Exploring the Best Discover Credit Cards for Your Financial Needs

In today’s fast-paced world, having the right tools to manage your finances effectively is more important than ever. Finding options that not only cater to your spending habits but also provide valuable rewards can elevate your financial experience. Whether you’re looking for perks while traveling, cash back on everyday purchases, or simply a straightforward way to handle expenses, the right selection can make a significant difference.

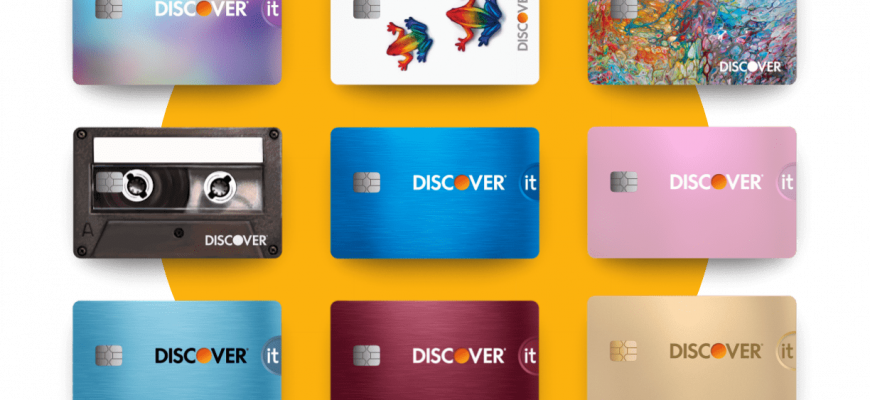

Understanding the various offerings available in the market can seem overwhelming at first, but it doesn’t have to be. Each option comes with unique features that can cater to different lifestyles and needs. From generous bonus opportunities to flexible rewards systems, there are choices that entice both seasoned users and those new to financial management.

As we delve into the realm of exceptional financial solutions, you’ll discover a variety of enticing options that can help you maximize your spending while enjoying benefits along the way. Let’s take a closer look at what stands out in today’s competitive landscape and how you can make an informed decision tailored to your personal preferences.

Advantages of the Discover Financial Product

When it comes to making purchases and managing expenses, having a reliable financial tool can make all the difference. This particular option comes packed with a variety of perks that can enhance your everyday spending experience. Let’s delve into some of the remarkable benefits that come with it.

- Cashback Rewards: Earn a percentage back on every purchase you make. It’s like getting paid to spend!

- No Annual Fee: Enjoy all the benefits without worrying about yearly costs eating into your rewards.

- Introductory Offers: Take advantage of attractive initial promotions, including bonus cashback after meeting certain spending requirements.

- Flexible Redemption Options: Use your rewards in various ways, whether it’s for statement credits, gift cards, or even direct deposits into your bank account.

- No Foreign Transaction Fees: Perfect for travelers! Make purchases abroad without incurring additional charges.

- Enhanced Security: Equipped with advanced fraud protection, you can shop online and in stores with peace of mind.

- Customer Service: Access reliable support, available 24/7, ensuring assistance is just a call away whenever you need it.

In summary, this financial tool not only simplifies your monetary transactions but also provides a plethora of advantages that can enrich your spending habits and financial wellbeing.

How to Choose the Right Option

Finding the perfect financial option for your needs can often feel like a daunting task. With so many choices available, it’s essential to consider what features align best with your personal habits and goals. A thoughtful approach can lead you to an option that complements your lifestyle and maximizes benefits.

Begin by evaluating your spending patterns. Are you a frequent traveler, or do you prefer dining out? Different offerings cater to various interests, so identifying where your money goes can help narrow down your selection. Next, pay attention to rewards programs. Some options provide cash back, while others may give travel points or discounts at retailers. Choose what aligns with your preferences for the greatest return.

It’s also important to consider fees and interest rates. Some options may lure you in with enticing rewards but come with hidden costs that can offset any benefits. Compare these elements to ensure the overall value suits your financial situation. Additionally, look for any introductory offers that may give you a head start on earning rewards or bonuses.

Lastly, read customer reviews and experiences. Real-life feedback can offer insights that numbers alone may not convey. Take time to research and make an informed decision that suits your unique needs. Ultimately, the right choice will help you manage your finances more effectively while rewarding you for your everyday activities.

Maximizing Rewards with Discover Offers

When it comes to making the most of your spending power, leveraging special promotions can make a significant difference in the perks you rake in. By staying informed about unique opportunities and strategically planning your purchases, you can amplify the benefits you receive. Whether it’s through cashback, discounts, or bonus points, understanding how to navigate these offerings can truly enhance your financial experience.

First things first, keep an eye on seasonal campaigns. Many promotional deals change throughout the year, allowing you to earn extra rewards for everyday purchases. For instance, if a certain category is highlighted this month, plan your shopping around it. Whether it’s dining, groceries, or online shopping, timing is everything when aiming to get the best return on your expenditures.

Don’t forget to take advantage of rotating categories that sometimes offer increased earnings. By monitoring these categories closely and adapting your spending habits accordingly, you can transform ordinary expenses into extraordinary rewards. Additionally, signing up for alerts or newsletters can keep you in the loop about the latest offers and maximized earning potential.

Moreover, consider pairing your offers with special promotions available at your favorite retailers. Combining these deals can lead to even greater savings and rewards. Whether it involves using specific coupons or taking advantage of store sales, these little strategies can stack up to substantial gains.

Lastly, always evaluate your options. Before making a purchase, take a moment to explore how you can score the most points or cashback. By being intentional about your spending and utilizing available resources, it’s easier than ever to enhance the rewards you enjoy with each transaction.