A Comprehensive Guide to the Ten Leading Credit Reporting Agencies in the Industry

Understanding your financial standing can be a daunting task. It’s like navigating a maze where every turn can lead you closer to your goals or further away from them. Fortunately, there are specialized organizations designed to help you decode this intricate system. These entities play a crucial role in evaluating individual financial histories and providing essential insights.

Whether you’re looking to secure a loan or simply want to keep track of your fiscal health, turning to these institutions can be highly beneficial. They gather and analyze various financial data points, offering a clearer picture of your economic habits and reliability. This information is invaluable not just for lenders, but also for consumers eager to make informed decisions.

In this article, we’ll delve into a list of ten prominent players in this field. Each one offers unique services and information that can empower you to understand your financial profile better. With the right insights, you can approach your financial future with confidence and clarity.

Understanding Credit Reporting Agencies

When it comes to managing your financial reputation, there’s a crucial player that everyone should become familiar with. These organizations keep track of your financial behavior and provide valuable insights that lenders and others utilize to assess your reliability. Knowing how they operate can empower you to make informed decisions about your financial future.

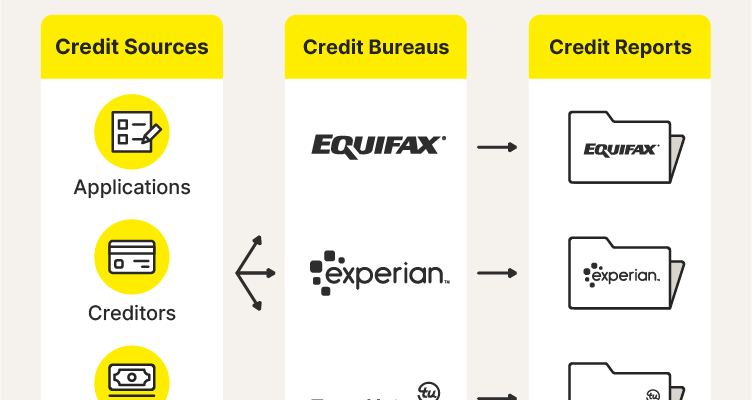

It’s essential to understand what these entities do and how they affect various aspects of your life. They gather information from multiple sources, including banks, credit unions, and other lending institutions. This information is compiled into a detailed record that’s often referred to as a profile.

Here are some key reasons why these entities are important:

- They provide a snapshot of your financial history.

- They influence the terms and interest rates you receive on loans.

- They help identify potential risks for lenders.

Furthermore, the accuracy of the information they maintain is vital. Mistakes can lead to serious consequences, including higher costs for borrowing. Therefore, it’s always a good practice to regularly review your records and dispute any inaccuracies.

In summary, knowing how these organizations function and what information they gather can significantly impact your financial decisions. Taking the time to educate yourself about their role in the financial ecosystem will lead to better financial health and opportunities.

Key Players in Credit Reporting Industry

In the landscape of financial assessments, several notable entities play a crucial role in shaping how individuals and businesses are evaluated. These organizations hold significant influence, providing essential information that helps lenders make informed decisions regarding creditworthiness. Their impact extends beyond just compiling data; they also contribute to the broader understanding of consumer behavior and financial trends.

At the heart of this ecosystem are the major firms that collect and analyze data from various sources, including banks, credit unions, and other financial institutions. They create comprehensive profiles that reflect a user’s financial history, including borrowing, repayment patterns, and any public records. This information is then utilized by lenders to gauge risk levels and determine the terms of loans or credit offers.

Additionally, these key players often develop sophisticated algorithms for risk assessment, further refining their evaluations. They provide services not only to lenders but also to individuals, offering insights into personal financial health and aiding in identity verification. This dual role underscores their importance in both the lending landscape and consumer finance management.

As a result, understanding the key players in this field is beneficial for anyone looking to navigate the complexities of financial opportunities. Knowing who these organizations are and how they function can empower consumers to make better decisions about their financial futures.

How Credit Profiles Impact Financial Health

Understanding how personal financial evaluations affect your monetary well-being is crucial. These assessments can play a significant role in determining your eligibility for loans, interest rates, and even rental agreements. A solid understanding of your financial standing helps you make informed decisions.

First impressions matter. When lenders review your financial background, they gain insight into your ability to repay borrowed funds. A positive assessment can open doors to more favorable terms, while a less-than-stellar one might limit your options. This influence extends beyond just borrowing; it can also affect insurance rates and job opportunities in some cases.

Maintaining a good financial profile is therefore essential for a healthier economic future. Regularly checking your information ensures there are no errors that could hinder your financial progress. Moreover, understanding the factors that contribute to your assessment allows you to take proactive steps toward enhancing your financial situation.

In conclusion, staying informed about how these evaluations work and their implications empowers you to navigate your financial journey effectively. Your future economic health depends on the actions you take today, so prioritize your financial integrity!