Leading Companies for Credit Scoring in the UK

When it comes to managing your finances and ensuring lucrative opportunities, understanding how financial institutions assess your worth is crucial. In the UK, there are several key players in the realm of financial evaluations that help individuals and businesses navigate the complex landscape of lending and borrowing.

These organizations offer valuable insights and ratings that can influence decisions from loan approvals to interest rates. Knowing which services to trust can make a significant difference in your financial journey, allowing you to secure better terms and improve your overall financial standing.

Let’s dive into the most renowned entities in this industry, exploring their unique features and how they can assist you in achieving a financially sound future. Whether you’re looking to secure a mortgage, apply for a personal loan, or simply want to stay informed about your financial health, these providers offer essential information to help guide your decisions.

Understanding Ratings in the UK

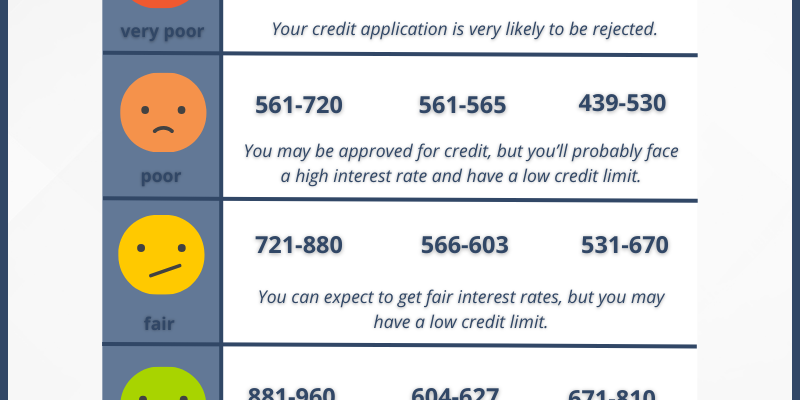

Getting a grasp of how ratings work in the UK is vital for anyone looking to manage their financial life effectively. These assessments play a key role in determining how lenders view you and your borrowing potential. Knowing the ins and outs of these evaluations can empower you to make informed choices and improve your financial standing.

In the UK, a variety of organizations evaluate individuals based on their financial history and behavior. This background review includes factors like payment punctuality, outstanding debts, and credit utilization. Understanding these elements can help you identify areas for improvement and enable you to build a healthier financial profile.

Why are these ratings important? They influence not only loan approvals but also the terms attached to them, such as interest rates and repayment schedules. A stronger assessment can lead to more favorable conditions, which is why taking steps to enhance your profile is worth the effort.

Moreover, it’s essential to regularly check your own evaluations. Errors or outdated information can hinder your chances of securing favorable deals. Being proactive allows you to spot inaccuracies and take corrective action before they affect your financial opportunities.

Ultimately, making sense of how these metrics work is the first step toward achieving your financial goals. Whether you plan to apply for a mortgage or simply want to improve your overall financial health, a solid understanding of your standing is indispensable.

Leading Firms for Financial Assessments

When it comes to managing your financial health, having access to reliable firms that provide assessments is crucial. These organizations play a vital role in helping individuals and businesses understand their financial standing. They gather and analyze various types of information to produce insightful reports that can guide users in making informed decisions.

ClearScore stands out for its user-friendly platform, offering free access to reports and useful tips on how to improve your financial profile. With a focus on transparency, it allows users to see what affects their standing and how to navigate it effectively.

Experian is another significant player in this space, recognized globally for its comprehensive services. They not only offer assessments but also tools tailored to help users enhance their financial situation. Their services include ongoing monitoring and alerts, ensuring users stay informed on any changes in their status.

Equifax is well-known for its robust reporting systems and diverse range of products aimed at both consumers and businesses. They provide insights that can lead to better financial decisions and enhance overall awareness of one’s financial landscape.

Lastly, TransUnion is praised for its emphasis on security and accuracy. With innovative technology, they deliver timely information that can help users manage their financial lives with confidence. Each of these firms contributes uniquely to ensuring individuals and organizations can track and improve their financial health effectively.

Improving Your Rating Effectively

Boosting your financial standing is not just a task; it’s an ongoing journey that can open doors to better opportunities. Whether you’re looking to secure a loan, apply for a mortgage, or even get a new mobile phone contract, your rating plays a crucial role in these processes. Fortunately, there are effective strategies you can adopt to enhance your financial profile and achieve the results you desire.

One of the simplest yet most impactful ways to improve your standing is to ensure that your payments are always made on time. Late or missed payments can significantly damage your reputation, so setting up direct debits or reminders can help you stay on track. Additionally, keeping your balances low relative to your available limits is another critical factor. This demonstrates to lenders that you can manage your finances wisely, which can positively influence your standing.

It’s also essential to check your financial history regularly. Mistakes can happen, and inaccuracies can hinder your progress. By reviewing your reports, you can identify any errors and take immediate steps to rectify them. Furthermore, minimizing unnecessary applications for new accounts can prevent any negative impacts from hard inquiries on your history, helping you maintain a more favorable reputation.

Lastly, consider diversifying the types of accounts you hold. A mix of credit options, such as a personal loan or a credit card, can show lenders that you are capable of handling different forms of credit responsibly. With patience and diligence, you can effectively improve your standing and pave the way for better financial prospects in the future.