Discover the Ten Best Credit Monitoring Services to Protect Your Financial Health

In today’s world, staying on top of your finances is more important than ever. With the ever-evolving landscape of personal finance and the many factors that can impact one’s financial health, having a reliable resource to keep an eye on your financial well-being is key. Whether you’re looking to protect yourself from fraud or just want to be more informed about your financial situation, it’s essential to find the right tools to help you navigate these waters.

There are numerous services available that can help you track your financial status and provide insights that may otherwise go unnoticed. From alerts about significant changes to thorough reports analyzing your financial habits, these platforms can serve as your financial watchdog. With so many options out there, it can be challenging to determine which ones truly stand out in terms of reliability and user satisfaction.

In this article, we’ll delve into several of the most noteworthy services that excel in providing financial oversight. We’ll explore what each service brings to the table, highlighting their distinct features and benefits. By the end, you’ll have a clearer picture of which options can best support your journey toward maintaining a sound financial future.

Benefits of Credit Monitoring Services

Staying on top of your financial health can feel overwhelming, but there are tools available to help you keep track of everything. Using special services designed to keep an eye on your financial report can provide a sense of security and awareness that is hard to achieve on your own.

Instant Alerts: One of the biggest advantages is the immediate notifications you receive if there are any changes to your financial profile. Whether it’s a new account opened in your name or a significant shift in your score, these timely updates allow you to act quickly and resolve any issues before they escalate.

Fraud Detection: With the rise of identity theft, knowing that someone is watching your records is crucial. These services can catch suspicious activities early and help you protect your hard-earned reputation.

Score Improvement Guidance: Many of these platforms provide insights that can help you understand what influences your financial score. They might offer personalized tips on how to boost your rating and manage your finances more effectively, putting you in control of your economic future.

Comprehensive Reviews: Regular assessments of your financial standing can reveal patterns that you may not have noticed. Understanding your financial habits can lead to better decision-making and improved money management skills.

Peace of Mind: Ultimately, having access to these services gives you a layer of comfort. You’ll feel more in charge of your financial journey, knowing you have support to navigate potential pitfalls.

How to Choose the Right Option

Selecting the ideal service for tracking your financial health can feel overwhelming. With so many choices available, it’s crucial to understand your specific needs and preferences. Taking the time to assess your situation will help you find a solution that truly fits your lifestyle and financial goals.

First, consider what features are most important to you. Some individuals might prioritize real-time alerts for any changes in their financial background, while others may value comprehensive reports that provide insights and trends. Think about what will give you peace of mind and allow you to stay proactive.

Another factor to contemplate is budget. Services come in various price ranges, and knowing how much you’re willing to invest can narrow down your options significantly. There may also be free alternatives that provide basic functionalities, so weigh the benefits against the cost.

Lastly, don’t forget to read user reviews and compare experiences of others. Real feedback can shed light on the reliability and effectiveness of a service, helping you make a more informed decision. Taking the time to evaluate your options can lead to a choice that supports your financial well-being.

Key Features of Leading Providers

When it comes to safeguarding your financial health, the most reputable services offer a suite of impressive attributes designed to keep you informed and secure. These standout qualities not only enhance your understanding of your financial standing but also provide peace of mind in today’s ever-evolving landscape.

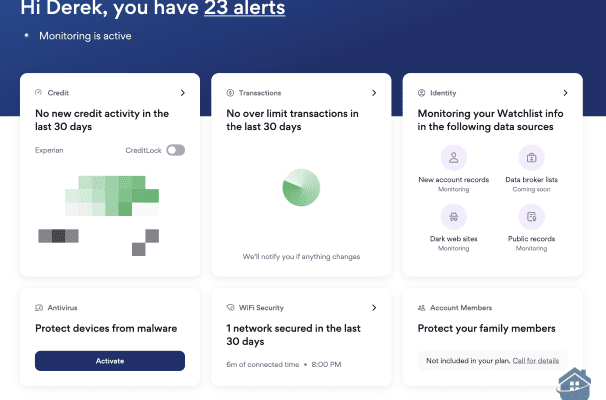

One major aspect is real-time alerts. Users can receive instant notifications whenever there are changes in their reports, ensuring that they stay ahead of any potential issues. Additionally, a user-friendly interface allows easy navigation, making it simple for anyone to access important information when they need it.

Another significant feature is comprehensive reports. They not only provide scores from various bureaus but also delve into the factors influencing those scores. Advanced tools for analysis give insightful perspectives on personal credit status, helping individuals make informed decisions.

Moreover, identity theft protection is a crucial component of these services. Many providers include monitoring for suspicious activities, such as new account openings or significant transactions, acting as a safeguard against fraud. This proactive approach is essential for those wanting to maintain a safe financial profile.

Simplified dispute resolution is another key offering. If discrepancies arise, leading services provide guidance on how to address them, streamlining the process to ensure that users can resolve issues efficiently and get back on track.

Lastly, educational resources play an invaluable role. Many companies equip users with tutorials, articles, and tools aimed at improving financial literacy and management skills, empowering individuals to take control of their finances with confidence. Together, these features create a robust package that meets diverse needs in the realm of financial well-being.