Leading Credit Reporting Agencies in the United States You Should Know About

Understanding how financial institutions evaluate our borrowing potential is crucial in today’s economy. These organizations play a pivotal role in how lenders determine whether or not to extend a loan to an individual, based on various factors like credit history and financial behavior. Without these key players, navigating the intricate world of loans and credit would be a much harder endeavor.

The function of these agencies extends beyond simply providing a score; they compile comprehensive reports that encompass an individual’s credit activities over time. This information is utilized not just by banks, but also by landlords, insurers, and employers to make informed decisions. The insights they offer can significantly impact one’s financial opportunities and overall stability.

In this discussion, we’ll delve into the premier institutions that have established themselves in this sector. By highlighting their unique features and the services they provide, we hope to shed light on the importance of understanding your personal financial footprint and how it affects your daily life.

Understanding Major Credit Reporting Agencies

When it comes to evaluating an individual’s financial history, three key organizations play a crucial role in gathering and analyzing this information. These entities provide valuable insights into how consumers manage their finances, which can influence lending decisions and financial opportunities.

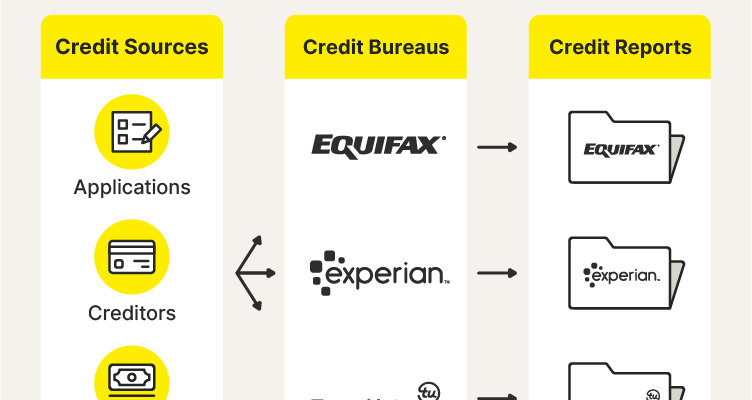

Each of these companies operates independently, yet they all share the same goal: to compile and maintain accurate records of people’s borrowing behaviors. They collect data from various sources, including banks, credit card companies, and other lenders, creating a comprehensive profile that reflects a person’s creditworthiness.

Understanding how these organizations function can empower individuals to make informed decisions about their financial lives. By knowing what information is collected and how it’s utilized, consumers can better navigate the complexities of borrowing and manage their credit profiles effectively.

Comparing Services Offered by Credit Agencies

When it comes to assessing your financial health, various organizations offer a range of tools and resources. Each entity specializes in unique services designed to help individuals understand their financial standing. By comparing what these organizations provide, you can make informed decisions that align with your financial goals.

One of the primary services includes monitoring your financial profile, ensuring that you stay updated on any changes or suspicious activities. These organizations also offer reports that summarize your financial behaviors, giving you insights into your borrowing habits. Some may have features that assist in budgeting, while others provide personalized advice tailored to improve your standing.

Additionally, many of these entities offer educational resources, such as articles and tools that clarify the intricacies of financial management. From understanding how to build a solid reputation to tips for improving scores, these resources can be invaluable. Furthermore, some agencies may provide identity theft protection and recovery services, ensuring your information remains secure.

Finally, there are options for subscription services that go beyond the basics, offering advanced monitoring and alerts for significant changes or potential risks. Evaluating these offerings can help you choose the right fit for your needs, ultimately guiding you towards better financial decisions.

Impact of Credit Scores on Lending

Understanding how financial ratings influence borrowing can be a real eye-opener for many. When individuals seek funds from lenders, their financial assessments play a significant role in determining the terms of the loan, including interest rates and approval chances. It’s not just about the amount you want; it’s about how lenders perceive your financial behavior through these scores.

Higher ratings usually result in more favorable borrowing options. Lenders are generally more willing to offer loans with lower interest rates or even larger amounts to those with stellar financial histories. On the flip side, individuals with lower scores may find themselves facing steeper rates and stricter terms, possibly making it harder to secure the financing they need.

Moreover, the ability to obtain credit isn’t solely about approval. A quality rating can enhance your overall financial flexibility, allowing you to invest in opportunities that may otherwise be out of reach. In contrast, poor evaluations can limit options and lead to missed chances for growth or improvement in one’s financial situation.

Ultimately, maintaining a healthy financial record is essential. Regular checks and smart financial practices can help you navigate the lending landscape more effectively, ensuring you’re prepared when the time comes to seek financial assistance.