A Comprehensive Guide to the Ten Most Important Factors Influencing Your Credit Score

When it comes to navigating the world of personal finances, understanding your financial ratings can make a significant difference. They serve as a reflection of your financial health and can impact everything from loan approvals to interest rates. It’s no secret that lenders are keenly interested in assessing how likely you are to repay borrowed funds, and that’s where these ratings come into play.

In this article, we’ll explore the most essential factors that influence these numerical representations and help you understand how they shape your financial journey. Whether you’re looking to buy a house, secure a vehicle loan, or simply want to improve your financial standing, knowing what goes into these ratings is crucial. Your journey to achieving a stellar financial image starts here, and we’re excited to share our insights with you!

Let’s dive into the key components that can elevate your standing and enhance your financial opportunities. With the right knowledge and strategies, you can boost your financial image and open doors to better rates and terms. Ready to get started?

Understanding Ratings and Their Impact

When it comes to managing personal finances, one crucial aspect often comes into play: the evaluation of one’s financial reliability. This assessment can deeply influence various facets of your financial journey, from securing loans to negotiating better interest rates. Grasping how these evaluations function and the factors that contribute to them can empower anyone to navigate their financial landscape more effectively.

Essentially, these evaluations are numerical representations of an individual’s creditworthiness. They reflect how likely you are to repay borrowed funds based on your past behavior. A positive assessment can open doors to better opportunities, while a negative one might cause hurdles that can disrupt financial plans. Additionally, understanding the components that shape this numerical value can equip you with the knowledge to improve it over time.

It’s also important to recognize that various organizations utilize these evaluations differently. Some may focus on certain behaviors, while others might weigh different factors. Regardless, a solid grasp of what constitutes a favorable rating can be immensely beneficial in achieving your monetary goals. By focusing on responsible financial habits, anyone can work toward a more favorable reputation in the eyes of potential lenders.

Factors That Influence Your Credit Rating

When it comes to your financial health, several elements play a crucial role in shaping how lenders perceive you. Understanding these components can help you manage your financial reputation more effectively.

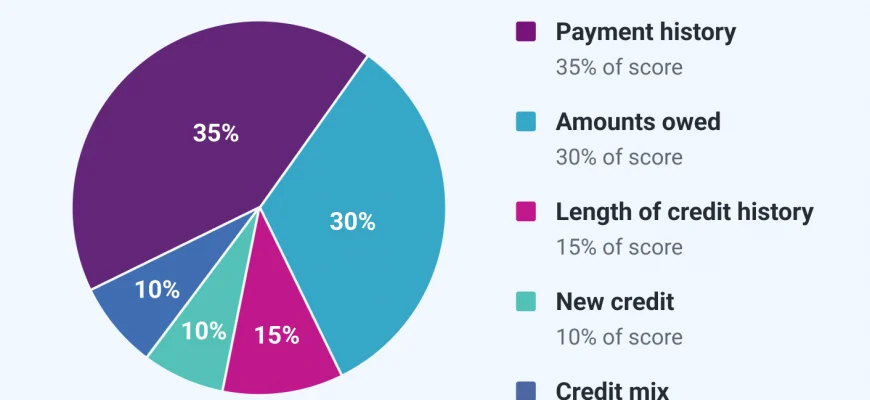

One of the primary aspects is your payment history. Consistently paying your bills on time demonstrates reliability and responsibility. On the flip side, late payments can significantly harm your standing, as they indicate potential risk to lenders.

The amount of money you owe also matters. Lenders look at your total debt compared to your available credit to gauge your financial discipline. Maintaining a low balance relative to your credit limits shows that you aren’t overly reliant on borrowed funds.

Length of credit history is another influencing factor. Generally, the longer you have been managing accounts responsibly, the better it is for your reputation. It allows lenders to see a solid track record of your financial behavior over time.

Your mix of account types plays a role too. Having a variety of accounts, such as installment loans and revolving credit, can be beneficial. This diversity shows that you can handle different kinds of financial commitments, which can enhance your credibility.

Lastly, recent inquiries into your financial background can have an impact as well. Multiple applications for new lines of credit within a short time frame may signal to lenders that you are in financial distress, potentially raising red flags.

By being aware of these factors, you can take proactive steps to improve your financial standing and open the door to better lending opportunities in the future.

Tips for Boosting Your Financial Reputation

Improving your financial reputation can seem like a daunting task, but it doesn’t have to be. With a few simple strategies, you can enhance your standing and open doors to better opportunities. Every action you take contributes to how lenders view you, and that’s what truly matters.

Stay On Top of Payments: One of the most crucial aspects of maintaining a good standing is to make your payments on time. Late payments can have a lasting effect, so setting up reminders or automatic payments can help you stay organized.

Reduce Debt Balances: Keeping your balances low in relation to your available funds is vital. Aim to pay down existing debts consistently, which not only helps in improving your financial image but also reduces the stress associated with heavy borrowing.

Check Your Records: Regularly reviewing your financial records is essential. Mistakes can happen, and errors can negatively impact your standing. If you spot anything suspicious or incorrect, be sure to challenge it promptly.

Limit New Inquiries: When you apply for new loans or lines of credit, these inquiries can affect your overall assessment. Try to limit the number of applications you submit within a short timeframe to avoid raising any red flags.

Diversify Your Accounts: Having a mix of different types of accounts can showcase your ability to manage various financial commitments. However, only take on what you can handle; it’s about balance.

Use Credit Responsibly: Using your available funds wisely can help establish a positive history. Even small purchases paid off each month can demonstrate your reliability without causing excess debt.

Be Patient: Remember that building a solid reputation takes time. Consistent positive behaviors over months and years will ultimately yield the best results.

By adopting these practices and being mindful of your financial habits, you can significantly enhance your standing in the eyes of lenders and financial institutions. Small steps can lead to great outcomes!