The Best Ten Cash Back Credit Cards You Should Consider for Maximum Savings

Finding the right financial tool can be a game changer in managing your expenses and enhancing your purchasing power. It’s amazing how some options can put money back into your pocket with every transaction, allowing you to enjoy little perks without changing your spending habits. Whether you’re fueling up your vehicle or grabbing a meal, making informed choices can maximize your benefits.

Imagine a scenario where you could ease your spending by earning rewards for everyday purchases. The magic lies in selecting the right financial solution, one that complements your lifestyle and habits. For savvy shoppers, understanding the different offerings available can lead to significant savings and rewards in the long run.

In this guide, we will explore a curated list of premium options designed to help you earn impressive rewards on your regular expenditures. Let’s dive into the choices that could help enhance your financial experience and bring a little extra to your life!

Best Cash Back Credit Cards of 2023

In today’s world, finding ways to maximize your spending can really tip the scales in your favor. Whether you’re buying groceries, filling up the tank, or ordering your favorite takeout, there are fantastic options out there that can reward you for your everyday purchases. The right choice can not only help you save money but also allow you to enjoy various perks that come along with it.

When exploring the options for 2023, you’ll notice a variety of offers that suit different lifestyles. Some options provide higher rewards for specific categories, while others offer a flat rate across the board, making it easier to choose based on your shopping habits. The key is to find a solution that aligns with how you spend.

Many providers in the market are competing for your attention, and this translates into generous incentives. Look for programs that include bonuses for new users, enticing reward ratios, and added benefits such as travel perks or shopping insurance. A careful comparison can help you discover what truly meets your needs.

Overall, the landscape for 2023 is rich with choices designed to give you more bang for your buck. By evaluating these fantastic programs, you can effortlessly turn your everyday expenses into substantial rewards over time–ensuring that every dollar spent pulls its weight in value.

Maximizing Rewards on Everyday Purchases

Getting the most out of your spending can truly elevate your financial game. By strategically planning your transactions, you can earn more rewards from your regular expenses. It’s all about making the right choices and focusing on those routine purchases you make every day.

To really boost your earnings, start by identifying where you spend the most. Whether it’s at grocery stores, gas stations, or restaurants, knowing your spending habits can guide you toward options that offer excellent returns. Look for programs that specifically cater to these categories for optimal benefits.

Many offerings provide higher rewards rates on specific types of purchases. For instance, some may give extra points for dining out or shopping online. Keep an eye out for special promotions or seasonal boosts, as these can further enhance your earning potential during certain times of the year.

Don’t forget about referral bonuses and other incentives. Many programs reward you for bringing in new users or engaging with their services in unique ways. Taking advantage of these can give your rewards a nice little bump.

Finally, always check for opportunities to combine rewards. Some individuals may have several programs that complement each other. By aligning your spending with strategies that work best for you, you can significantly increase the rewards you accumulate.

Comparing Fees and Benefits of Top Picks

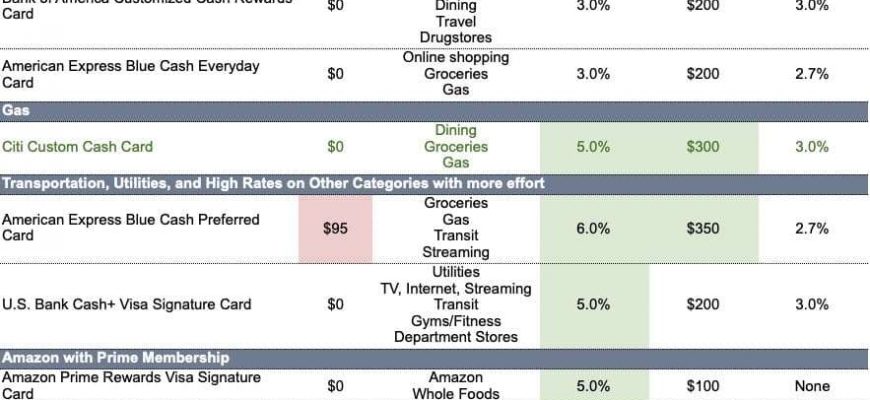

When it comes to choosing the right options for earning rewards, understanding the costs and advantages is essential. Different selections come with varying features, and delving into these details can help you make an informed choice tailored to your spending habits.

Here are some critical fees and benefits to consider:

- Annual Fees: Some selections come with an annual fee, while others offer no-cost alternatives. Weigh the fee against potential rewards to see if it’s worth it.

- Foreign Transaction Fees: If you travel frequently, look for offerings that waive these charges, saving you money on international purchases.

- Introductory Offers: Many options provide enticing sign-up bonuses. Pay attention to the required spending to unlock these perks and factor them into your decision.

- Reward Rates: Not all selections offer the same earning potential. Check for variations across different categories, such as groceries, gas, or dining.

- Redemption Flexibility: Some programs allow you to redeem points for various rewards, from statement credits to travel perks. Review how easily you can utilize your earnings.

Taking time to compare these factors can reveal the best fit for your financial lifestyle. Ensure you choose an option that maximizes your rewards while minimizing unnecessary costs.