Discover the Best 10 Credit Union CD Rates Available Today

When it comes to planning your financial future, finding the right avenues for growth is essential. One increasingly popular method of saving involves securing funds in special accounts that offer attractive opportunities for interest accrual. Many individuals are on the lookout for the most rewarding options to make their money work smarter, not harder.

Imagine a scenario where your savings not only stay intact but actually flourish over time. This world of financial possibilities is populated by various institutions committed to providing fantastic offerings for those who choose to invest their money wisely. Understanding the landscape of these offerings can help you make informed decisions and maximize your earnings potential.

In the ensuing discussion, we will delve into a selection of standout opportunities available to savers today. We’ll explore the specifics of what makes these options appealing, from the competitive returns to the unique benefits that come with each choice. Get ready to embark on a journey to uncover the most advantageous places for your funds!

Understanding Certificates of Deposit Among Financial Institutions

When it comes to enhancing your savings, exploring options offered by community-focused financial entities can be quite rewarding. One of the attractive choices available involves fixed-term savings accounts, commonly referred to as certificates of deposit. These accounts allow you to secure your funds for a specified duration while earning a potentially higher return compared to standard savings accounts.

What makes these accounts appealing is the assurance of a fixed interest income throughout the term of the deposit. This means you can plan your finances with confidence, knowing exactly what return to expect at maturity. Additionally, these institutions often provide more favorable terms than traditional banks, making them a smart choice for those looking to maximize their earnings.

However, it’s crucial to consider several factors before committing. Look for varying investment periods, and ensure you understand the implications of withdrawing your funds before maturity, as this may come with penalties. By doing your homework and comparing different offerings, you’ll position yourself to make an informed decision that aligns with your financial goals.

Benefits of Choosing High-Yield CDs

When it comes to saving wisely, opting for a high-yield certificate of deposit can be a smart choice. These savings tools offer more than just a safe place to park your money; they bring a wealth of advantages that can help you grow your funds with minimal risk. Let’s dive into some of the key benefits that make these financial instruments appealing.

First and foremost, the most attractive feature is the competitive interest offered. This allows your funds to accumulate earnings at a faster pace than traditional savings accounts. It’s an excellent way to maximize your returns while keeping your money secure. You’re essentially putting your cash to work without having to handle any complex investment strategies.

Another advantage is the predictability that comes with fixed terms. With a set maturity period, you know exactly when your investment will mature and what kind of returns to expect. This makes financial planning much easier, enabling you to align your savings goals with your timeline, whether it’s for a future purchase or a rainy day fund.

Additionally, the low level of risk associated with these deposits makes them suitable for individuals who may be apprehensive about market volatility. With your principal amount protected, high-yield options provide peace of mind, which is especially reassuring in uncertain economic times.

Finally, many institutions offering these accounts often have fewer fees compared to other financial products. This means more of your hard-earned money stays in your pocket rather than being eaten up by various charges. Choosing a higher-yield option can be a win-win, allowing you to save more effectively while still enjoying favorable terms.

Comparative Analysis of Leading Institutions

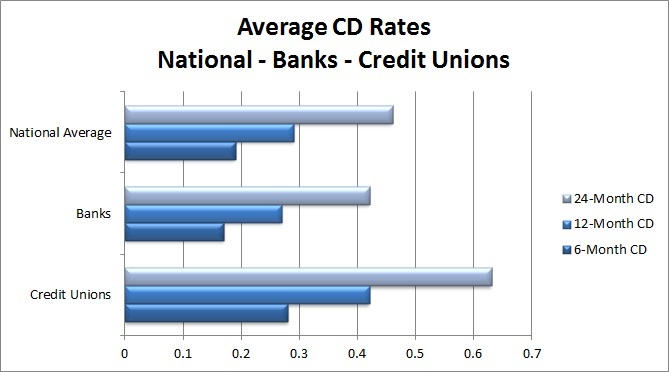

In this section, we’ll delve into a comparison of various organizations that provide alternative investment products, focusing on the attractive offerings available to consumers. Each institution has its unique advantages and appeal, making it crucial to evaluate their proposals side by side.

Some establishments shine with their competitive offerings, often appealing to different segments of investors based on their specific needs. Interest percentages can vary significantly, influenced by factors such as term lengths and minimum deposit amounts. Understanding these distinctions can empower potential investors to make informed choices tailored to their financial goals.

When analyzing these institutions, customer service, online accessibility, and additional benefits also play a vital role. While some might provide stellar rates, others might excel in overall experience. This comprehensive approach ensures that savers can align their preferences with the best investment pathways available.

Moreover, seasonal promotions and limited-time offers can sway decisions, further highlighting the dynamic nature of this financial landscape. As such, staying informed about the ever-evolving terms and conditions is essential for maximizing returns and securing the best possible outcomes from your investment decisions.