help you identify unnecessary expenses and adjust your budget accordingly.

- Set savings goals: Whether it’s for an emergency fund, a vacation, or a big purchase, having clear targets can motivate you to save consistently.

- Use the envelope system: Withdraw cash for various spending categories and place them in labeled envelopes. Once the cash is gone, that’s it for the month.

- Automate your savings: Set up automatic transfers to your savings account right after you get paid to make saving easier.

In addition to these methods, consider these tips to make your saving journey smoother:

- Cut unnecessary subscriptions: Review your recurring payments and cancel services you rarely use.

- Take advantage of discounts: Look for coupons, cashback offers, and seasonal sales to save on purchases.

- Start a side hustle: Utilize your skills or hobbies to earn extra income that can go straight into savings.

By implementing these strategies, you can create a more secure financial future and enjoy greater peace of mind. Remember, small changes can lead to significant improvements over time!

I was smiling the whole way through! Your videos are always so much fun to watch.