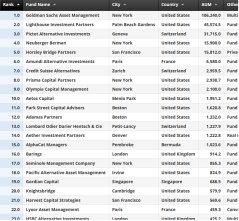

Leading Hedge Funds Specializing in Credit Strategies

In the world of finance, there exists a realm where innovative strategies meet complex market dynamics. This intriguing segment not only attracts seasoned investors but also beckons the adventurous at heart. Here, financial maestros navigate through a landscape filled with opportunities and challenges, seeking to maximize returns while expertly managing risks.

With a plethora of choices available, discerning which pathways to follow can be quite the task. As various players innovate and adapt, they craft unique approaches to capitalize on shifting trends and market behaviors. Understanding these methods allows investors to make informed decisions and potentially enhance their portfolios in ways that traditional avenues may not offer.

In this exploration, we dissect some of the most effective and dynamic methodologies that characterize this influential sector. Prepare to dive deep into the intricacies that define this space and discover the strategies employed by those who thrive in the ever-changing financial environment.

Characteristics of Leading Credit Hedge Funds

When diving into the realm of successful investment strategies, certain traits consistently stand out amongst the most respected players in the field. These attributes not only shape their approach to asset management but also significantly impact their performance during various market conditions. Understanding these qualities can offer valuable insights into what makes them excel in an ever-evolving financial landscape.

Strategic Diversification: One hallmark of these prominent investment entities is their commitment to diversification. By spreading their investments across various sectors and asset classes, they mitigate risks associated with concentration. This careful allocation helps in balancing potential losses and gains, leading to more stable returns over time.

Analytical Rigor: Another key aspect is their unwavering focus on data analysis and research. These organizations employ sophisticated algorithms and rely on expert insights to scrutinize market trends and identify lucrative opportunities. This diligence in research ensures well-informed decisions, enhancing their ability to navigate complex financial scenarios.

Risk Management Expertise: Managing risk is second nature to these flourishing entities. They actively assess and adjust their portfolios to respond to changing market dynamics. Using advanced strategies like derivatives and hedging techniques, they protect their assets while still pursuing gains, ensuring a robust performance even in tumultuous periods.

Flexibility and Adaptability: The ability to pivot in response to new information or market shifts is another defining characteristic. These players are not rigid in their strategies; instead, they remain open to new methodologies and adjust their tactics as needed. This adaptability is crucial for sustained success, particularly in unpredictable environments.

Experienced Leadership: Strong leadership is often the backbone of these distinguished investment groups. Visionary leaders guide their teams with expertise and foresight, steering their strategies and ensuring alignment with overarching goals. This leadership fosters a culture of innovation and discipline that permeates the organization.

In summary, the most prominent players in this investment sphere share a blend of strategic diversity, analytical prowess, effective risk management, adaptability, and strong leadership. These traits not only bolster their resilience but also enhance their potential for consistent success in a challenging financial landscape.

Investment Strategies Employed by Investment Vehicles

When it comes to managing capital, various approaches exist to maximize returns and minimize risks. These methods can range from traditional buy-and-hold techniques to more complex, dynamic strategies that adapt to market conditions. Understanding these strategies provides insight into how skilled managers navigate the financial landscape to seek profits.

One common approach is the long/short equity strategy, where managers take long positions in undervalued assets while simultaneously shorting overvalued ones. This tactic allows for potential gains from both rising and falling markets, creating a balanced risk profile. Additionally, many practitioners utilize event-driven tactics, capitalizing on specific events like mergers, acquisitions, or restructurings that can impact asset prices significantly.

Another prevalent strategy involves employing macroeconomic analysis, where investors make decisions based on global economic trends, interest rates, and political developments. This strategy often includes derivatives and other financial instruments to leverage positions in various markets, aiming to profit from broad economic movements.

Moreover, some choose a systematic approach, relying on algorithms to identify trading opportunities based on historical data and market signals. This method relies heavily on technology and statistical models, aiming for efficiency and speed in executing trades.

Lastly, multi-strategy approaches combine several tactics, allowing flexibility to switch between different techniques based on market conditions. This diversification can mitigate risks while enhancing the potential for returns across various asset classes.

Performance Analysis of Leading Investment Vehicles

In this section, we will explore the effectiveness and outcomes of some of the most recognized investment entities operating in the financial markets. Understanding their performance can provide valuable insights into their strategies and the overall landscape of investments.

When evaluating their success, we consider a few key metrics:

- Annual Returns: Analyzing how much capital these entities generate over a year can reveal their profitability.

- Volatility: It’s crucial to assess the fluctuations in their performance. Lower volatility often indicates better risk management.

- Sharpe Ratio: This metric helps to understand if the returns justify the risks taken.

- Drawdown: Investigating the maximum peak-to-valley loss can yield insights into potential risks during downturns.

The landscape is diverse, with various players adopting unique approaches. Here’s a look at some strategies employed:

- Long/Short Positions: Managers often take opposing positions to capitalize on market inefficiencies.

- Event-Driven Strategies: Investments based on specific events, like mergers or acquisitions, can yield significant returns if timed correctly.

- Relative Value Approach: This tactic involves identifying mispriced securities and profiting from the price convergence.

By reviewing historical performance and strategic tactics, investors can better gauge which entities align with their financial goals and risk tolerance. The key is to analyze trends and outcomes meticulously, paving the way for informed investment decisions.