Leading Credit Funds to Consider for Your Investment Portfolio

When it comes to building a portfolio, exploring avenues that revolve around lending and borrowing can be an exciting journey. These investment opportunities offer a unique blend of potential rewards and risks, making them an intriguing choice for those looking to diversify their assets. With the right information and guidance, anyone can navigate this landscape effectively.

Engaging in this type of market allows investors to tap into various strategies focused on generating income through interest payments. From institutional offerings to specialized avenues, there are numerous ways to approach this asset class. Each option has its unique set of characteristics, catering to different risk appetites and financial goals.

Whether you’re a seasoned investor or just starting to explore the world of investments, understanding the nuances of these instruments can significantly enhance your financial literacy. As we delve deeper into this fascinating subject, you’ll discover strategies, opportunities, and insights that can help bolster your investment strategy.

Understanding Investment Vehicles Essentials

When diving into the realm of financial investments, it’s crucial to grasp the fundamental concepts that underpin various types of investment vehicles. These entities provide a unique opportunity for investors looking to diversify their portfolios while seeking returns that align with their risk tolerance and financial goals. By delving into the essentials, one can better appreciate how these instruments function and their significance in the broader marketplace.

At their core, these investment vehicles pool resources from multiple investors to create a larger capital base. This structure enables a more diversified approach, potentially reducing individual risk and enhancing returns. Participants often gain access to a range of debt instruments that may be challenging to navigate individually. Understanding the mechanics behind how these arrangements operate is key to making informed investment decisions.

Moreover, the management of these entities plays a vital role in their performance. Skilled managers analyze market conditions, creditworthiness, and interest rates, all while striving to maximize returns for their participants. It’s this expertise that can make a significant difference in outcomes, emphasizing the importance of choosing wisely when considering participation.

As one explores this investment avenue, it’s essential to familiarize oneself with various strategies and inherent risks. Each vehicle operates differently, and comprehension of these distinctions ensures that investors align their choices with personal financial objectives. Investing smartly can lead to fruitful opportunities, but an informed approach is paramount.

Advantages of Investing in Fixed-Income Portfolios

Putting your money into fixed-income portfolios offers a range of appealing benefits. These investment vehicles are designed to provide investors with predictable returns, making them an attractive option for those looking to balance risk and reward. Beyond just financial gains, such investments can help diversify your overall portfolio, which is essential for managing risks effectively.

One of the primary advantages is the steady cash flow. Many of these options yield regular income through interest payments, allowing you to enjoy a consistent stream of revenue. This feature is particularly beneficial for individuals seeking reliable income sources, such as retirees or those saving for future goals.

Another key benefit is the potential for capital preservation. Fixed-income instruments often come with a lower risk profile compared to stocks. This characteristic makes them a safer bet during market volatility, helping to shield your investments from major downturns. Thus, they serve as a stable foundation within a wider investment strategy.

Additionally, these options often have lower fees compared to more actively managed alternatives. This can lead to a higher net return for investors, enhancing the overall profitability of your financial strategy. It’s worth noting that fees can significantly impact your long-term gains, so opting for more cost-effective solutions may prove advantageous in the long run.

Finally, investing in these types of portfolios grants a great opportunity to support various sectors of the economy. By distributing your funds, you contribute to areas like housing, infrastructure, or corporate development. This not only benefits you financially, but also aids in fostering economic growth, which can be quite rewarding.

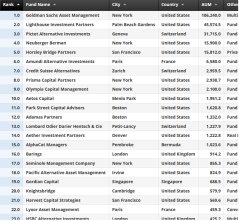

Best Performing Investment Vehicles in 2023

This year has brought a wave of interest in various lending opportunities, showcasing how certain groups have managed to outperform expectations. Investors are increasingly looking for avenues that not only provide potential returns but also offer stability and resilience in uncertain times. Let’s explore some of the standout performers that have captured the attention of those seeking to diversify their portfolios.

Among the most impressive options, several have demonstrated significant growth and strong management strategies. These choices have effectively balanced risk and reward, making them appealing for individuals who wish to navigate the complexities of the market with confidence. With various approaches tailored to different investor needs, 2023 has been a year of discovery and opportunity.

The performance metrics from the past months reveal the brilliance of certain management teams that have adapted swiftly to changing economic landscapes. Their ability to identify key sectors, capitalize on emerging trends, and make informed decisions has mapped out a pathway for impressive returns. It’s fascinating to see how these diverse approaches resonate with investors looking for reliability.

As we delve deeper, it becomes clear that some of these selections not only performed well but have also set a benchmark for future investments. The focus on consistent yields and effective strategies has attracted a wider audience, allowing a broader segment of investors to feel secure in their ventures. So, if you’re considering where to channel your resources, exploring these remarkable performers might be a step worth taking.