The Best Services for Protecting Your Credit and Financial Identity

In today’s world, ensuring the safety of your financial identity is more crucial than ever. With the rise of digital transactions and the increasing sophistication of fraud tactics, individuals are often left feeling vulnerable. Fortunately, there are effective avenues available that aim to keep your personal information secure and provide peace of mind against potential threats.

These invaluable options can help mitigate risks associated with unauthorized access to sensitive data. They offer a range of tools and strategies designed to monitor, alert, and even assist users in managing their finances in a safer manner. By leveraging advanced technology and professional insight, individuals can take proactive steps towards safeguarding their assets.

Whether you’re looking for ongoing monitoring of your financial activities or want to know how to navigate potential crises, understanding the scope of these tailored programs is essential. Let’s explore some of the leading options available today that prioritize your financial well-being and security.

Understanding Credit Protection Benefits

When it comes to ensuring your financial well-being, having a solid safety net is essential. These helpful tools can provide you with peace of mind, knowing that your financial identity is shielded from potential threats. With various features designed to monitor your financial activities, you can stay informed and take action if something seems off.

One of the key advantages of these protective measures is that they often include regular updates about your financial status. This can help you catch any suspicious activities early on, allowing for quick intervention. Additionally, a robust monitoring system can alert you to changes in your financial profile, giving you the insight needed to make informed decisions.

Another significant benefit is the support you receive in case of unauthorized activity. Many of these programs offer assistance navigating the often-complex landscape of resolving fraud-related issues. This can save you time and stress, allowing you to focus on what really matters in your life.

Moreover, having access to educational resources can empower you to make smarter choices regarding your financial health. Understanding how to build and maintain a solid financial profile can go a long way in enhancing your overall stability. It’s not just about defense; it’s also about building a stronger financial future.

In summary, investing in these safety measures can offer you a range of benefits that go beyond mere surveillance. They provide a comprehensive approach to securing your financial identity, supporting you whenever needed and enabling you to thrive in your financial endeavors.

How to Choose the Right Service

Selecting the perfect solution for safeguarding your financial well-being can feel overwhelming. With so many options available, it’s essential to approach the decision-making process with a clear strategy. To start, consider what specific needs you have and what aspects of your financial health are most crucial to you.

Begin by researching different offerings. Look for features that align with your goals, such as monitoring capabilities, identity theft insurance, or recovery support. Don’t hesitate to dive into customer reviews – firsthand experiences can provide valuable insights into the effectiveness and reliability of various options.

Another key factor is the level of support provided. Consider whether you prefer automatic updates or personal assistance in case of any issues. A responsive support team can make a significant difference should you face any concerns down the line.

Pricing is also an important aspect. Compare the costs associated with each option and ensure that the services you’re considering provide good value for what you pay. Look for any hidden fees or long-term contracts that may complicate your financial planning.

Lastly, trust your instincts. If a particular solution feels right for you after reviewing its offerings and terms, it’s likely a suitable choice. Make sure to take your time and choose wisely, as this decision can significantly influence your financial future.

Leading Firms for Financial Safety

When it comes to safeguarding your financial health, it’s essential to choose the right organizations that specialize in keeping your information secure. In today’s digital age, many businesses offer various ways to help individuals shield their monetary assets and prevent identity theft. With so many options available, understanding which ones stand out can make a significant difference in achieving peace of mind.

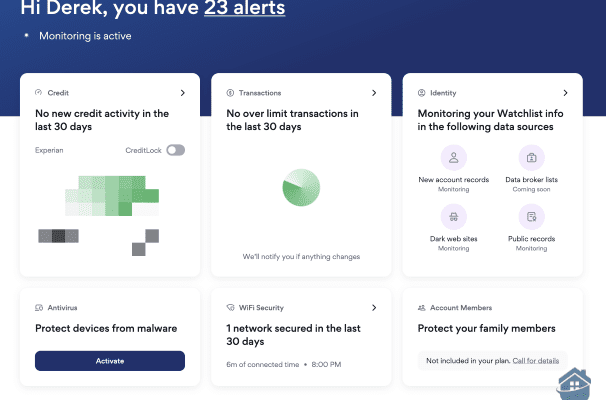

Several notable companies have earned a reputation for their commitment to helping consumers maintain their financial integrity. These firms provide a range of solutions, from monitoring services that alert you to suspicious activities to comprehensive recovery plans in case of a breach. By leveraging advanced technology and dedicated support teams, they ensure that your personal data remains under wraps, allowing you to navigate your financial journey with confidence.

It’s important to compare what each organization brings to the table. Some might focus more on real-time alerts, while others emphasize restoration services after a compromise. Reviews and user experiences can shed light on the effectiveness of their offerings. Making an informed choice not only empowers you but also enhances your overall financial resilience.