Achieving the Highest Credit Score in India and Its Importance for Financial Success

In today’s fast-paced financial landscape, having a solid understanding of how lending institutions evaluate individuals is essential. Knowing what influences your standing can be a game changer when it comes to making significant financial choices. Many people aim to achieve and maintain a favorable ranking, which serves as a testament to their reliability and fiscal responsibility.

The intricacies of this assessment can be quite fascinating. From various factors that play a role in determining your standing, to the impact it has on your borrowing power, there’s so much to unpack. It’s not just about numbers; it reflects your financial behavior and history, essentially painting a picture of your monetary habits that can open or close doors to opportunities.

If you’ve ever wondered how this system works and what it takes to climb the ladder of financial reputation, you’ve come to the right place. Let’s dive deeper into the elements that contribute to achieving a stellar ranking, and discover the guidelines that can help you on this journey.

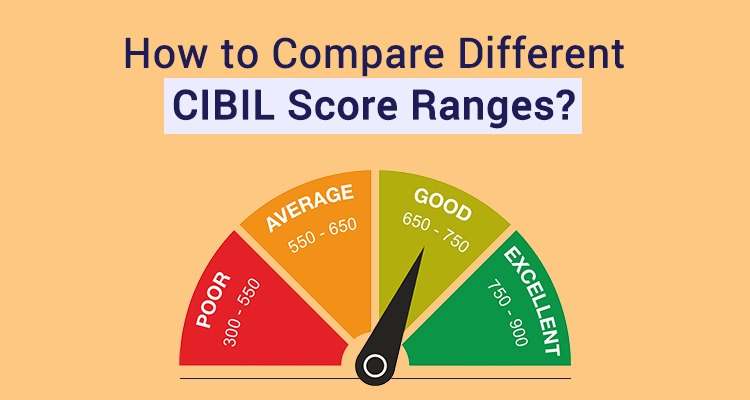

Understanding Credit Scores in India

When it comes to personal finance, one concept that often pops up is the numeric value reflecting your financial reliability. It’s crucial in determining your eligibility for loans and even rental agreements. But what exactly goes into calculating this figure? Let’s break it down in a way that makes sense to everyone.

Firstly, this numerical representation is influenced by various factors. Your payment history plays a significant role; consistently meeting deadlines enhances your reliability. In addition, the proportion of utilized available resources compared to the total limit contributes to how lenders perceive you. The mix of different types of accounts can also have an impact, showcasing your ability to manage various financial commitments.

Moreover, the duration of your financial journey matters as well. A longer and well-maintained history typically signals stability and responsibility. Frequent inquiries or requests for fresh resources, though, can raise red flags, suggesting potential financial struggles. Hence, maintaining a disciplined approach to managing your finances is key.

Understanding this numerical measure not only empowers you but can also pave the way for better opportunities in your financial journey. Whether you’re eyeing a new car, a home, or simply want to keep your options open for the future, grasping the intricacies of this assessment is essential.

Factors Affecting Your Rating

When it comes to understanding how your financial standing is evaluated, several elements come into play. These components work together to create a comprehensive picture of your financial behavior and responsibility. Let’s dive into what influences this assessment and how you can take charge of it.

One significant aspect is your payment history. Consistently making payments on time shows lenders that you’re reliable, while missed or late payments can severely impact your standing. Additionally, the amount of money you owe across various accounts also plays a crucial role. High balances relative to your limits can signal more risk to potential lenders.

Your length of credit history is another factor. The longer you’ve maintained accounts, the better. It demonstrates experience and stability in managing your finances. Moreover, the types of accounts you hold also matter; a mix of revolving credit and installment loans can reflect versatility and responsible management.

Finally, frequent inquiries about new lines of credit can raise red flags. While a single inquiry might not have a drastic effect, multiple requests in a short period can suggest financial distress. By being mindful of these elements, you can work towards a healthier financial image and ensure that you’re well-positioned for future opportunities.

How to Improve Your Rating

Enhancing your financial reputation is crucial for unlocking better opportunities in life. It’s not just about numbers; it’s a reflection of your creditworthiness and can significantly affect your future borrowing capacity. Fortunately, there are several actionable steps you can take to uplift your rating and position yourself for future financial success.

First and foremost, always pay your bills on time. Late payments not only incur fees but also leave a negative mark on your profile, which can linger for quite some time. Setting reminders or automating payments can help you stay on top of your obligations.

Next, consider keeping your credit utilization low. This means using a smaller portion of your available credit limits. Aim to keep this figure below 30%; doing so demonstrates that you are responsible and not overly reliant on borrowed funds.

It’s also wise to check your financial reports regularly. Mistakes can happen, and they can adversely affect your standing. If you spot any inaccuracies, make sure to dispute them promptly to have them corrected.

Another effective technique is to maintain a diverse mix of credit accounts. Having a blend of revolving credit, such as credit cards, and installment loans, like car or personal loans, can contribute positively to your overall assessment.

Finally, avoid applying for multiple new accounts in a short period. Each application can trigger a hard inquiry, which might lower your reputation temporarily. Patience is key; focus on building a robust history over time to achieve more favorable outcomes.